To download the report, fill out the form below.

The Future is Connected:

While still taking shape in Latin America, retail media has already become the fastest-growing digital marketing channel in the region. Its strong appeal among advertisers lies in its unique ability to connect media investments with measurable commercial outcomes that leverage first-party retailer data, high-intent shopper audiences, and controlled, brand-safe environments.

However, the conversation around retail media is already evolving, shifting from visibility to incremental growth.

Once confined to sponsored product or display ad formats, the practice is now expanding into the broader media ecosystem, actively encompassing mid- and even upper-funnel activations that build brand demand and feed conversion pipelines.

Identity-led strategies are central to this shift. Integrating identity into campaigns lets brands understand how their investment drives incremental sales — enabling the exclusion of habitual buyers, optimizing spend toward growth audiences, and creating synergies with the core media budget.

This identity-driven, consumer-centric approach advances retail media from a sales activation tool to a strategic growth engine that connects data, creativity, and commerce — enabling brands to measure and drive incrementality across the entire funnel.

This growing sophistication reflects a broader industry shift: retail media is no longer an isolated performance channel but a cornerstone of modern commerce strategies. As this evolution unfolds, emerging markets like Latin America are rapidly catching up with global trends as new networks, technology partnerships, and data infrastructures redefine how brands plan and measure impact.

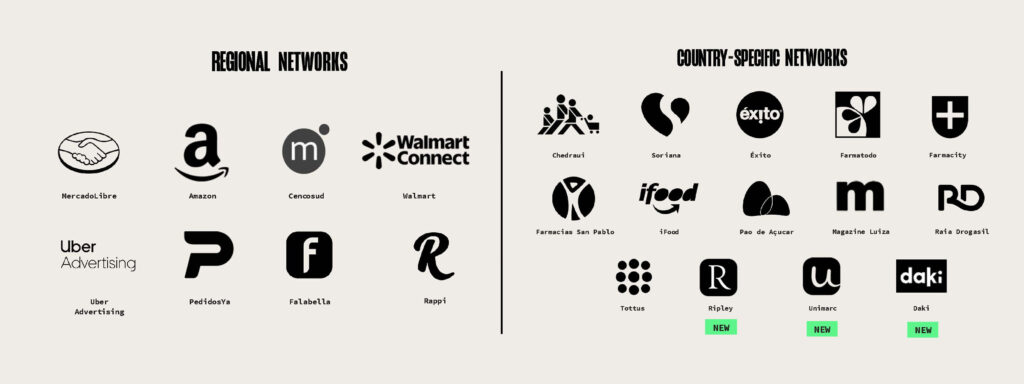

According to EMARKETER’s “Latin America Retail Media Ecosystem Trends 2025” report, nearly half of the region’s existing networks were launched in 2024 — marking a turning point in maturity. Growth has been fueled by the expansion of marketplaces such as Mercado Libre and Amazon alongside technology enablers like VTEX, Topsort, and Adsmovil, which have allowed supermarkets, pharmacies, and department stores to monetize their data and build scalable media offerings.

Despite the momentum, the industry continues to face key challenges: a lack of standardized measurement, limited self-service capabilities, and the need for stronger alignment between marketing and trade investment models. Only a few regional players currently provide automated tools for buying, segmentation, and reporting, while most are still building foundational data and operational frameworks.

According to EMARKETER, spending is heavily concentrated in Latin America’s three largest markets — Argentina, Brazil, and Mexico — which will generate nearly 85% of regional ecommerce sales in 2025. Across LatAm, retail media will surpass 10% of all digital ad spending for the first time in 2025, according to EMARKETER, which also expects total spending to double by 2029 to USD $5.2 billion. In this context, there is rising demand for privacy-compliant and brand-safe environments, and retail media is ready to oblige — connecting marketing, data, and commerce under a unified, shopper-centric vision that drives long-term growth.

The Vision at Publicis Commerce & Mars United

At Publicis Groupe LatAm, we believe the next stage for retail media involves a deeper integration of media, data, and technology to enable a true full-funnel, connected commerce strategy. This vision links retail media and shopper marketing as complementary forces: retail media drives precision and performance across digital environments, while shopper marketing brings a strategic understanding of consumer journeys, purchase triggers, and omnichannel experiences that span both online and offline contexts.

Connected commerce bridges these disciplines, allowing brands to synchronize touchpoints, connect CRM and retail data, and create unified strategies across marketplaces, retailers, and physical stores. This approach transforms isolated activations into cohesive business solutions that connect brand building, sales acceleration, and loyalty.

To achieve sustainable growth, retail media must start to capture new budgets and client briefings rather than simply repackaging the existing shopper spend — developing 360-degree, omnichannel journey campaigns that balance shopper insights with commercial goals to drive incremental growth. But, as retail media analyst Kiri Masters recently noted:

“Retail media’s measurement problem isn’t just with the retailers, it’s about how trade and marketing align their objectives and budgets around it.”

As retailers evolve toward omnichannel models, brands seek to standardize metrics, optimize investments, and build collaborative frameworks that foster shared growth. Within this context, our second Retail Media Report Card LatAm serves as both a benchmark and a catalyst — helping define, evaluate, and strengthen the region’s rapidly maturing retail media ecosystem.

In this edition, we include profiles of emerging networks that are becoming fundamental ingredients in the recipe for a thriving retail media ecosystem. Like skilled chefs, these networks bring their own specialties — data, technology, and shopper insight — and blend them into a cohesive formula that fuels performance, innovation, and sustainable growth across Latin America. We also present updates from major regional partners that are rapidly adapting to the evolving needs of both advertisers and the overall industry.