The Mars Agency presents a quick take on strategic shifts and tactical initiatives across the ever-evolving retail media landscape.

To keep the industry updated between the quarterly editions of our Retail Media Report Card, The Mars Agency is monitoring the efforts at leading platforms to improve and expand their capabilities and services.

We’re focusing on the initiatives these networks are undertaking to make it easier and more efficient for advertisers to effectively plan, execute and measure their marketing programs. In particular, we’ll be tracking changes that impact the 62 key performance criteria on which the platforms are evaluated within the Report Card.

The information covered in these updates will be used by Commerce Media analysts to inform the network evaluations that will be presented in future editions of the Report Card.

We’ll also report on key events and initiatives taking place across the rest of the ever-growing and always-evolving retail media landscape.

Amazon Still Dominates Retail Media Marketplace

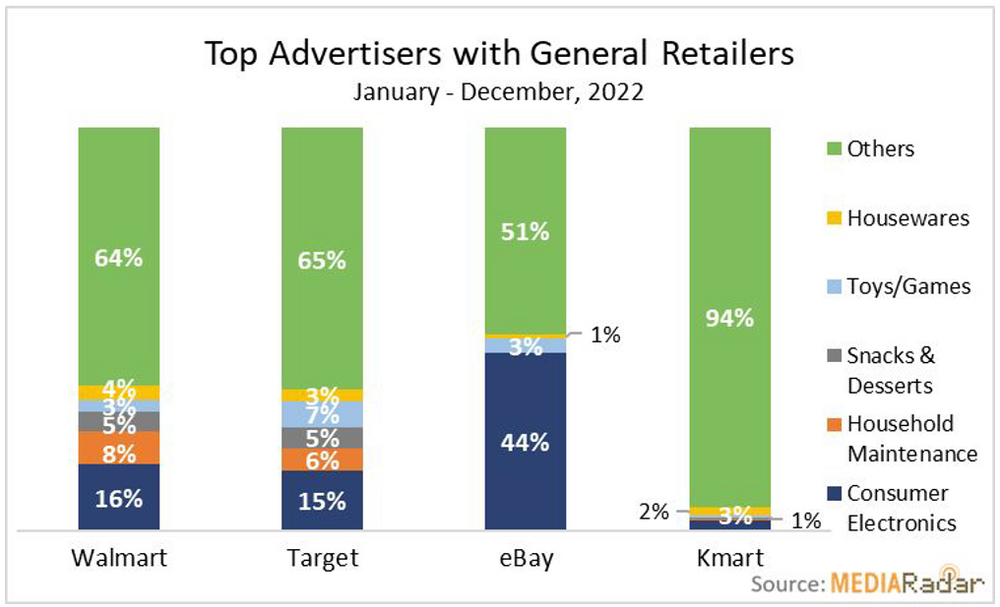

No surprise here: According to MediaRadar, Amazon captured 37% of retail media ad spending in 2022, when total outlays reached roughly $100 billion. About 17,000 brands from 14,200 companies advertised across the e-commerce giant’s properties during the year, MediaRadar estimates.

In response to Amazon’s continued dominance, MediaRadar encourages competing retailers to explore opportunities to extend their own media opportunities to places where Amazon doesn’t have much traction, such as in-store digital experiences or email newsletters. The Mars Agency couldn’t agree more — especially in regard to in-store opportunities. (See what Commerce Media EVP Ethan Goodman has to say on the subject here.)

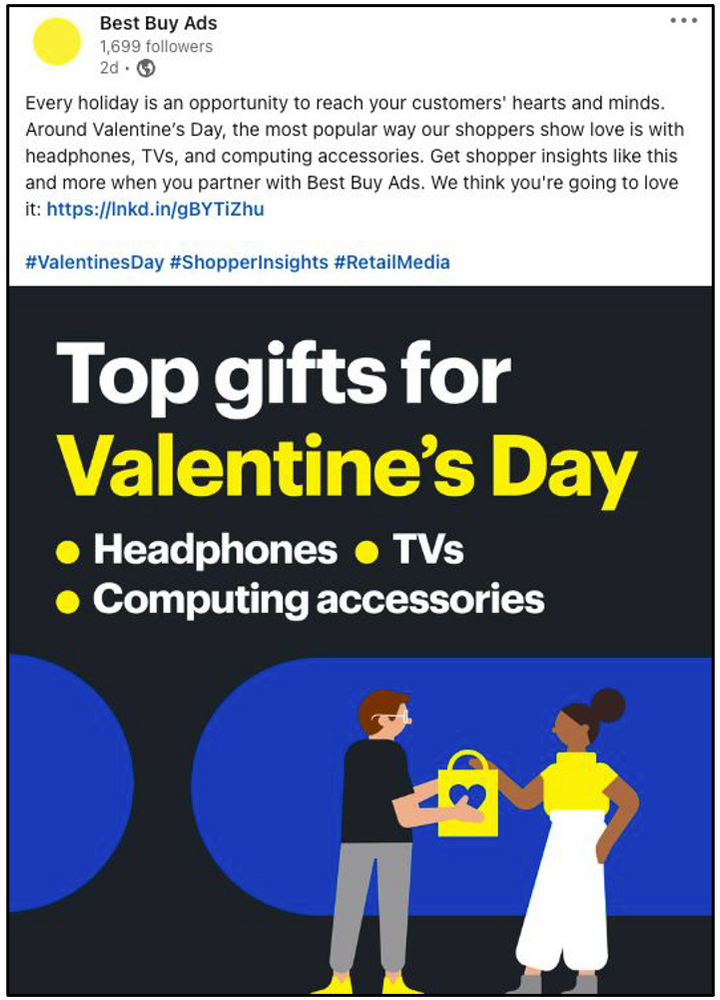

Best Buy Ads Creates a Category Marketing Team

Speaking of in-store opportunities, Best Buy Ads has established a Partner & Category Marketing team within its managed services “to continue improving how we support our partners,” the company said. By combining the legacy category marketing and retail media teams, Best Buy’s goal is to give brand partners a single point of contact that can provide “a comprehensive, connected approach to their marketing and media needs,” according to the retailer.

This move represents a huge step forward in the development of connected commerce solutions for suppliers because it formally aligns retail media activity with other Best Buy initiatives such as as drive time campaigns (holiday, back to school); ongoing promotions (Deal of the Day, flash sales, second-tier holiday weekend sales); and curated content solutions in-store, on bestbuy.com, and through social channels. (Read The Mars Agency’s position on the “single point of contact” approach to partnership here.)

In just its second year of operation, Best Buy Ads has been making great strides to not only match the existing innovation of other networks but to take a leadership position in the marketplace. As another example, Best Buy is actively exploring opportunities for customer engagement in the metaverse which, among other benefits, could be an ideal environment for product testing (think of how much easier trying out multiple treadmills could be, for instance.)

Elsewhere, Best Buy has forged an extensive first-to-market partnership with Roku that will provide access to the retailer’s first-party shopper data for audience targeting and closed-loop measurement with campaigns on the streaming TV platform. Best Buy also becomes the exclusive retailer for newly launched Roku-branded smart TVs. The relationship was formally unveiled at a unique home theater experience staged earlier this month as part of SXSW.

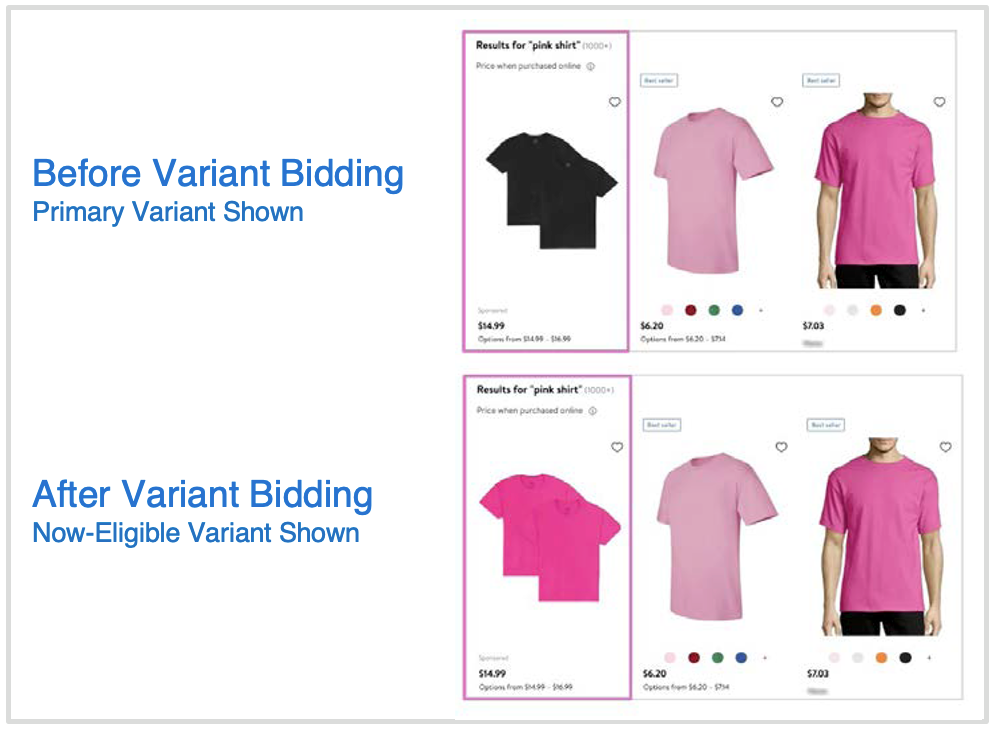

Walmart Connect Adds Variant Bidding

Walmart Connect has enhanced Sponsored Product campaigns on Walmart.com by adding Variant Bidding, which lets advertisers promote any variation of an item in their catalog — including sizes, colors, counts, and patterns — rather than just a single SKU. The goal is to improve brand and item discovery — and thereby boost conversion and sales — by giving shoppers more choice. (The strategy is not available for Browse In-grid placement or Sponsored Brand ads.)

Walmart Connect continues working to become a leader in search capabilities by investing in updates like these, which are designed to boost relevancy, cost-efficiency and/or shopper engagement. In addition to enhancing the shopper experience by expanding choice, Variant Bidding should help advertisers:

• Grow conversion and sales by identifying and promoting multiple high-converting products (popular or seasonal SKUs) from a single item listing.

• Enhance brand exposure by strategically promoting variant items to grow share of voice.

The new feature also will likely intensify competition, given the increased number of items being promoted. This will be an area to monitor closely.

Meanwhile, Walmart Connect has been alpha testing Sponsored Videos this winter as a likely new advertising opportunity. In the test, relevant video ads appear in-grid as part of onsite or in-app search results and begin playing automatically when they’re 50% in view.

Sponsored Video offers brands increased engagement potential and a solid opportunity for product storytelling. The feed placement is eye-catching and ideal for providing additional product information and inspiring discovery among keyword searchers. This placement isn’t offered by some other key retail media networks, which could give Walmart Connect a leg up on the competition.

Albertsons Shifts to Google Ad Manager

In a pivotal move for Albertsons Media Collective, Google Ad Manager last month took over management of onsite display campaigns. (Former partner CitrusAd will continue managing onsite search.)

Featured enhancements include:

● Frequency capping, which will control the number of times a shopper sees the same ad and should lead to campaign efficiency and improved performance.

● Contextual search terms, which will enhance targeting.

● Geo-targeting of onsite banner ads to specific Albertsons divisions or even stores. This will be a particular benefit to regional brands or new items launching in select chains.

● Guaranteed impressions and fixed CPMs, which will drive cost savings and better forecasting.

● A limitation on takeover campaigns to two days/week across all clients, freeing up prime inventory.

In addition, Google Ad Manager will make management of onsite and offsite activity available through a single hub for the first time. The new partnership also paves the way for future capabilities such as audience targeting, incremental lift reporting, viewability, bundled keywords, and creative optimization. The transition is a great step for Albertsons Media Collective as it continues improving its network offerings.

KPM Releases New Onsite Ad Guidelines

Kroger Precision Marketing has created new templates and simplified creative guidelines for advertisers that will take effect on March 30.

The new guidelines are far more prescriptive than previous versions, requiring a single color, no patterned background and limited copy in a separate container.

It’s likely that KPM will roll out similar creative guidelines across other channels, following in the footsteps of other top retail media networks like Target and Amazon. In the meantime, brands should make sure that their offsite creative maintains the same look, tone and feel as onsite ads without jeopardizing their unique appeal.

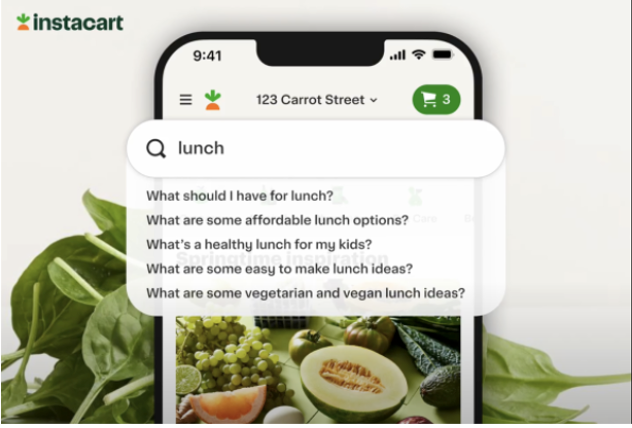

Instacart Plans Move into ChatGPT

Instacart will integrate OpenAI’s ChatGPT chatbot technology into its ecommerce shopping app later this year. The on-demand delivery leader plans to let shoppers ask food-inspiration and recipe-related questions to receive responses that will contain shoppable suggestions, according to the companies.

The adoption of ChatGPT-like technologies will add a whole new dimension — and another layer of complexity — to shopper engagement that retailers and brands will need to investigate.

IGA Launches a Network for Members

Independent Grocers Alliance (IGA) is launching a retail media network for its members in partnership with Ideal Design House. Advertisers will be able to invest and execute campaigns across multiple independent retailers simultaneously.

The platform will offer onsite and offsite ad placement, along with back-end metrics and reporting that includes in-store traffic, basket size, category growth, and ROAS.

IGA aims to become a one-stop shop for brands looking to gain scale by investing across numerous independent grocers while helping its members gain a critical share of the ever-growing retail media pie. It will be interesting to see how IGA’s offering compares to other third-party networks with the same goal of aggregating smaller supermarket operators.

Quotient Builds a Retail Ad Network

Speaking of aggregators, third-party solution provider Quotient has launched its own Retail Ad Network to enable cross-chain execution of offsite media.

While still taking shape (beta results from Q4 2022 are pending), Quotient’s plan centers on the use of first-party purchase data from partnering retailers (currently including HyVee, Rite Aid and Giant Eagle) along with the company’s own proprietary location data. Audiences for other retailers will be modeled until more contracts are in place.

Initial ad vehicles will cover offsite mobile/desktop and digital out of home; advertisers can also combine the buy with Quotient digital coupons to incentivize purchase. Primary KPIs will be attributable sales, trial rates, and trips.

In related news, Criteo just acquired Australia-based Brandcrush, a software platform designed to facilitate and simplify the buying and selling of retail media, shopper marketing, and third-party touch points through a single system.

We’ll be watching closely to see how the Retail Ad Network evolves, especially in terms of the additional retailer partners it can recruit. Since the network is designed as a one-stop shop, even Quotient suggests that advertisers work directly with specific retailers if the objective does not involve cross-retailer activation.

____________

About The Mars Agency

The Mars Agency is an award-winning, independently owned, global commerce marketing practice. With talent around the world, they connect people, technology and intelligence to create demand and drive profitable, sustainable growth. Their latest MarTech platform, Marilyn®, enables marketers to make better decisions, create connected experiences and drive stronger results. Learn more at meetmarilyn.ai.