Agentic search platforms for shoppers and AI-enabled efficiency tools for advertisers are dominating industry discussions these days.

Courtesy of Albertsons Companies.

But retail media networks also continue to make strides in expanding their media offerings, enhancing their targeting and measurement capabilities, adding self-service functionality, and improving their operations overall to meet the needs of an increasingly demanding advertiser community. Meanwhile, the need for both full-funnel activation and cross-network performance transparency persist, along with the ongoing call for industry-wide measurement standards.

The media experts in Mars United’s Retail Consultancy practice took some time over the holidays to assess the current landscape, looking back at the key trends that shaped 2025 and the major initiatives that will drive the marketplace forward in 2026 — and, of course, the ways in which agentic AI will transform both best-practice retail media activation and business-building shopper engagement. Here are their perspectives.

The ongoing impact of generative/agentic AI

Generative AI will accelerate self-service retail media by powering stronger creative, automated optimization, and rapid idea iteration. It will enable more personalized, dynamic messaging and real-time creative refinement based on performance, making campaigns more efficient and tailored for specific retail media environments.

Andy Howard, Senior Commerce Media Director

___

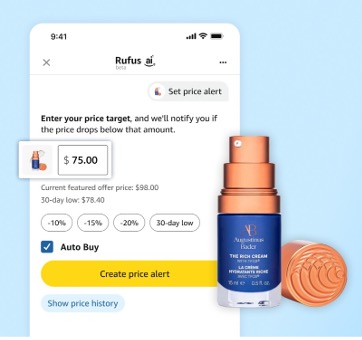

Paired with ecommerce fulfillment, agentic AI will make deal hunting and multi-store shopping seamless. Premium and high/low retailers will need to sweeten their loyalty offerings to grow or even maintain share.

Erin Taylor, Senior Commerce Media Director

___

It will transform the retail media marketplace by enabling personalized ads, automating campaign management, and shifting the focus from keyword bidding to influencing AI shopping agents. This will create new monetization opportunities and require brands to optimize product content for AI-driven recommendations — moving from SEO to GEO. Brands must now focus on influencing these agents, which involves optimizing the product data that informs their recommendations. A+ content on the digital shelf, therefore, will become even more important. (For consumers, AI agents will facilitate hyper-personalized ads and recommendations.)

___

Heather Luna, Senior Ecommerce Director

Generative and agentic AI will take a lot of complexity out of retail media. We’re already seeing tools that unify campaign setup, automate optimization, and even draft creative concepts and audience plans. As these agents get smarter, teams will spend far less time managing tasks and far more time shaping strategy.

Kayla Corridon,Senior Media Director

Andy Howard

The (other) most significant trends of 2025

Beyond AI, we witnessed a strong shift to self-service as RMNs opened access to brand-managed DSPs. We also experienced significant growth for in-store media through digital screens supported by closed-loop measurement and wider availability of incrementality metrics as networks expanded this capability across more tactics and media formats.

Howard

___

CPGs have been clamoring for advanced measurement capabilities, and each RMN is creating solutions independently. Unified measurement (exposed vs. unexposed lift across all activations during a set time period) is taking precedence, with two RMNs rolling out solutions this year. Unified measurement helps brands clearly quantify retail media’s impact on marketing objectives, leading to better informed investment and activation decisions.

Taylor

___

From an online grocery perspective, value-driven shopping increased and private label product sales grew due to persistent economic pressures. Affluent shoppers are trading down to Walmart and the dollar channel, forcing more brands to compete on affordability and value.

___

Luna

One major shift in 2025 was how quickly retail media moved into premium video and entertainment environments. More RMNs began connecting upper funnel reach with commerce signals through partnerships like Amazon and Netflix and Gopuff with Disney Ads. This has broadened retail media from being mostly performance-driven to something much more full-funnel and storytelling-focused.

Corridon

Erin Taylor

Key trends for 2026

Retail media will move toward full-funnel integration that connects onsite, offsite, and in-store data through more unified planning and measurement solutions. Self-service platforms will continue to expand and mature via AI-driven optimization and automated workflows. RMNs will also better leverage dynamic creative optimization technology to deliver more personalized, SKU-level messaging tied to real-time availability, pricing, and shopper behavior.

Howard

___

Expect to see RMNs better integrate into their parent operations, with retailers and CPGs collaborating on where and how best to invest to achieve brand-at-retailer objectives.

Taylor

___

Social commerce and livestream shopping will continue to rise. Social platforms are now shopping destinations, helping users discover and buy products without leaving the app. Supply chain optimization will continue evolving to keep up with demand for fast delivery, powered by AI route planning, automation, and robot/drone delivery.

Luna

___

We expect a big push toward more unified buying, fewer separate tools and more places where search, display, video, and onsite/offsite planning all lives together (as in Amazon’s recent unified Campaign Manager and Complete TV rollouts). This shift should help brands make cleaner budget calls and finally understand how different channels work together to drive long-term sales.

Corridon

Heather Luna

Trends we’re hoping might happen

Ideally, we’d like to see full enterprise solutions that align retail media, loyalty, and merchandising toward a single goal. We’d also like to see a consolidation of smaller RMNs for advertiser efficiency, as well as standardization of measurement practices and transparency in metrics across retailers and tactics. In reality, these outcomes are unlikely to fully materialize in the short term, leaving challenges around fragmentation and inconsistent evaluation.

Howard

___

RMNs have been very focused on keeping up with competitive capabilities which has led to a lack of distinction that will likely have brands spending with the retailers that can reach and convert the most shoppers. Some RMNs are revisiting their growth strategies, recognizing the need to differentiate. But bold changes take time and effort.

Taylor

___

Ecommerce should move toward universal, interoperable digital identity standards for secure, one-click checkout across all platforms — independent of the payment provider. This would significantly reduce checkout friction and enhance security, streamlining the complete customer journey. This likely won’t happen because of proprietary interests and a lack of incentives for major ecommerce players to collaborate; each company benefits from locking customers into its own ecosystem. And the regulatory push needed to force this cooperation will probably be too slow or nonexistent.

Luna

___

The marketplace needs shared measurement standards with clear definitions for incrementality, audience quality, and attribution across networks. It probably won’t happen yet because each platform has its own data, identity systems, and business priorities, which makes true cross-network alignment difficult.

Corridon

Kayla Corridon

___

Mars United Commerce is a leading global commerce marketing practice that aligns people, technology, and intelligence to make the business of our clients better today than it was yesterday. Our worldwide capabilities coalesce into four key disciplines — Strategy & Analytics, Content & Experiences, Digital Commerce, and Retail Consultancy — that individually deliver unmatched results for clients and collectively give them an unparalleled network of seamlessly integrated functions across the entire commerce marketing ecosystem. For more information about our commerce media practice, contact Willy Blesener, SVP-Media, at [email protected].