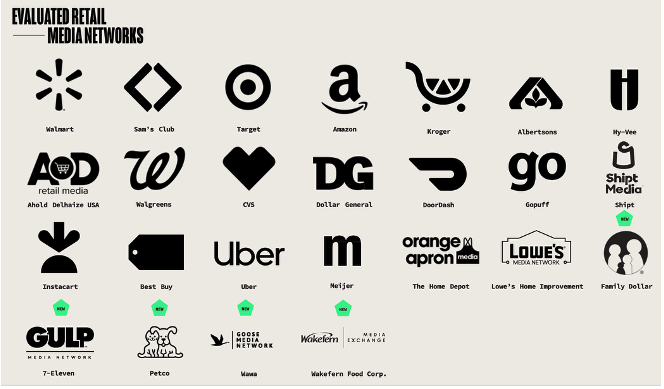

The 11th edition of the industry’s most informative cross-network assessment guide evaluates 89 capabilities at 25 leading platforms.

To download the report, fill out the form below.

Retail media is moving in new directions.

Overall U.S. ad spending is expected to reach $61.2 billion in 2025, according to eMarketer’s most recent forecast (which, by the way, represents a dip of about $1.2 billion from its previous projection).

But outlays for offsite media will grow 42% in 2025 — nearly triple the rate (15%) for onsite advertising — to account for roughly 20% of the total pie. In-store spending, too, will grow 47% this year but still represent less than 1% of the total.

“With retail media networks growing in scale and complexity, marketers should push for campaigns that take advantage of the exposure that offsite ads can offer,” recommends eMarketer. “Additionally, retail media planners should balance onsite tactics with offsite expansion for full-funnel impact.”

For brand advertisers, however, the goal of moving offsite isn’t only to expand the audience available through the network’s owned and operated channels, but also to make the rest of their digital media plan more effective by infusing it with the retailer’s first-party data and closed-loop measurement capabilities.

Despite a recent (and inevitable) slowdown in growth rates, retail media remains among the fastest-growing segments of the media ecosystem. As a uniquely effective advertising vehicle that can deliver truly targeted audiences and directly measurable results, it has become a focal point for most consumer packaged goods marketers — and a foundational element of the overall strategic plan at more than a few.

This makes it critical for brands — faced with an array of choices about where and how to spend their money — to scrutinize their options. That’s why retail media networks are now working more closely with brands to earn those dollars by improving their capabilities and developing unique points of differentiation.

To help our clients efficiently evaluate spending opportunities, Mars United created a retail media health scorecard to track the capabilities of leading networks across the key criteria advertisers need to optimally plan, execute, and measure their activity. This general framework for network scorecarding is customized for each client to reflect its unique business objectives, budget, performance expectations, and retail partnership priorities. Internally, we continuously update the information to stay ahead of the rapidly evolving capabilities of existing networks and the ongoing launch of new platforms.

To help the industry at large gain a better understanding of the opportunities available, and to encourage the development of evaluation standards that might ultimately improve both the collaborative process and overall network effectiveness, Mars United publicly shares this Retail Media Report Card on a regular basis. This report presents the foundational scorecarding elements of our evaluation process for clients.

New Features This Quarter

Each quarterly Report Card is updated to reflect the ongoing enhancements made by these platforms, to evaluate additional platforms, and to modify our analysis as needed to continue reflecting best practices across the industry.

In this report, we initiate coverage of five networks. Our largest quarterly expansion to date takes us into two new retail channels: convenience stores with 7-Eleven and Wawa, and pet with Petco. We also move deeper into two channels via Wakefern Food Corp. in grocery and Family Dollar in value.

Meanwhile, nine of the 20 retail media networks covered in previous reports combined to add 30 new tools and opportunities to their capabilities, as they worked to either keep pace or gain an advantage (as the case may be) in this highly competitive marketplace. Gopuff and The Home Depot led the way with six updates each, followed by Albertsons with five.

Elsewhere, we’ve added five more criteria to the evaluation — one capability each in the Key Performance Areas of Targeting, Measurement & Reporting, and Partnership, along with two On-Location Media Opportunities. And this edition’s quarterly “Capability Spotlight” takes a close look at shoppable ads and other forms of interactive media (see page 22).

We hope you enjoy the 11th edition of Mars United Commerce’s Retail Media Report Card. If you’d like to learn more about how Mars United can help you help excel in retail media, contact Willy Blesener at [email protected].