As part of their ongoing mission to help clients stay ahead of the competition in a fast-paced, constantly evolving marketplace, the field teams in Mars UnitedSM Commerce’s Retail Consultancy closely monitor the strategic activity taking place across all key retailers and channels.

Each month, the teams compile Marketplace Assessment reports on the retailers (including Walmart, Target, Amazon, and Kroger) and channels (such as Regional Grocery, C-Store, Club, Pet, Beauty, and On-Demand Delivery) that are most important to the business success of our clients. The following report outlines noteworthy events across five key retailers from the team’s most recent round of assessments. (To receive copies of the full reports, contact EVP-Retail Consultancy Kandi Arrington at [email protected].)

Walmart Is Supersizing for the Future

Walmart opened its first “Store of the Future” in Cypress, Texas, last month. The location, which also represents the mass merchant’s first “ground-up” new supercenter in four years, is part of a massive modernization initiative unveiled in early 2024 that earmarked $9 billion for bringing the future store concept to roughly 1,400 U.S. stores. The plan calls for roughly 150 stores to be built or converted over the next few years, including the addition of four more “ground-up” supercenters and two conversions in 2025.

The Cypress store boasts reimagined department layouts, expanded customer services, and a variety of technology upgrades. Highlights include:

- Services such as a gas station and an auto care center.

- An updated pharmacy with a health services room and pickup window.

- A refreshed vision center.

- Improved designs for the fashion, baby, home, and pet departments.

- Regional ready-to-eat offerings, including a Hispanic bakery, fresh tortilla maker, sushi station, and Dunkin’ restaurant.

- All of Walmart’s pickup and delivery options, including delivery within 30 minutes and three hours, as well as InHome.

- Enhanced technology that lets shoppers use the Walmart App to schedule an in-home TV installation, add to their product registries, book a tire appointment, or schedule other services.

- QR codes placed throughout the store linking to product information, online access to additional inventory, and other shopping tools.

- At-shelf digital price labels throughout the store.

Relevance: The fact that Walmart is opening supercenters after a four-year layoff is proof enough that the physical store remains the most crucial element of the retailer’s overall strategy. And the new “Store of the Future” design is evidence that Walmart continues looking for new ways of driving traffic to stores, enhancing the shopping experience, and aligning the digital and physical stages of the path to purchase.

Opportunity: Brands should keep in lockstep with their Walmart partners to identify ways of helping the retailer enhance the shopping experience in the future store environment and all other locations. They also should consider relevant promotional tie-ins as Walmart continues adding more customer services to present itself as a one-stop shop for consumer needs.

Albertsons Debuts Business Ecommerce Offering

Albertsons Companies is capitalizing on the return-to-office trend among U.S. companies by expanding its services for small and medium-sized businesses, nonprofits, schools and local governments that need supplies for their day-to-day operations. The retailer’s ecommerce platform for businesses is now available for fulfillment through more than 2,000 stores in the Albertsons, Safeway, Acme, Jewel-Osco, Shaw’s, Star Market, Vons, Pavilions, Tom Thumb and Randalls chains.

The free membership platform lets businesses order food and other break room supplies, as well as cleaning and paper products. Available services include same-day delivery, flexible payment options, white-glove service (delivery to a specific area within the building the business is at), and tax exemptions for online purchases.

Relevance: “We saw an opportunity in the market to reach this important customer base and foster customer growth by leveraging our extensive store network and diverse product selection,” said Stephen Menaquale, SVP of Ecommerce for Albertsons. “Ecommerce is a top priority for Albertsons Cos., and the enhancement of our business platform underscores its critical role.”

An energized focus on outreach to local businesses and other “bulk purchase” institutions is a great way for Albertsons’ to drive ecommerce sales by leveraging its vast physical footprint and last-mile capabilities. It also gives the grocer an opportunity to gain new market share from office supply specialists with which it does not typically compete. While other retailers including Walmart and Instacart also offer business services, Albertsons’ free membership proposition might provide a competitive edge.

Opportunity: Brands should keep watching Albertsons’ activity on the business front to learn what marketing opportunities are available on this ecommerce platform and elsewhere — especially for products that might have bulk purchase appeal.

Sam’s Clubs Aims for Exponential Growth

Sam’s Club announced plans to open 15 new stores and remodel all 600 existing locations across 45 states over the next eight to 10 years as it seeks to double membership numbers, sales, and profits. The ambitious plan, which also involves a strengthening of ecommerce operations, follows footprint-expansion announcements from both of Sam’s Club’s primary warehouse club rivals, Costco and BJ’s Wholesale.

Relevance: Membership is a crucial aspect of Sam’s Club’s business model, and technology-enabled stores that deliver a seamless omnichannel shopping experience are critical for attracting and retaining members. Sam’s Club currently generates 80% to 90% of its profits from membership fees. Digital transactions (purchases made online or through in-store Scan & Go technology) account for 40% of all transactions. Additionally, shoppers who use Sam’s Club’s online tools shop three times more frequently than members who only buy in clubs, according to Tom Ward, Sam’s Club’s End-to-End Chief Operating Officer.

Opportunity: As Sam’s Club continues bridging the gap between physical and digital experiences, brands should investigate the opportunities to deliver targeted offers that will resonate with members shopping in-store. They also should explore partnerships on membership-driving promotions and events.

Amazon Broadens the ‘Shop the Show’ Experience

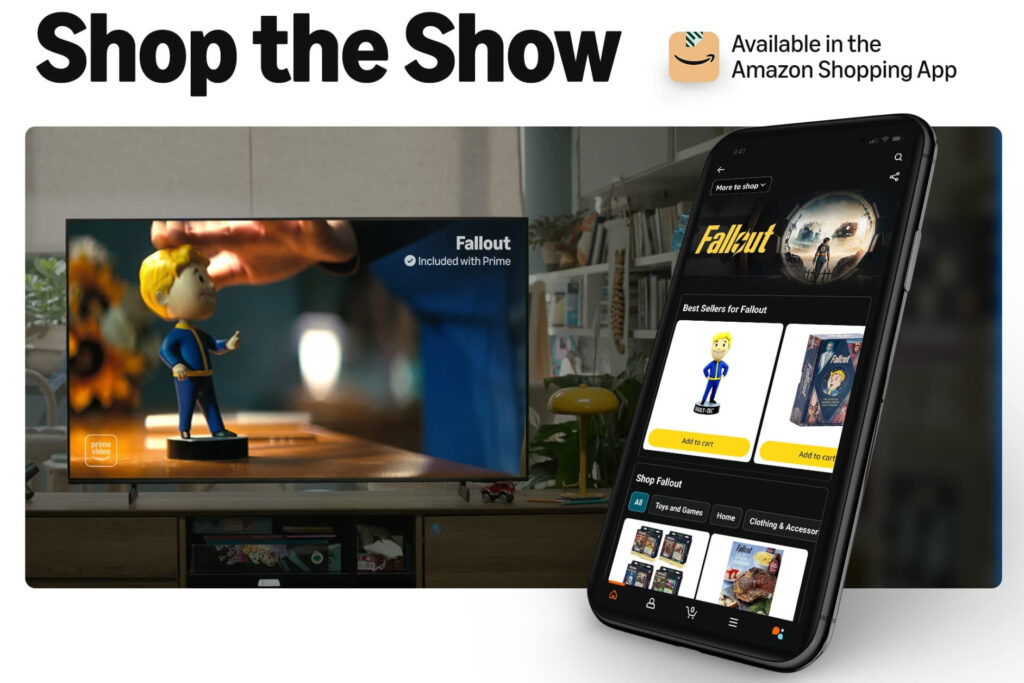

Amazon has expanded the availability of its “Shop the Show” service to more than 1,300 entertainment properties. The tech-enabled service lets U.S. viewers shop for related products as they watch TV series, movies, or live sports events.

Launched in 2024 across a limited content inventory, “Shop the Show” creates a second-screen experience on mobile devices. Viewers logged into their Prime Video accounts can search “shop the show” in the Amazon app to get a list of available titles, with any eligible recently watched programs automatically appearing on the page. Shoppable products include items featured within the program or others related to, or inspired by, the content.

Relevance: “Shop the Show” supports the second screen behavior of many consumers, who commonly utilize their mobile devices while simultaneously watching content on a larger screen. It also capitalizes on the growing demand for personalized shopping experiences, allowing viewers to be further immersed in their favorite entertainment content by purchasing relevant merchandise while they watch. According to Russell Research, 94% of adults have browsed, shopped, or made a purchase inspired by something they watched on TV; “Shop the Show” makes the experience of finding these products seamless.

Opportunity: Brands should work with their Amazon partners to understand the mechanics behind “Shop the Show” and the opportunities for making relevant products available through the service.

Amazon Adds AI-Powered Discovery

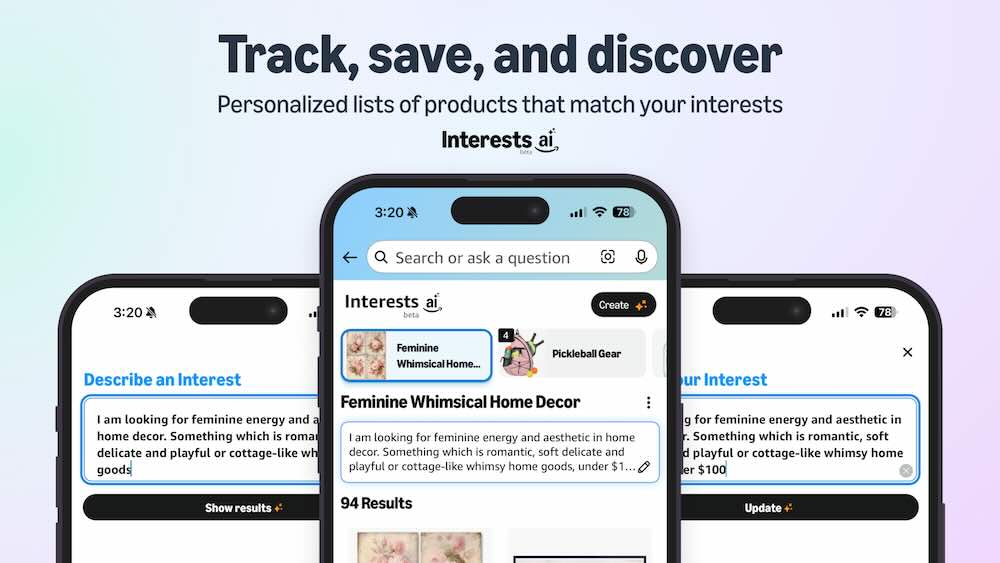

Shopping experiences inspired by activities other than bingewatching have a place on Amazon as well. “Interests,” a recently launched AI-powered feature, helps shoppers find products relevant to their hobbies or passions. Users create personalized shopping profiles tailored to their interests, price limits, and product preferences such as colors and flavors. The service then continuously checks new Amazon inventory and notifies the user about available products matching their criteria.

The “Interests” feature is currently available on the Amazon App and mobile website to a small subset of U.S. shoppers, although there are plans to roll it out nationally in the next few months.

Relevance: “Interests” uses large language models (LLMs) to automatically translate conversational language into queries and attributes that traditional search engines can process to deliver product recommendations. The feature’s “set it and forget it” capability extends product discovery to moments when consumers aren’t even actively shopping or searching.

Opportunity: As Amazon continues to modify product discovery and ramp up AI capabilities on its app and website, digital shelf content strategies for brands will need to keep pace. Download Mars United’s latest Digital Shelf Report to stay abreast of more changes at Amazon and 10 other leading ecommerce players.

Chewy Adds More Vet Care Locations

Ecommerce pet specialty retailer Chewy.com’s push for a physical presence continued last month with the opening of two veterinary clinics in the Dallas-Fort Worth area. There now are 11 Chewy Vet Care Clinics in Georgia, Texas, Florida, and Colorado.

Open to all breeds of dog and cats, the clinics provide affordable care plans administered by licensed veterinary teams. A suite of accompanying tools include a mobile app offering access to personal medical records and 24/7 virtual health guidance.

Relevance: Already dominating ecommerce in the pet category, Chewy.com is seeking additional ways to extend its day-to-day relevance among pet owners. By offering personalized, convenient and comprehensive in-person care, the retailer can strengthen loyalty among existing customers and attract new shoppers to its still-growing ecosystem.

Opportunity: Brands should study how value-added services that combine convenience, education, and ongoing care can strengthen customer relationships and extend brand relevance beyond the point of sale. Read “How to Win with Chewy.com” to learn about more opportunities to build a stronger relationship with this critical retailer and its shoppers.

Mars United Commerce’s Retail Consultancy is an unrivaled team of in-market commerce experts who simplify the complexity of retail for our clients. Located in Bentonville, Minneapolis, Cincinnati, Chicago, Tampa and the “backyards” of other key retailers, they provide deep knowledge of the retailer, expertise in key business areas (like strategy, media and creative), and door-opening personal relationships with key executives to deliver an unmatched level of business success for clients across accounts, channels, and shopper engagement platforms. For more information, contact EVP-Customer Development Kandi Arrington at [email protected].