Key Takeaways from the E2 Live: Excellence in Ecommerce conference in Bentonville

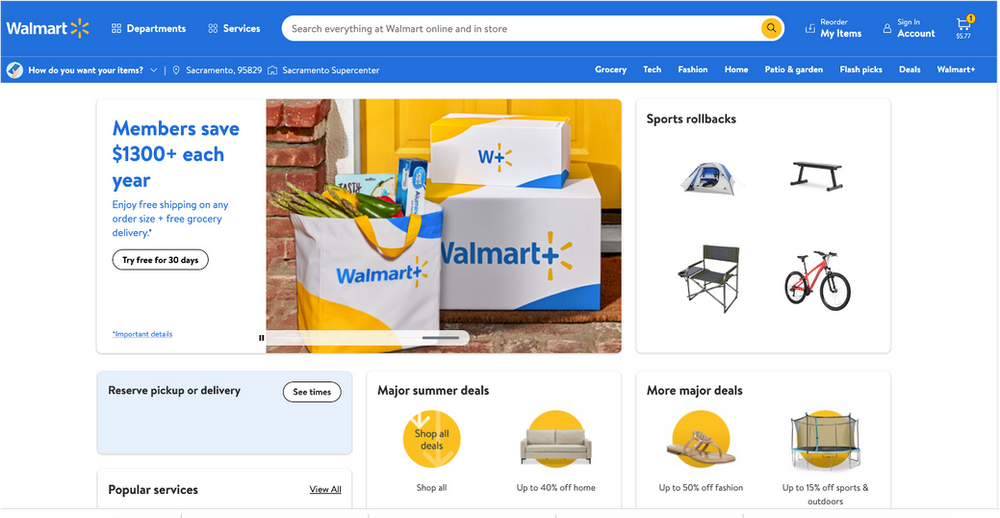

In the retail landscape, Walmart has long required special treatment. The same holds true in ecommerce, where the retailer often takes a backseat to Amazon in the minds of analysts, advertisers and even some shoppers — even though it remains as critical a retail partner for consumer brands as it always has been.

With a committed focus on omnichannel commerce that involves both building out a thriving ecommerce ecosystem and, more recently, aligning ecommerce with its brick-and-mortar operations, Walmart is giving brands a tremendous opportunity to grow their presence online and in stores.

But succeeding in ecommerce with Walmart requires a solid understanding of the retailer’s ecosystem, which to a large extent operates similarly to Amazon and other ecommerce players but also has many of its own unique characteristics and nuances. (That’s why The Mars Agency has a dedicated team of Walmart experts whose job is to help clients navigate Walmart’s ever-changing omnichannel landscape.)

Helping brands gain this understanding was the intent behind “E2 Live: Excellence in Ecommerce,” a one-day event held in Bentonville on May 25 to educate brands and agencies about Walmart-specific best practices within the context of broader discussions about omnichannel retail. The event was hosted by Analytic Index with support from Skai, Stopwatch and Vizit; all four vendors have tools that help brands gain insights into their marketing activity at Walmart and other retailers.

Several members of The Mars Agency’s Walmart Customer Development team attended the event. The following is a report on their overall takeaways from the conference, as well as more detailed takeaways from each of the sessions.

Keynote Panel:

Unearthing the Secrets of the Walmart Marketplace

- Nathan Rigby, Co-founder & CRO, Analytic Index

- Richard Lockton, SVP-eCommerce, Ashley Furniture

- Matt Pabst, Director of Shopper Marketing, Conagra Brands

- Erin Peetoom, Senior Director, Ecommerce Sales at Hart/Techtronic Industries

- Sofia Bailey, Sales Account Manager, Walmart Omnichannel, SC Johnson

Key Takeaways:

>Brand organizations are looking for ways to maintain the ecommerce growth momentum they experienced during the COVID pandemic. But some are now encountering shoppers with less money to spend, and are therefore seeking ways to efficiently target their digital spend against consumers with intent to buy vs. “everyone.”

>Accurate performance measurement remains an issue. In particular, improving the quality of search results is a challenge, in part because of the limited ability to independently verify ROI. One key question raised was the use of a standard 14-day window for paid search attribution: while that might make sense for general merchandise, it probably doesn’t for popcorn. What are the most credible metrics for driving the business?

There are an “incredible amount” of companies selling ways to look at Walmart data. But it’s hard to drive action even when insights are available. One recommendation: Lead with the problem to solve and determine what data can drive the solution rather than starting with the data and looking for insights.

Better internal alignment can help. The necessary insights are sometimes unknowingly available within the organization, so make sure your sales team has access to your insights team and tools. Walmart’s merchants typically love the insights you bring them and will often share them internally, so make that priority.

>Effectively determining proper spending levels is another issue. The traditional one-year duration of a Joint Business Plan can cause challenges when “things happen” over the course of the year, like new competitors or higher search costs. Spending more than originally planned can then drive tougher negotiations and expectations in the next JBP cycle. How can a brand determine the optimal investment?

>Ideal ways of working in the omnichannel environment still need to be determined as well. Internally, brand organizations need to identify roles and responsibilities to maintain the necessary “swim lanes” of ownership while finding the best ways to “swim together.” Externally, they must better understand “who to ask” at Walmart and transparent methods of working across the retailer’s functions: merchants, Walmart Connect, Luminate, etc.

>Keeping up with technology is also a challenge. New search tools are relying on AI/Machine learning to drive results, and that seems to be more difficult to manage and control through keywords and content. Determining ways to override search results to align with brand priorities can be difficult and outside the merchant’s abilities. “You can’t shake hands with an algorithm,” but you can arm merchants with necessary information to help your brands while driving category growth, one panelist suggested.

>Walmart is unique. As one company executive in attendance noted, Amazon is the Google for product search, but Walmart’s strategy is to get shoppers to the sale faster and therefore is set up differently than its competitor. Brands must consider these differences when working with the retailer.

Session 1:

Winning in Digital Shopper Marketing with Connected Commerce

- Nich Weinheimer, GM, Strategy, Skai

- Keven Weiss, VP-Retail Media, Skai

- Katia Colston, Senior Director-Ecommerce Sales, Central Garden & Pet

Key Takeaways:

>The momentum around ecommerce and retail media continues to grow. Walmart now generates 13% of its sales online, and it collected $2.1 billion in retail media ad sales in 2021. What’s more, 81% of brands will increase their retail media spending this year — with one in four devoting more than half of their total marketing budget, according to Skai.

>Omnichannel success requires a change in mindset from:

- Offline/online to Omnichannel

- Experience and reactive marketing to Intelligent marketing

- Channel-centric to Consumer-centric focus

- Branding to Full-funnel, relevant and consistent communication

- Traditional attribution to Incrementality in measurement

- Siloed teams to Centers of excellence

>Brands need to move from Commerce Intelligence to Intelligent Commerce. Digital shopper marketing has a hierarchy of needs that moves from consumer insights to retail analytics to performance data.

>For Central Garden, omnichannel marketing has three legs: brand, shopper, retailer. They want a shopper to pick their brand (whether shopping or Googling), put it in the cart and make a purchase. And they want the retailer to feel confident and put their brand on the shelf.

>Retail media, in this context, is more about consideration and therefore has to become a bigger part of the overall marketing plan.

>Data is helpful in the right hands but can be overwhelming. “Share” (of voice, of page, of search) has become very important. Data can also help show the retailer how to improve results.

>Sponsored product drives sales. Paid search enhances organic search and brands need to use KPIs to find the right balance between the two.

>Plan intelligently. Make sure to accelerate in-stock inventory; don’t drive traffic to pages that aren’t meeting content score goals.

>Walmart is admirably working to improve its algorithm, which means brands must continue making adjustments —”set and forget” is not a strategy.

>Have conversations with your buyer and focus on what will drive sales, like improving your content scores and selecting the right keywords (which will drive immediate results with Walmart, unlike with Amazon). Benchmark where you are.

>Tap into Google Trends, which can map the last 52 weeks of search trends for your category/item to provide keywords and seasonal patterns.

Session 2:

Driving Ecommerce ROI Through Shopper, Competitor, and Retailer Intelligence

- Mike Karlsven, Co-founder & CEO, Analytic Index

- Nathan Rigby, Co-founder & CRO, Analytic Index

Key Takeaways:

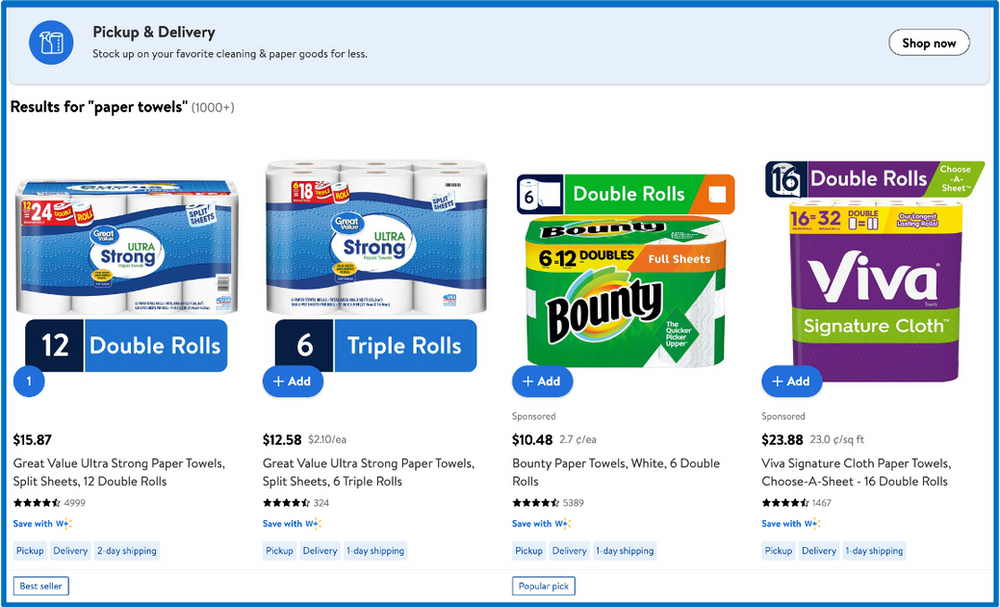

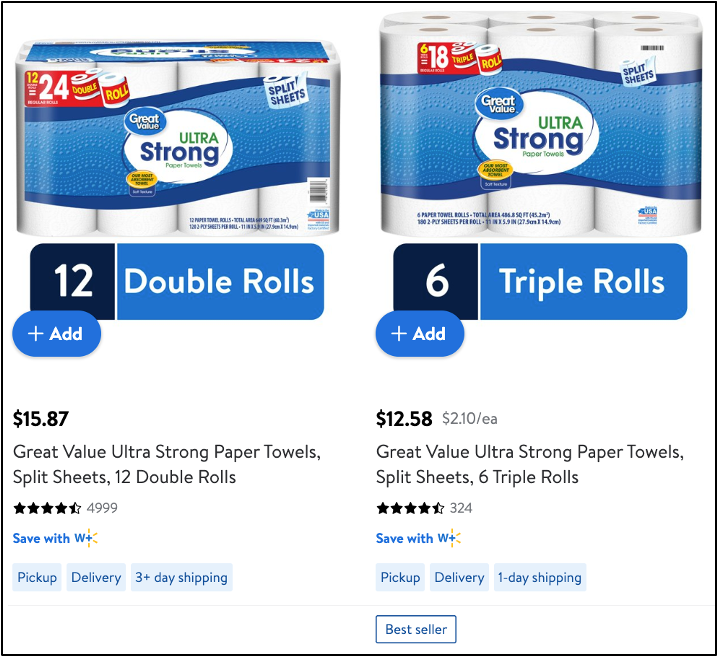

>Product detail pages don’t drive sales, search does. Shoppers make decisions based on these five pieces of content:

- Primary Image

- Price

- Title

- Reviews

- Shipping speed (a new addition that’s important for conversion).

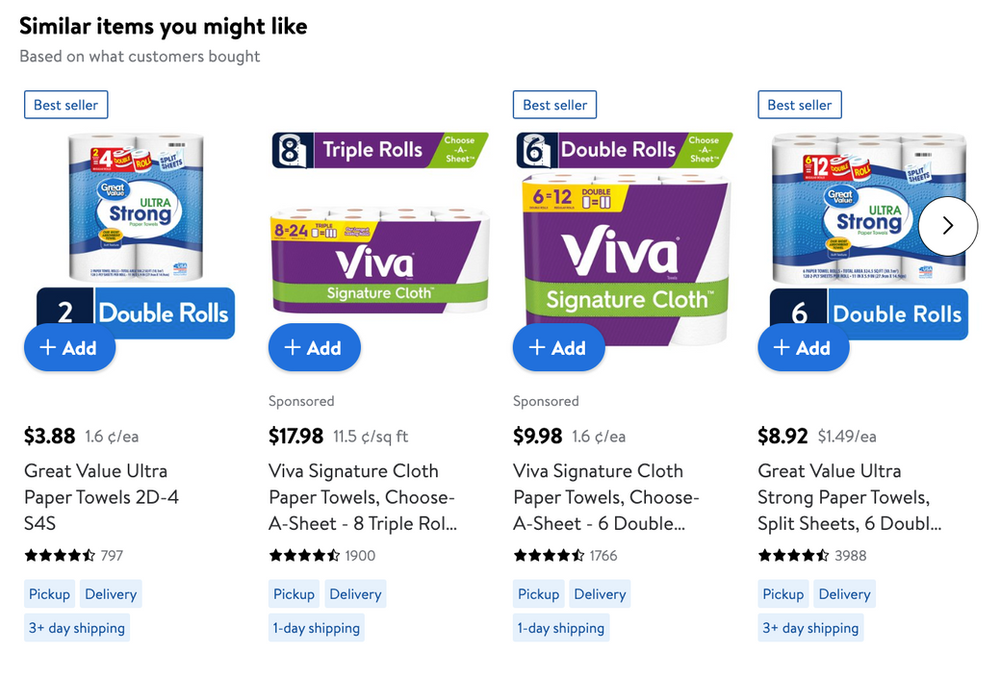

>PDPs have roughly the same above-the-fold content but contain one danger area underneath: the “Similar items you might like”/”Customers also considered” feature that could redirect shoppers to your competitor. Ideally, you want shoppers to click the “Add to Cart” button on the search result and not even go to the PDP.

>Walmart’s algorithm chooses the order of search results. But here are some optimization possibilities to consider:

- Organic rank (keyword relevance is important here)

- Number of keyword shelves

- Price

- Ratings and reviews

- Sponsorship vs. organic keyword count ratio (you should target a 1:3 ratio.)

- Search Volume + Organic Relevancy = Opportunity. But the algorithm can work for or against you, which makes auto-campaigns risky.

>The best ways to measure search performance are:

- Market share (share of category sales, although this is a moving target online).

- Total share of voice (page saturation).

- Organic share of voice (which more accurately reflects the algorithm).

- Number of keyword “shelves” (keyword saturation across the category, although it’s more important for the keywords to be relevant and drive sales).

- Page placement (above the fold, etc. But remember that rankings evolve every 15 minutes).

- Search volume (which reflects shopper demand for that keyword).

- All of the above compared to your competition’s activity.

>Brands should evaluate the whole picture and then break things down to see how/where they can improve each element. Technology is helpful, but humans are needed to optimize and improve.

Session 3:

Walmart Omni-Commerce: How to be Quick But Not Rush Walmart Optimization

Meagan Bowman, Founder & CEO, Stopwatch

Key Takeaways:

>Don’t forget to slow and get the basics right first. Humans know the problem to solve, and good technology helps them solve it.

>Your work with Walmart can be informed by what you learn from Amazon. Think about how they work differently to win with each of them.

>Don’t work in isolation. Walmart should soon be bringing Walmart Connect, Luminate and the omnichannel merchant together to the table. You will have a major advantage if you can link everything together now while Walmart isn’t still necessarily all connected.

>Use Walmart’s scorecard to make comparisons with other retailers. Reporting weeks and SKU identities are different, but you can normalize the data to make smart decisions and recommendations.

>Focus on the moment of transaction — “when they hand over the dollar,” regardless of how or when the order is fulfilled.

>Omnichannel merchants are being retrained from a data perspective to evaluate dollars, units and profit. Their “pillars of control” are the digital shelf, the “digital backroom” (inventory) and smart computing.

>When meeting with the merchant, always try to learn something and teach them something.

Session 4:

Boosting Conversion Through Relevant Visual Experience on Walmart’s Digital Shelf

Joe Annunziato, Vice President-Sales, Vizit

Key Takeaways:

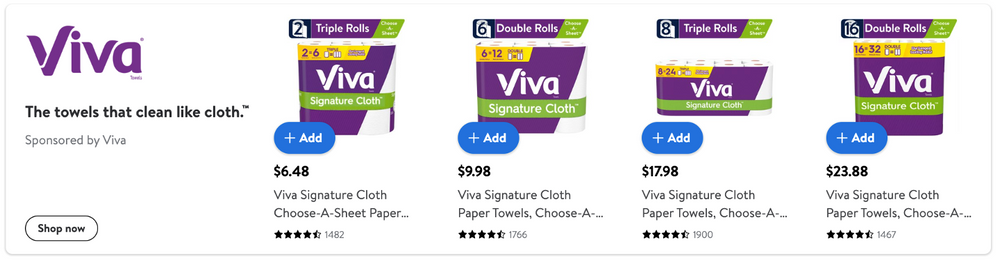

>Images have become a key area of opportunity in digital retail: 95% of U.S. shoppers make their purchase decision based on the brand’s images; 30% say they won’t buy a product if images are missing or low quality.

>AI and predictive analytics can be used to optimize your ecommerce images and grow sales.

>Brands and retailers are investing more in the creation of visual content but not as heavily in analytics tools that can make the spend more impactful. Instead, they continue to rely on subjective, manual reviews to measure effectiveness.

>Brands and retailers need to eliminate subjectivity so they can better understand what works. The key questions they should be asking are:

- How can I quickly and cost-effectively generate multiple versions of visual content to test?

- What are the visual elements most likely to resonate with my core consumers?

- Which visual assets are preferred among my target audience?

- How can I optimize my imagery to gain more stopping power and conversions?

- Which images will outperform my competitors’ visuals?

Contributors: Kandi Arrington, Group SVP-Customer Development; Steven Finney, VP-Customer Development; Marta Kiser, Director-Customer Development