New products and themes that caught the attention of Mars United’s team as it walked the aisles of the annual event for pet-focused brands and retailers.

By Madalynn Owens & Sophia Spence, Mars United Commerce

With pets increasingly regarded as much an integral part of the family as their human counterparts, the opportunities for innovation in relevant product categories are virtually endless — especially among premium health and wellness niches. NielsenIQ sizes the entire U.S. pet category at $86.9 billion (as of July 26), up 3.1% versus the prior year and driven largely by online growth of 12.3% plus a continued rise in spending for premium offerings.

The recent SuperZoo pet retail event, held August 13-15 in Las Vegas, positioned some 1,100 exhibitors in front of roughly 22,000 members of the global pet industry. Brand owners, buyers, merchants, ecommerce facilitators, grooming specialists, and pet lovers in general from across the specialty, grocery, convenience, hardware, farm, mass, dollar, club, and online channels converged for the 75th annual event to assess the state of the industry and evaluate today’s prospects for growth.

Three recurring themes rose to the top across the product innovation pipeline that was on display at the show, illustrating the novel thinking and messaging being used to help brands connect with today’s pet shoppers.

1. Extreme Humanization

The practice of “extreme humanization” that began warming up over the last few decades has reached its boiling point. According to Pew Research, a full 96% of pet owners consider their pets family and over half say they’re as much a part of the family as any human member. Throughout SuperZoo, various trends in human nutrition and health & wellness were on exhibit to meet the needs of pet owners striving to give their pets the best.

Nowhere is extreme humanization reflected more clearly than in the pet food category, where “human grade” is now table stakes. Marking a new standard for pet food brands, products are either specifically calling out human-grade and clean, whole-food ingredients or alluding to them with farmer’s market and fresh imagery. Brands including Mars Petcare’s Orijen Wild Reserve and The Butcher’s Pup are emphasizing the outdoorsy, meat side of the fresh equation.

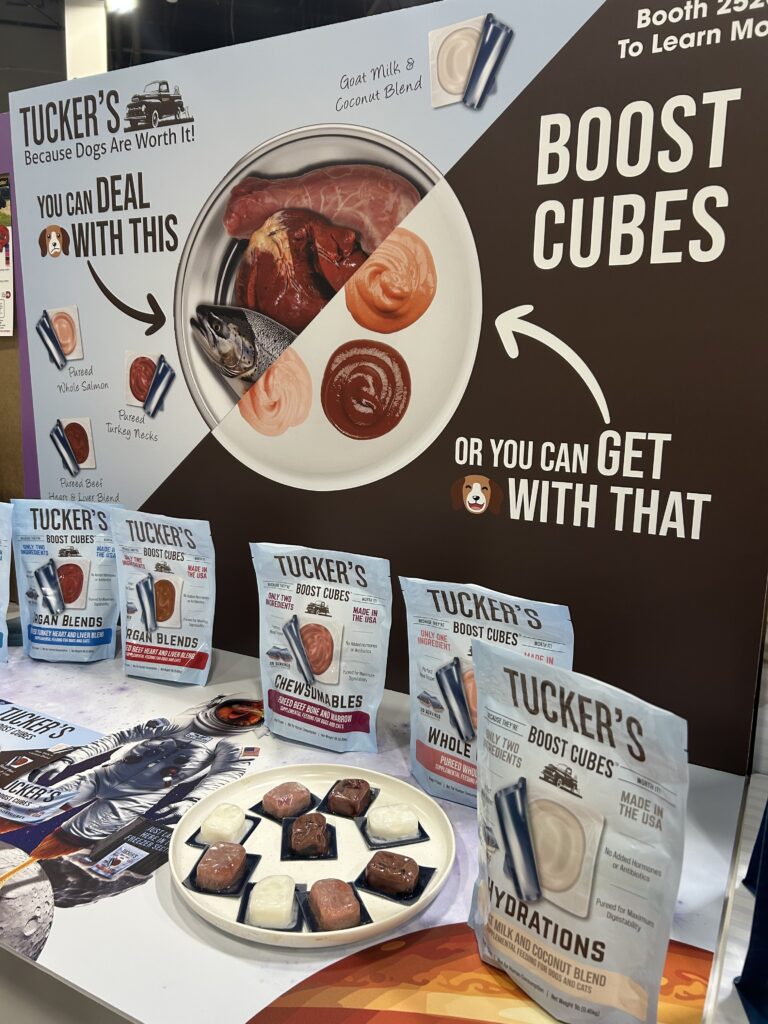

Protein types and gut health are becoming a particular focus across food as well as treats, flavorings and toppers. From gravies, purees, and pates to broth, jerky, and baked goods, human-like food types and forms are proliferating, even extending to sous vide cooking methods and raw formulations.

Humanization is also becoming evident across non-food product categories as brands are seeking to deliver fashion and even Korean beauty’s signature emphasis on preventative skin care to the pet marketplace. Typical human-centric brands such as SPARC Group’s Eddie Bauer and Carhartt are showing up with dog apparel and accessories. For playtime, Woof Pet’s popular line of childlike toys is continuing to grow in assortment. Human-themed toys are encompassing “Nomchucks,” “Treat Trays,” farmer’s market plushies, wine bottle squeaky toys, and dedicated birthday gifts.

In the wellness space, accessories are expanding to include daily pill dispenser and cutters as well as cooling technology for mats and beds. Supplements, sunscreen and other skin care products are following messaging strategies and packaging concepts similar to those aimed at human-use cases, delivering on transparency while employing bright and appealing imagery.

OPPORTUNITIES FOR COMMERCE MARKETERS

Connect Emotionally: Messaging focusing on the strong emotions people have for their pets will continue to be successful in the era of extreme humanization. Highlighting product attributes and functional benefits while aligning with the pet-obsessed lifestyle is a good way to leverage this theme.

Be Transparent: Brands that are upfront with their ingredients and sourcing appeal to pet owners continuing to scrutinize their pet’s products. Product messaging needs to set brands apart within their respective categories and explain product claims and functionality. Offering clear information about ingredients and benefit assertions, alongside credentials and certifications where appropriate, offers a pathway to establishing trust.

2. Optimizing Additions

Toppers and treats with functional benefits are experiencing significant growth, especially with younger pet owners. According to a Mintel category report, 48% of cat owners and 45% of dog owners under the age of 35 purchased toppers in 2024.

Previously used to add flavor and variety to pet meals, toppers took on various formats and packaging at SuperZoo, but all brands went beyond taste to communicate their particular preventative and nutritional benefits. Goat milk, bone broth, powders, and even infused peanut butter are being showcased as ways to enhance mealtime or simply as a bonus treat. Touted benefits range from promoting gut health and cognitive function to improving hydration and mobility and even enhancing relaxation. Some brands focus on ingredients, positioning themselves as a solution to offering raw diets without the prohibitive hassle or cost.

Many brands are aligning themselves with professional veterinary practices to enhance credibility, whether by touting vet-developed formulas or simply incorporating the word “vet” into product names and branded content. Dental care and allergens are also part of the conversation.

OPPORTUNITIES FOR COMMERCE MARKETERS

Embrace Versatility: In food, toppers must do more than just taste good to woo shoppers. Identifying ways to help pet owners continue optimizing their pet’s wellbeing is one potential strategy for tapping into this theme. Other options could take the form of creative cross-merchandising, such as pairing products with grooming services.

Lean into Education: As owners continue to show interest in supporting their pet’s health, there’s an opportunity to provide further education. Additional information on product attributes, benefits, safety, and functionality can encourage pet owners to convert.

3. Purposefully Specific

Since many direct-to-consumer brands have offered tailored meal plans for years, personalization isn’t exactly groundbreaking in the pet space, but it is moving toward even greater specificity. With 58% of pet owners willing to pay more for custom pet products, per another Mintel category report, brands are going a step further by identifying niches to own.

There was a pervasive focus on age and breed groups on the show floor, with the food category once again front and center. A concerted effort to help pets age gracefully has seniors stealing the show as brands trot out softer kibble or call out the specific health needs of older dogs. Brands targeting the individual needs of specific breeds are taking a more educational approach. Replenish Pet’s Maximum Bully, for example, is highlighting the additional protein in its formula that addresses the nutritional needs of those types of dog breeds. Vitamins are likewise presented as tailored to specific pet types and breeds.

Cat brands are differentiating themselves by proudly touting cats as their central focus — not just another product line, appealing to owners who are tired of playing second-fiddle to dogs. Some brands are even starting to create nutritional plans and food that solve cat-specific issues like hairballs and urinary health.

OPPORTUNITIES FOR COMMERCE MARKETERS

Demonstrate Location Needs: As pet products get more niche-focused, messaging that zeroes in on a brand’s applications for specific regions also comes into play. Location-based messaging can resonate with pet owners navigating regional needs or challenges. For example, mosquito protection can be especially useful to pet owners in mosquito-prone areas.

Celebrate More Engaged Cat Owners: The use of training tools like leashes, as well as the purchase of cat-themed merchandise, is on the rise among cat owners — who increasingly are men, especially Gen Zers and Millennials. Speaking directly to these “cat dads” with a clear positioning that celebrates and elevates the bond they have with their pet will resonate with today’s more engaged owners.

Beyond the overarching themes of extreme humanization, optimizing additions, and purposefully specific, noteworthy new category innovations at the show spanned packaging trends such as upcycling and zero-waste, elevated ways of sourcing ingredients including sustainable fishing, as well as products featuring dye-free formulations, DIY elements (for items such as at-home testing and grooming kits), and electronic enhancement or connection.

Regardless of product category, the key themes evident at SuperZoo reflect insights into the pet “parent” mindset that are key for brands working to stay relevant and get into the cart.

About the Authors

Madalynn Owens is a Senior Strategic Planner with a passion for bringing empathy and research together to better understand today’s shoppers and culture, distilling insights into creative strategies. She has been a strategic planner in commerce marketing for her entire career spanning food and beverage, alc-bev, wellness beauty and petcare categories.

Sophia Spence is a Senior Account Executive who brings energy, collaboration, problem-solving expertise, and clear communication to every client relationship, guiding projects gracefully to the finish line. She has extensive experience in client leadership and marketing roles, with a recent focus in the medical space.

Mars United’s Madison Buckby and Emily Fultz also contributed to this report.