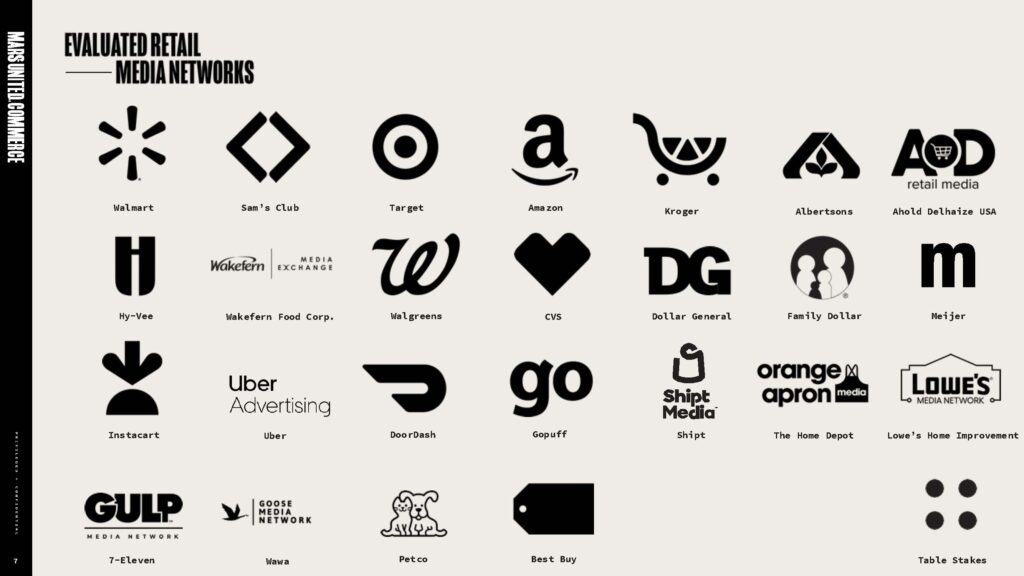

The 12th edition of the industry’s most informative cross-network assessment guide evaluates 89 capabilities at 25 leading platforms.

To download the report, fill out the form below.

In May, eMarketer again adjusted its forecast for U.S. retail media spending downward — ever so slightly — to $60.8 billion, eliminating roughly $400 million from its previous projection.

But that’s perfectly OK. Because while the pace of revenue growth is, of course, critically important to each individual retailer media network, what’s more important to the industry as a whole is the pace of maturation, sophistication, and innovation that is taking place. And in that regard, things seem to be progressing just fine.

Growth rates are slowing here in the U.S. (which, by the way, accounts for 36% of all investments worldwide). But spending will continue to increase at double-digit rates for the rest of the decade to surpass $100 billion in 2029 — when retail media will account for 20.4% of all digital advertising outlays, eMarketer predicts.

Growth rates are slowing here in the U.S. (which, by the way, accounts for 36% of all investments worldwide). But spending will continue to increase at double-digit rates for the rest of the decade to surpass $100 billion in 2029 — when retail media will account for 20.4% of all digital advertising outlays, eMarketer predicts.

However, Amazon is still cornering the marketplace and will claim more than 77.3% (about $47 billion) of all U.S. spending this year. Walmart comes in second with 7% ($4.3 billion). That leaves roughly $9.5 billion in estimated spending for the scores of other retail media networks to fight over.

And that’s exactly why the pace of maturation, sophistication, and innovation is so strong. While Amazon assuredly still leads the way in innovation, and Walmart has taken the pole position when it comes to agentic AI, the need to stand out in an increasingly crowded field is driving networks of all shapes, sizes, and channels to find ways of carving out a niche and earning whatever slice of market share might be available.

Retail media networks, therefore, have been working more closely with brands, following the requests and recommendations of their advertising partners to win their investments by enhancing and expanding capabilities onsite, offsite, and increasingly in stores; by developing unique points of differentiation; and perhaps most importantly, by clearly proving performance through metrics that will satisfy the entire brand organization — not just the media planners. These efforts are fully evident across the scorecard charts and Platform Profiles contained in this Report Card.

All these advancements make it even more critical for brands to scrutinize their options carefully. Brands are tasked with developing a strategic understanding of how they can best leverage retail media to drive incremental growth, which retailers will provide the greatest opportunities for success, and what specific media investments will be most effective at achieving the desired impact. They also must align their retail media activity with the rest of the commerce marketing plan, which can improve success not only through more seamless shopper engagement but by fostering greater internal efficiency across functions. This level of understanding is critical to future growth.

How to Pick Partners

There are two very important ways to evaluate the best retail media platforms for investment. The first is to assess each network individually, the role it plays within — and the impact it has on — your broader retailer relationship, and the opportunities it provides for achieving your specific brand objectives. Retail media has become a critical aspect of the broader supplier-retailer partnership and, in an increasing number of cases, an important factor in joint business planning. This broader context must always be considered when making investment decisions. The second, more objective way to evaluate the best places to invest is by comparing the various networks to determine their relative strengths and weaknesses against a uniform set of key performance criteria. As the marketplace has evolved, in fact, a growing number of criteria that initially served as network differentiators are now “Table Stakes” that any network must offer to address the needs of brand partners and keep pace with competitors.

To help our clients efficiently evaluate spending opportunities, Mars United created a retail media health scorecard to track the capabilities of leading networks across the key criteria advertisers need to optimally plan, execute, and measure their activity. This general framework for network scorecarding is customized for each client to reflect its unique business objectives, budget, performance expectations, and retail partnership priorities. Internally, we continuously update the information to stay ahead of the rapidly evolving capabilities of existing networks and the ongoing launch of new platforms.

To help the industry at large gain a better understanding of the opportunities available, and to encourage the development of evaluation standards that might ultimately improve both the collaborative process and overall network effectiveness, Mars United has publicly shared this Retail Media Report Card on a quarterly basis since fall 2022. This public report presents the foundational scorecarding elements of our evaluation process for clients.

New Features This Quarter

We update each quarterly Report Card to reflect the ongoing enhancements made by these platforms, to evaluate additional platforms, and to modify our analysis as needed to continue representing best practices in the industry.

In the second-quarter Report Card, we undertook the largest-ever expansion of our coverage by adding five more networks to the evaluation. Those additions also increased the report’s scope to another two retail channels: convenience and pet. That inspired us to reorganize the Key Performance Area scorecards into two groups that we’ve loosely labeled “Core CPG” and “Essential Specialty.”

In terms of updates, 19 of our 25 retail media networks added a collective 48 tools and opportunities to their existing capabilities, working either to keep pace or gain an advantage (as the case may be) in this highly competitive marketplace. DoorDash Ads led the way with seven updates, followed by Hy-Vee RedMedia, Sam’s Club Member Access Platform, and Spot Media by Petco with five each.

Finally, our quarterly “Capability Spotlight” looks at several ways in which networks are working with brands to plan integrated campaigns that unite digital media with in-store activation (see page 22).

We hope you enjoy the 12th edition of our Retail Media Report Card. If you’d like to learn more about how Mars United can help you help excel in retail media, contact Willy Blesener at [email protected].