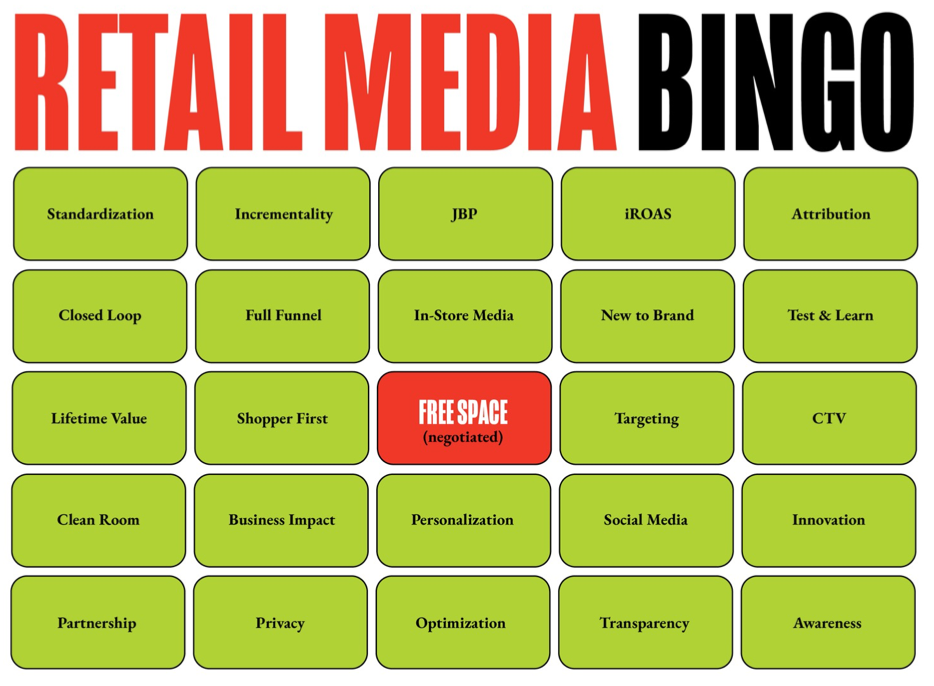

There are still plenty of spaces to fill, but brands and retailers are working more off the same scorecard these days.

Download a copy of this report here: Winning at Retail Media Bingo

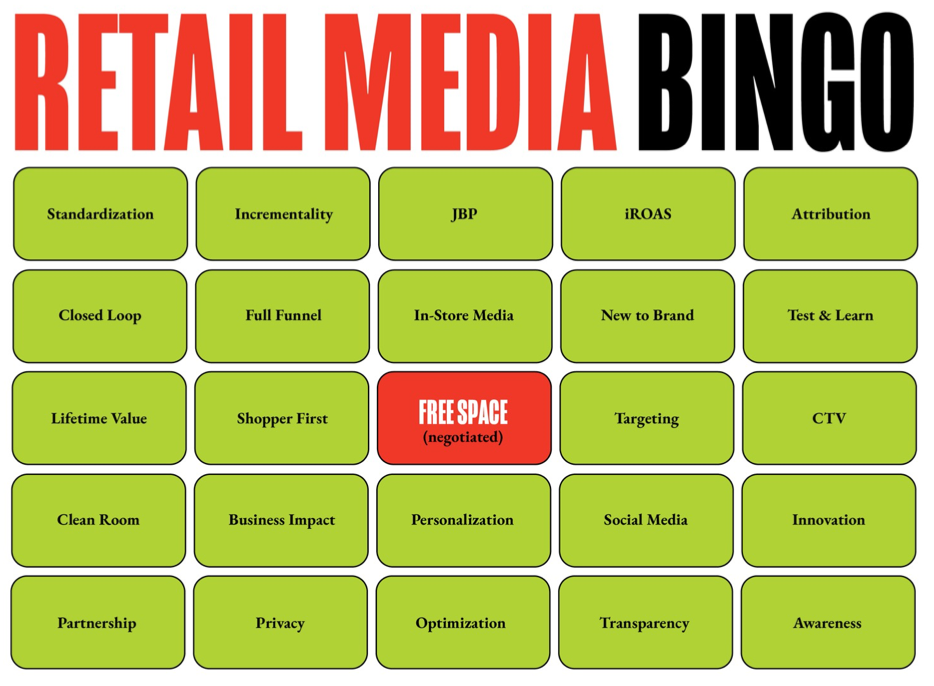

It’s pretty common for a marketing conference to be dominated by a handful of terms reflecting the industry’s latest, most pressing issues. But rarely has the repetition of these buzzwords been a more important sign of the progress being made across the industry.

With the call for standardization having recently become a legitimate movement, P2PI’s Retail Media Summit was an ideal time for brands and retailers to prove that they’re speaking more of the same language these days than ever before.

So while cocktail party commentaries, offsite dinner conversations, and even the occasional back-row muttering may have painted a slightly little less rosy picture, the on-stage discussion showcased a marketplace that is steadily improving for retailers, brands and shoppers — at least if all the necessary buzzwords are adequately addressed.

And there are plenty of buzzword-worthy topics that demand attention, some that now are universally considered best-practice industry needs (like ATTRIBUTION and TARGETING) but also a few (ROAS, standardization) that still require a little more discussion.

The following recap covers a bingo card’s worth of key topics Including two already mentioned) that dominated the agenda at P2PI’s Retail Media Summit, held in Chicago from June 28-30.

STANDARDIZATION was far and away the buzziest of words at the event, especially since Albertsons Media Collective was on hand to amplify the official framework it unveiled at the Cannes Lions festival one week earlier.

Developed in conjunction with McKinsey to supplement work being conducted by the IAB (Interactive Advertising Bureau), the framework calls for best-practice standards across four “high-priority areas” of the marketplace:

1. Performance measurement and metrics, which begins with the simple task of “agreeing on the definitions” and the methodologies behind them, according to Claire Wyatt, the Collective’s vice president of business strategy and marketing science (left, with P2PI Managing Editor Cyndi Loza).

2. Product specifications. Here, retail media networks should adhere to IAB guidelines (for display ads, native ads, CTV, etc.) wherever they exist, and “try to align as much as possible” on any on-platform media unique to RMNs.

3. Third-party verification. Networks should disclose the methods and organizations they use to validate their activity (ad placement & viewability, brand appropriateness, competitive separation, etc.), and/or the organizations they let advertisers use directly.

4. General capabilities across people (staffing), processes (like post-campaign reporting) and technology (such as clean rooms).

While generally well-received, the idea did receive a little pushback, some from industry veterans skeptical about the willingness of competitively motivated retailers to come together for the cause — no matter how beneficial it might be. (“If you want Amazon to play by your rules, good luck with that,” laughed Prabal Majumdar, principal of The Math Company.)

“I don’t have a unicorns and rainbows perspective that this is going to be easy,” acknowledged Wyatt. But in conversations with other networks, “We’re all super-excited about this,” she said.

“We look forward to elevating the standards across the entire industry, said Cara Pratt, SVP of Kroger Precision Marketing (right), when asked about the IAB’s efforts.

While standardization would be “cool” for offsite media opportunities because it lets RMNs be compared with other digital media, onsite and in-store advertising “are my primary point of differentiation,” said Art Sebastian, principal at NexChapter LLC, who until recently led the launch of an RMN at Casey’s General Stores. “It is really hard to standardize unique environments that were built to compete with other retailers.”

Pratt didn’t overtly call for standardization in her keynote address, but she did discuss the potential for networks to “hold media accountable to a new standard” by using Closed-loop measurement to evaluate sales lift, lifetime value, household penetration and incremental volume and thereby move all of digital marketing beyond the “vanity metrics” of impressions and likes. “This is a once-in-a-lifetime opportunity to impact a $600 billion industry,” she said.

Networks also have the opportunity to elevate their own standards through ongoing innovation, said Pratt, while discussing the one-stop, self-serve ad platform that KPM unveiled days before the event. The in-house platform will ultimately let brands customize ad groups, design creative, run and optimize programs, and build reports using deterministic data across KPM’s entire ecosystem. The two-fold goal is to “improve the shopper experience and make it easier for advertisers to optimize” their investment, she said.

TRANSPARENCY was presented as the minimum best-practice objective for networks and advertisers to follow when true alignment can’t be met within those four framework areas. “We can at least push for transparency if we can’t standardize methodology,” said Wyatt, during the measurement discussion. “The methodology might be different, but networks need to provide access to the granular data brands need to analyze cross-platform.”

Brands should get the transparency they need to understand where to invest and feel comfortable about the investments, said Wyatt. “Growth is going to stall if we can’t figure out how to work together.”

For some, “transparency” reflects the need for brands to move beyond the aforementioned vanity metrics to gain the SKU-level performance data commerce marketers needed to “show their bosses that this is actually working,” said Liane Gonzalez, VP-Client Development at Epsilon.

Transparency is a vital component of the shopper relationship as well. Regardless of any other objectives, all of KPM’s activity is focused on safeguarding customer privacy, according to Pratt. “Consumer trust is the most valuable asset we have.”

It also is a critical ingredient for true PARTNERSHIP between RMNs and advertisers, something that all speakers and attendees acknowledged as fundamental to future success. Some brand organizations, however, are still viewing the network’s investment “ask” as more of a demand that isn’t always delivering the promised results. “We need to hit performance standards. And if we do, it shouldn’t feel like a tax,” said Wyatt.

Partnership is also the means through which networks will improve and expand their capabilities. Boots UK teamed with third-party provider Threefold to improve speed to market, gain access to existing (and customizable) tools, and find the necessary talent, explained Ollie Shayer, Boots UK’s Omni-Media Director.

The collaborative work conducted with advertisers by the Boots Media Group has “fundamentally changed” the retailer’s relationship with suppliers and aligned its business internally, Shayer said.

Meanwhile, formal partnerships with external SOCIAL MEDIA platforms and consumer content publishers are helping networks drive traffic to their owned properties while expanding their ad inventory in relevant ways for brands. To that end, Walmart Connect joined the stage with TikTok and KPM with Roku to discuss their symbiotic relationships. Data alignment between the latter two partners can produce “a true one to one match” for audience targeting, said Jake Piasecki, Roku’s U.S. Head of Verticals for CPG (above right, with 84.51 Director of Sales Claire Straus at left and Danone’s Woltz center).

JOINT BUSINESS PLANNING would be the most formal evidence of true partnership, and several speakers called for more networks to build JBP relationships with advertisers. “You cannot think of your retail media investment as transactional, you need to think of it as a relationship,” said Matt O’Grady, president of dunnhumby for the Americas. “Ask for what you need, [then] ask to link the investment that you are making in their platform to some other area that you need.”

The ”other area” O’Grady mentioned refers to the more important wish among advertisers: for retail media discussions to be integrated into retailer-level negotiations. “We need to upskill and get it into the brand JBP,” said Yolanda Angulo, Director of Customer Marketing at Mondelez International. “The most successful RMNs have JBP — the merchants are incentivized to sell media,” noted O’Grady.

Retail media is helping to improve relationships — “as long as it’s part of a JBP,” added Sebastian, who advised brands to “force the RMN to become part of the JBP. Retail media cannot — should not — be the next slotting fee. [It’s] an important piece, but it’s just one piece” of the overall retailer-brand relationship, he stressed.

“You can move a lot faster when everyone is in the room,” said Austin Leonard (below, with Letterle), head of sales at Sam’s Club MAP (Member Access Platform], while outlining the strategy behind the warehouse chain’s recent partnership with Clorox’s Kingsford charcoal brand on a parking lot grilling tour.

Planning for the 250-club tour, which celebrated Sam’s Club’s 40th anniversary, involved meetings with members of the marketing, ecommerce and merchant teams. “It’s exciting to see the merchants grab onto retail media,” said Lindsay Letterle, Director of Sales for Clorox’s Sam’s Club team. (One side note for shopper marketers focused on digital these days: “Live events work,” said Letterle.)

Increasingly, IN-STORE MEDIA is becoming a critical component of the retail media offering, for two very important reasons:

1. “Brands have asked — consistently and politely — for in-store, in-store, in-store,” said Ben Tienor, Director of 7-Eleven’s Gulp Media Network, which launched in January to help advertisers reach the convenience chain’s 10 million daily “immediate consumption” customers. In Europe, the retail media movement actually started in the store environment and then moved online, noted Shayer.

2. “You have to meet the shopper where they’re at,” which still is the physical store for more than 70% of purchases, according to opening keynote Andrea Leigh, CEO of Allume Group and former Amazon category leader (below). In addition, retailers need to find new ad channels to monetize because “it’s getting harder for [them] to squeeze out more ecommerce growth,” she said.

Tienor joined with representatives from Qsic, an AI-driven audio platform for retail, to announce the imminent rollout of the “largest and most intelligence in-store audio network in the U.S.” The system will deliver advanced targeting opportunities at the store cluster or even store level that can be tailored to specific dayparts and trip missions based on natural shopping demands. A unique sales/demand profile will be created for each product (using 7-Eleven’s robust shopper data) to optimize ad schedules. Performance metrics will include both sales and impressions.

As the store becomes media, speakers cautioned marketers to maintain the same rigor on the fundamentals as they do in the digital world: advertising needs to be measurable, relevant and impactful. (In the store, it needs to be more contextually relevant, noted Kyle McWhirter Head of Emerging Sales at Walmart Connect.)

INNOVATION should be considered another fundamental across the path to purchase, with the primary goal being stronger shopper engagement rather than scalable advertising opportunities.

Retailers do have the option of simply adding their existing in-store radio programming to their network’s menu, but they should instead look to launch better tools that can more effectively meet brand needs — like 7-Eleven is doing.

“We are pushing the networks to move the needle on new technology,” said Angulo at Mondelez. As one example of in-store innovation, Leigh mentioned smartphone-based store navigation tools that trigger on-shelf lights near the searched-for product as the shopper approaches.

Boots is implementing a system that will let advertisers buy digital store window screens programmatically and compare physical foot traffic with online impressions. “We want to offer our suppliers the opportunity to [reach shoppers] everywhere,” Shayer said.

Brands themselves should innovate by adapting to each network’s unique go-to-market strategies, said Diana Finster, Walmart Connect’s Head of Agency & Tech Partnerships (below, with TikTok U.S. Head of Retail & eCommerce Matt Cleary and P2PI Managing Editor Charlie Menchaca. “Don’t copy and paste across networks.”

Innovation is often synonymous with creativity, which for keynote speaker Colin Lewis, principal at Retail Media.Works, includes developing unique insights as well as engaging content. “Creativity is the one thing that’s [still] not commoditized,” he said.

Retail media as a FULL FUNNEL marketing tool almost seems to be a foregone conclusion now, with the benefits of first-party data and closed-loop measurement making upper-funnel activity more effective than it’s ever been before (as first noted by KPM’s Pratt).

“Retail media can launch a brand,” said Mary Katherine Woltz, Director of Media Connections at Danone, who noted that it is “powerful to share” the real-time impact of retail media campaigns with the brand team rather than waiting months for an MMM (marketing mix modeling) study to come back. Also “powerful” is the ability to connect activity across the full funnel, she said.

As Bayer increased the retail media spend eight-fold recently, the company broadened its initial focus on conversion and loyalty-building to move all the way up the funnel, according to Lisa Obaidullah, Head of Ecommerce and Retail Media Investment. The CPG is taking a “crawl-walk-run” approach to building a sustainable activation model, which has it ready to “test, learn and pivot” often, she said.

Moving up the funnel expands the debate over best practices in retail media measurement, with AWARENESS now a more common part of the discussion — and offsite advertising delivering the best forum to achieve that, according to dunnhumby’s O’Grady. (And if you’re thinking awareness, you should also consider allocations beyond the shopper marketing budget, suggested Walmart Connect’s Finster.)

ROAS (return on ad spend) is not entirely dead as a metric if ad-spend efficiency is important to the organization (which it usually is) and you want to compare against other digital media options (which you often do.) “There is no world without ROAS,” said Arthur Sylvestre, Director of Media, Digital & E-Commerce for Danone in Canada.

But the limitations of ROAS were more than duly noted. In one off-stage forum, commerce marketers swapped war stories about campaigns that delivered off-the-chart ROAS numbers alongside stagnant sales — and programs driving strong sales lifts but producing a poor return. “ROAS is great. Selling a unit … is even better,” summarized Clorox’s Letterle from the stage.

For that purpose, IROAS or just straightforward INCREMENTALITY is a far better metric for assessing program effectiveness — assuming the industry can agree on a standard definition of the term. (Albertsons Media Collective’s simple one: “The product would not have sold if the buyer hadn’t seen the ad,” explained Wyatt.)

Drilling down, NEW TO BRAND was presented as a key metric for understanding true incrementality and making sure campaigns aren’t just subsidizing purchases from loyal shoppers who would have bought anyway. There was some question, however, about how long between purchases a past buyer needs to go (26 weeks?) before being labeled “new” again.

LIFETIME VALUE is another increasingly sought-after metric. “Should I be using iROAS for product innovation?” asked O’Grady. “There are people out there who always buy new products — but did they adopt that product [in the long term]?”

“You want to see the repeated sales results, but that can’t happen immediately, ” said Woltz at Danone, who discussed the full-funnel launch campaign for Silk Greek plant-based yogurt: The effort drove significant “awareness at scale” for the new product, as well as a 10% lift in household penetration and 6.3% incremental sales lift.

Because 53% of shoppers say they’ve seen an ad on one retail website and purchased the advertised product on another, Walmart Connect is working to measure “rest of market” impact for its advertisers, said McWhirter.

Regardless of the metrics, brands should be working with their network partners to understand the total BUSINESS IMPACT of their activity. “We are investing national media dollars in RMNs, based partially on previous success but also on our business objectives,” said Woltz. “Retail media is helping us drive reach for our new products and is also driving the bottom line.”

“No matter what your metrics are, you need to line up with your objectives,” said Sebastian, who encouraged brands to “always look for incrementality” but also to “look beyond the scorecard to identify causation.”

Aligning to business objectives requires brand organizations to work more closely across teams, of course. “Brand, trade, shopper and retail media currently all have different objectives, KPIs and data sets, which means they are all still segregated,” said Lewis.

But retail media is breaking down those internal boundaries and “fueling an integrated experience across channels,” said Pratt. “It’s time for us to have a singular view.”

Newell Brands has been restructuring to eliminate those types of silos, “strengthen and streamline operations,” and establish greater accountability across functions, said Sheri Pasuco, the company’s Senior Manager, Ecommerce Digital Marketing. The moves included centralizing retail media with ecommerce and digital marketing.

Industry gadfly Peter Bond (one of “The CPG Guys”) advised companies to avoid getting “too hung up on org structure. If you want to pay McKinsey a lot of money to restructure your organization, you are welcome to do so. [But] the real work needs to happen at the process level [so everyone can] know their responsibilities and be accountable.”

Retail media is also inspiring brands to rethink their budgeting practices. Newell evaluates spending from the customer opportunity perspective “but you also have to look at platform effectiveness,” noted Pasuco.

“The bar for solid performance measurement is getting higher and higher,” said Wyatt, in calling for network operators to find ways to deliver the transparency brands need to compare results holistically across networks. “It’s the only way we’re going to grow as an industry.”

Finally, for readers looking to complete their bingo card:

CLEAN ROOMS are rapidly evolving from a differentiating capability to a must-have tool for networks. “This is a muscle that organizations have to build” because of the impact it has on targeting and, therefore, profitability, Leigh said. It shouldn’t be long before all leading media networks have one.

The need to maintain customer PRIVACY while giving advertisers the granular data they need to optimize performance is the key driver of the clean room movement, which will become even more critical if-and-when third-party cookies finally do go away. (“Third-party data never really worked well in the first place,” said Pratt.)

And it could become even more important if regulations surrounding data privacy intensify. Laws are much stricter in the European Union, where brands need to obtain “explicit consent” to use consumer data and can be fined up to 4% of global revenue if found to be non-compliant, explained Shayer. That level of regulation could be on its way to the U.S., he warned.

But while 42% of U.S. consumers are worried about how their personal data is used, 91% say they’re more likely to shop with brands and retailers who use PERSONALIZATION to make their messages and offers more relevant, said Sam Knights, CEO of Threefold.

OPTIMIZATION is at least a secondary consideration for all activity and a key reason why retail media has been adopted by so many marketing organizations. While there is still a long way to go, tools are now available to “essentially learn how to optimize [advertising for] every single product at every single location,” promised Matthew Eisley, CEO of Qsic, while explaining 7-Eleven’s new in-store audio program.

Optimization also delivers benefits for consumers, who “are tired of the constant, irrelevant noise” they receive through most advertising activity, said Pratt.

CTV will be the next major stage for retail media and should help facilitate the flow of national ad dollars into the marketplace, predicted Dmitry Pavlov, Retail Media Leader of The Math Company and former Walmart Labs executive. “Everything in streaming TV can be measured,” noted Roku’s Piasecki. “The concept of national media is changing, as is the concept of TV.”

Streaming TV is also quite conducive to TEST & LEARN opportunities — as is the retail media marketplace as a whole.

And in case anyone forgets the ultimate goal of commerce marketing, “You can’t win market share until you win mind share,” said Brian Spencer, KPM’s Marketing Director. “Advertising is the force which opens up people’s minds to new possibilities,” he said. And that makes a SHOPPER FIRST focus the key to winning through retail media or anywhere else in commerce.

“Advertising is changing the world, and retail media is changing advertising,” said Spencer, a comment echoed later by Pratt.

In an ideal world, retail media wouldn’t be “about monetizing [but] all about the customer,” said Sebastian (at left). The goal should be “to build customer relationships, not to build the bottom line.”

Download a copy of this report here: TheMarsAgency_Winning at Retail Media Bingo

About Mars United Commerce

Mars United Commerce is an independently owned global commerce marketing practice that aligns people, technology, and intelligence to make the business of our clients better today than it was yesterday. Our worldwide capabilities coalesce into four key disciplines — Strategy & Analytics, Content & Experiences, Digital Commerce, and Retail Consultancy — that individually deliver unmatched results for clients and collectively give them an unparalleled network of seamlessly integrated functions across the entire commerce marketing ecosystem. These disciplines are powered by our industry-leading technology platform, Marilyn®, which helps marketers understand the total business impact of their commerce marketing activation, enabling them to make better decisions, create connected experiences, and drive stronger, measurable results. Learn more at https://www.marsunited.com/