As part of their ongoing mission to help clients stay ahead of the competition in a fast-paced, constantly evolving marketplace, The Mars Agency’s Customer Development teams closely monitor the strategic activity taking place across all key retailers and channels.

Each month, the teams compile Marketplace Assessment reports on the retailers (Walmart, Target, Kroger, Amazon) and channels (Regional Grocery, Small Format, Club, Emerging) that are most important to our clients’ business success. The following report outlines 8 noteworthy events across the retail landscape from the team’s most recent round of assessments in November.

Amazon Layoffs: Priority Shift?

The Story: The majority of the 10,000 employees that Amazon laid off in November were part of the Alexa and retail teams. And the retail layoffs came mostly from the first party ranks, not functions related to Amazon’s third-party marketplace — which is more profitable, requires fewer people to operate, and has been consistently gaining a larger percentage of the retail sales mix percent over the years.

These moves suggest that Amazon is entering a new era that will focus more on ROI across the organization and leave considerably less room for the experiments and unprofitable ventures that have been part of the company’s DNA (remember the Dash button?).

Relevance: With the peak demand for ecommerce sparked by pandemic lockdowns subsiding globally, Amazon has experienced a significant erosion in profitability, and its retail market share has declined. The retailer could be planning to use the 3P marketplace to sustain retail growth — and to grow more profitably.

Opportunity: Brands might want to consider following Amazon’s lead and adopting a hybrid 1P/3P model for selling on the platform. 3P sellers typically have greater control over their pricing, product listings, and new product launches, although they assume responsibility for fulfillment and customer services as well. If this is where Amazon will be placing its future retail emphasis, brands should give it a good look.

____________

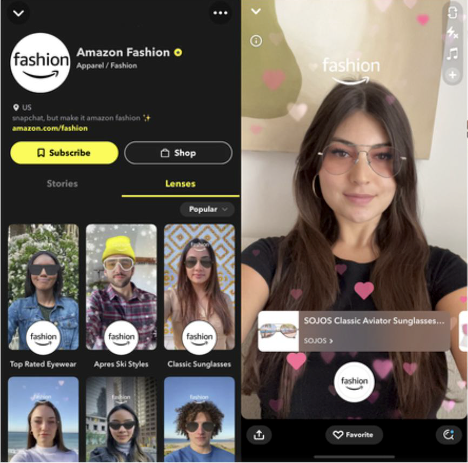

Amazon, Snapchat Partner on AR

The Story: Meanwhile, the product manufacturer side of Amazon has entered a partnership to use social media platform Snapchat’s augmented reality “lenses” to let shoppers virtually try on eyewear from the Amazon Fashion brand.

Relevance: Millions of customers regularly use Amazon’s AR shopping technology across various product categories, with Virtual Try-On for Eyewear being a long-time favorite. This partnership will extend that capability to Snapchat’s 363 million active daily users.

Amazon Fashion joins numerous other retailers and brands using Snapchat’s AR lenses to give shoppers an opportunity to virtually try on apparel and accessories before seamlessly purchasing the items through direct links to ecommerce venues.

Opportunity: Try-on technology and other types of AR-based engagement are fast becoming common practice for brands looking to effectively reach digital audiences — especially the hard-to-please Gen Z.

“It’s a challenge to reach Gen Z in a traditional manner,” said Jaclyn Wyatt, Head of Digital Media for Samsung Electronics America, while extolling the virtues of virtual try-ons at Advertising Week in New York last September. The technology lets consumers “have the shopping experience right there” on their phones to help them make purchase decisions, she explained.

____________

Best Buy Tests Stores of the Future

The Story: Best Buy is looking toward the future of the physical store in two ways:

1. Through the 40,000-square-foot, studio-like “Virtual Store” that officially launched last month after a one-year pilot. The space carries 10 different product categories and resembles a typical Best Buy store. But instead of customers, it is populated by a team of tech experts who assist both online and in-store shoppers live by answering questions, conducting product demonstrations, and helping them find exactly what they need.

2. Through the 5,000-square foot “Digital-First Store” that opened last summer near headquarters in Charlotte, NC. The small-format location carries a limited, curated selection of best-in-category products, along with customer services like Geek Squad. Similar to an Apple Store, shoppers can interact with the products on display. When ready to make a purchase, they scan a QR code, which prompts a Blue Shirt to go into the back and retrieve the item.

Relevance: The Virtual Store is Best Buy’s first foray into a new type of interactive, digital shopping experience that company leaders believe is the next step in retail’s evolution. Can the Best Buy Metaverse Store be far behind?

The Digital-First Store delivers a more aesthetically pleasing experience for the customer, which hasn’t been a strength for Best Buy in the past. And the curated selection points to an omnichannel on-site inventory strategy, where best sellers are in stock but other items are available for quick, easy home delivery.

Opportunity: Brands should work with Best Buy to ensure their items are featured prominently in these test locations and start collaborating with the retailer to collaborate on its long-term store transformation. This might be a good time to increase your Blue Shirt training efforts. (And see how you can get promotional messaging onto that 7-foot-tall interactive screen in the Digital-First Store.)

____________

Walmart Helps Small Business Pop

The Story: Walmart is partnering with short-term leasing marketplace Popable to help small local businesses open pop-up shops in supercenters.

Interested brands can register on Popable’s website to be paired with a nearby Walmart store to negotiate a temporary lease for store space. The leases will run from one month to a year but could become longer-term if the arrangement proves successful.

Relevance: Walmart is committed to supporting the communities it serves in various ways. By supporting small businesses, the retailer is addressing the longstanding belief that the retailing giant is a detriment to small-town mom-and-pop shops.

“We are proud to work with Popable to offer local brands an opportunity to grow inside our stores,” said Darryl Spinks, Walmart’s Senior Director of Retail Services. “This is a great example of our focus on offering services unique to the neighborhoods we serve through our store of the community initiative.”

Opportunity: While it likely won’t have much direct impact on national brands (other than whatever “share of wallet” competition these local businesses might bring), the initiative underscores Walmart’s “store of the community” focus. And that’s something national brands can consider helping bring to life through regional marketing activity — or maybe even through a more customized, store-level approach to the planogram.

____________

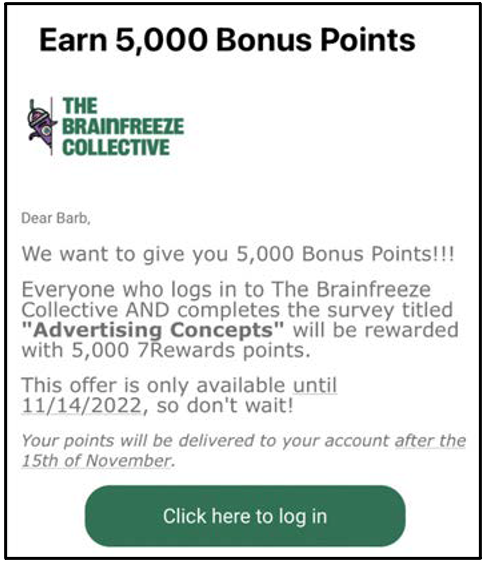

7-Eleven Gives Brands a Brainfreeze

The Story: The Brainfreeze Collective is a proprietary panel of 150,000-plus 7-Eleven customers that the c-store retailer is making available to brands for various types of research — quantitative, qualitative, home-use tests, in-store missions — to inform product development and marketing activity. Studies can be targeted to specific shopper types (category buyers, brand loyalists, etc.) to get more relevant results.

Relevance: 7-Eleven established the Brainfreeze Collective as an online community that would let customers share their experiences and opinions with each other as well as with the retailer. The insights provided by the group are providing 7-Eleven with a deeper understanding of shopper behavior.

Opportunity: The Brainfreeze Collective gives brands a unique forum for gaining insights into the behaviors and motivations of the “immediate consumption” shopper that can help them identify product opportunities as well as marketing options.

____________

DoorDash Grows in Grocery, Convenience

The Story: The on-demand delivery company reported that the “gross order value” of its grocery services doubled in the last year as margins improved, and its convenience business is on track to become profitable next quarter.

Relevance: The on-demand delivery marketplace has been experiencing a shakeout recently as some startups have succumbed to increased competition and operating costs that have sometimes exceeded consumer demand. While growth and expansion are still critical to success, leading players like DoorDash are now looking to play more of a long game by focusing on improved margins and profitability.

Opportunity: DoorDash and other leading “ODDs” have emerged as potentially important partners for CPG brands that can provide cross-retailer engagement and, in more than a few cases, are delivering incremental shoppers. Brands should be exploring ways to partner with these providers.

____________

SEG Looks for a Buyer

The Story: The saga of Southeastern Grocers (operator of Winn-Dixie, Harveys and Fresco y Mas) continued last month when news broke that the company is talking to prospective buyers.

SEG filed an initial public offering in 2020, but then decided against pursuing the IPO in 2021. In May 2018, the company emerged from Chapter 11 bankruptcy protection after a brief period.

Relevance: The announcement was the first sign that the blockbuster Kroger-Albertsons deal could set off a chain reaction of further grocery industry consolidation.

Opportunity: Brands and their agency partners need to keep pace with industry news to understand where the industry is heading and who their future key retail partners might be.

____________

Costco Makes MVMs ‘Omnichannel’

The Story: Costco’s longstanding Multi-Vendor Mailers have recently carried QR codes on ads for Apple and other brands. The codes link to branded landing pages on Costco.com.

Relevance: In the Club channel, marketing doesn’t get much more “old school” than the MVM. QR codes are an extremely simple way to link the limited product information provided in the MVM with additional details and assortment online — not to mention direct access to a purchase opportunity.

Opportunity: Assuming Costco is willing, there’s no reason why brands shouldn’t consider adding a QR code to their upcoming print executions and connect their print and online activity with the retailer.

____________

The Mars Agency’s Customer Development practice is an unrivaled team of in-market commerce experts who simplify the complexity of retail. Located in Bentonville, Minneapolis, Cincinnati, Chicago, Tampa and the “backyards” of other key retailers, they provide deep knowledge of the retailer, expertise in key business areas (like strategy, media and creative), and door-opening personal relationships with key executives to deliver an unmatched level of business success for clients across accounts, channels and shopper engagement platforms. For more information, contact Group SVP Kandi Arrington at [email protected].