A Retailer Intelligence Report from:

More than 70% of U.S. households shopped online for groceries in 2021, accounting for roughly $98 billion in sales, according to Brick Meets Click/Mercatus. Among those online shoppers, 33% are choosing home delivery as their favored method of fulfillment.

While overall ecommerce grocery sales dipped a little bit (2.5%) in the first quarter of 2022, sales through home delivery jumped 20% as monthly users increased their orders by 13% and receipts by 7%, Brick Meets Click/Mercatus found.

Retailers are working hard to keep ahead of this steady shift in traditional shopping behavior, with some striking or expanding deals with third-party services, others building up internal capabilities, and even a few testing unique fulfillment options.

As part of their ongoing mission to help clients stay ahead of the competition in a fast-paced, constantly evolving marketplace, The Mars Agency’s Customer Development teams closely monitor the strategic activity taking place across all key retailers and channels. The following report, which outlines recent efforts at 8 retailers to improve their ability to solve for the needs of home delivery shoppers, is an example of the retailer intelligence the teams deliver.

_________________________

7-Eleven, Walgreens Get in Shipt Shape

The Story: Two additional retailers, Walgreens & 7-Eleven, have signed on with the national home delivery service, which also counts Costco, Meijer, H-E-B, Winn-Dixie and Lidl among its partners — oh, and Target, which acquired Shipt in 2017.

The Walgreens and 7-Eleven deals increase Shipt’s national reach by more than 40%.

Relevance: The partnership helps Walgreens and 7-Eleven extend their product variety and convenience from the corner store all the way to the home. And it gives Shipt an even more formidable national presence.

Opportunity: “It’s important for brands to continue helping their retail partners introduce new services like these to shoppers, as well as to be relevant on growing national delivery platforms like Shipt,” says VP-Customer Development Barb Seman, who oversees small format channels for The Mars Agency.

In one recent example, General Mills promised $2 off a $14 Shipt purchase of “breakfast faves” from Walgreens and other retailers. (Delivery was available within one hour in some cases.)

_________________________

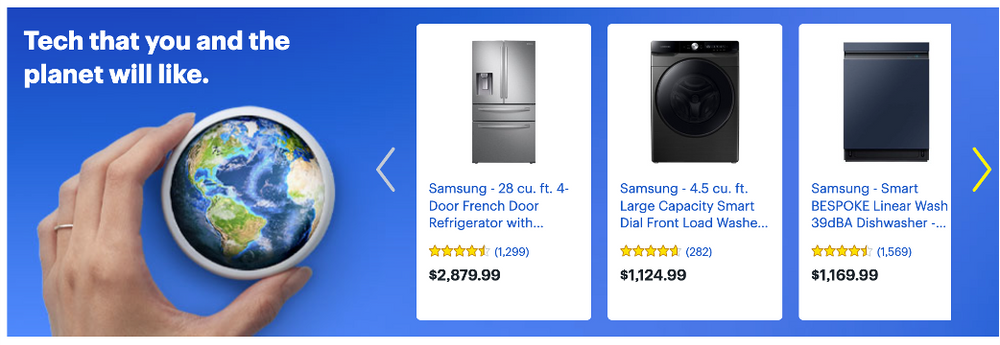

Best Buy Delivers — and Removes

The Story: Best Buy’s new Standalone Haul-Away service provides in-home pickup of old electronics and appliances (for a fee of $199.99). The products are then responsibly and safely recycled, keeping them out of landfills and giving them a second life. Consumers don’t need to purchase a new item from the retailer to use the service, but customers who do utilize Best Buy Totaltech for new-product delivery and installation get a 20% discount.

Relevance: Sustainability has been at the core of Best Buy’s business model for decades. The retailer is committed to being a world leader in protecting the environment, having reduced carbon emissions by 61% and recycled 2 billion pounds of electronics and appliances since 2009. The new Haul-Away service extends Best Buy’s longstanding practice of removing (and recycling) old items when delivering their replacements.

Opportunity: “Brands should find ways to help Best Buy continue achieving its goals for protecting the environment by developing sustainable packaging and even eco-friendly products,” recommends Meghan Heltne, SVP-Customer Development in Minneapolis. “In one key initiative, the retailer has pledged to help customers realize $5 billion in energy savings by 2030. Relevant brand partners can help Best Buy get there by working with their merchant and marketing teams to build energy-efficient innovation pipelines, and then promoting those products through Best Buy Ads and external channels.”

Promotional opportunities like the bestbuy.com showcase below are now common for brands such as Samsung that join the effort.

_________________________

BJ’s Wholesale Adds DoorDash

The Story: BJ’s Wholesale Club is the first retailer in the category to partner with DoorDash. (Costco works with Shipt, while Sam’s Club partners with Instacart.) On-demand grocery delivery will be available across all of BJ’s 226 stores in 17 Eastern states.

Relevance: The worst days of the pandemic are over, but convenience and grocery delivery remain key shopping trends. Although the club chains weren’t exactly early adopters of ecommerce, they’re making up for lost time now.

Opportunity: “Other wholesale clubs will be watching BJ’s partnership with the DoorDash closely,” says SVP-Customer Development Victoria Van Dusen, who oversees club store activity for The Mars Agency. “We might see some of them following suit by striking their own deals with grocery delivery services.”

_________________________

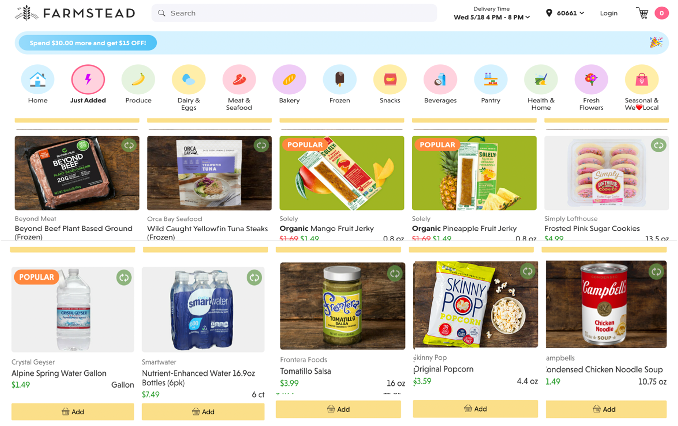

Circle K Takes Convenience Home

The Story: Circle K is teaming up with ecommerce grocery brand Farmstead to offer locally sourced fresh produce for delivery. The partnership also allows the convenience store retailer to use Farmstead’s technology to launch new formats for e-commerce fulfillment in U.S. suburbs.

The agreement is part of a $55 million investment in startup companies with various customer experience-enhancing technologies; Circle K has also struck a deal with quick-commerce service Food Rocket, which operates a “15 minutes or less” delivery model.

Relevance: The convenience landscape is constantly changing. Circle K’s parent company, Alimentation Couche-Tard, is exploring new technology that will help the company deliver on its core mission of convenience. Home delivery has become a key area of focus, and partners like these will help the retailer get up to speed with the capability faster.

Opportunity: Complementing snack and beverage offerings at c-stores with fresh, local products meets the needs of the younger, Millennial parents who frequent c-stores for that quick stop. “CPGs can provide a simple solve for time-strapped shoppers by showcasing bundled meals that include fresh produce,” suggests Seman. Among the brands already working with Farmstead are Conagra Brands, BlueTriton, Beyond Meat, and Campbell Soup.

_________________________

Kroger Keeps Moving Quicker

The Story: Kroger is advancing its partnership with Instacart to provide “Delivery Now” fulfillment in as little as 30 minutes to shoppers in additional markets. The service was first announced last fall.

Relevance: Kroger is the largest grocery retailer in the U.S., and Instacart is the leading third-party home delivery service. Same-day delivery is fast becoming an old-fashioned notion as shoppers increasingly seek near-immediate order fulfillment. Kroger is building out a massive internal operation that’s extending its marketplace well beyond the physical store footprint, and in February announced plans to open an internal quick-delivery service in South Florida this fall. In the meantime, the retailer continues partnering with third-party Instacart to more immediately address shopper demand for near-instant delivery.

Opportunity: “Instacart itself has become a key account for many CPGs,” notes Brian Higdon, SVP-Customer Development in Cincinnati. “This partnership gives brands a great opportunity to reach a large — and growing — number of shoppers through one of the fastest-growing segments of the commerce landscape.” As one example, Unilever and H-E-B staged a promotion last fall offering free home delivery with purchase of $15 worth of the CPG’s brands.

_________________________

Publix Picks Up the Pace

The Story: Publix and Instacart unveiled a partnership that soon will provide ultra-fast 15-minute delivery of grocery orders from nano-fulfillment centers in Miami and Atlanta. Called Carrot Warehouses (see Instacart’s logo), these warehouses will either be stand-alone facilities operated by Instacart or existing Publix stores.

Relevance: The pressure is on for Publix as Kroger moves its ecommerce business into South Florida and instant-delivery services such as Gopuff become more widely available across the retailer’s entire footprint. Instacart continues to fuel Publix’s omnichannel strategy, powering both delivery and curbside pickup. This latest plan speeds up Publix Quick Picks, a 30-minutes or less service the partners launched across Publix’s chain in fall 2021.

Opportunity: “With shoppers now expecting a seamless omnicommerce experience, regional grocers like Publix are looking for ways to broaden their delivery options to meet changing demands,” says VP-Customer Development Jeff Arquette, who oversees regional supermarkets for The Mars Agency. “A successful partnership between Instacart and Publix could be a regional game-changer for consumer shopping preferences. They will be looking for promotional help from brands to drive trial and repeat use.”

Last spring, the partners teamed to offer free branded merchandise to shoppers who placed delivery (or pickup) orders online; enterprising brands easily could be providing similar incentives.

_________________________

Walgreens Wings It

The Story: Walgreens is working with Google affiliateWing (both are owned by Alphabet) to conduct drone delivery in the Dallas-Fort Worth area. The service is delivering health and wellness products, pet medication, first aid kits, and even ice cream to local shoppers.

Relevance: As more consumers expect same-day and even one-hour delivery, Walgreens is testing this emerging “store-to-door” technology model, which lets the retailer remain in full control of order fulfillment — an important consideration for a drugstore chain.

Opportunity: “As same-day delivery orders continue to increase, and the fulfillment promises get even faster, it’s important for brands to help retailers lean into new technologies that make the process more efficient and scalable,” says Seman. And in the short-term, helping retailers test media-grabbing new technologies can give brands some national attention.

_________________________

A Sign of Things to Come at Walmart?

The Story: Walmart recently deployed shelf talkers in the pet department that instructed shoppers to scan barcodes on item-specific shelf signs to learn about shipping options for the related product.

Relevance: In reality, Walmart was dealing with major supply chain issues in the pet department when it used these signs, which helped shoppers find alternative ways to get products that might have been out of stock in the store. But the idea could be adopted in the future to let shoppers find additional SKUs that aren’t available in the store, or to order home delivery for those heavy bags of dog food or cat litter.

Opportunity: “Walmart is looking for ways to leverage its app to provide solutions like this that will make the shopping experience easier for customers,” says Van Dusen, who also oversees Walmart. “Brands should inquire about available opportunities, but also bring their own ideas to the table.” Brands that previously have provided Walmart with exclusive SKUs or launch windows might consider online-only offers, for instance.

_________________________

The unexpected growth in grocery home delivery over the last two years has opened an entirely new avenue of shopper engagement for brands, through both the additional opportunities it creates with existing retailer partners and the entirely new options now provided by third-party delivery services.

It will be critical for brands to stay informed about this rapidly evolving marketplace. They can then keep pace with changes in shopping behavior and work with their agency partners to identify new ways of engaging with shoppers who might not no longer be reachable through traditional retail marketing channels.

Note: This is the first in what will be an ongoing series of Retailer Intelligence reports from The Mars Agency’s Customer Development teams. The next report, which will cover recent sustainability initiatives, will be published in June.

_____________

The Mars Agency’s Customer Development practice is an unrivaled team of in-market commerce experts who simplify the complexity of retail. Located in Bentonville, Minneapolis, Cincinnati, Chicago, Tampa and the “backyards” of other key retailers, they provide deep knowledge of the retailer, expertise in key business areas (like strategy, media and creative), and door-opening personal relationships with key executives to deliver an unmatched level of business success for clients across accounts, channels and shopper engagement platforms. For more information, contact Group SVP Kandi Arrington at [email protected].