An ageless consumer need has gained far more meaning for omnichannel shoppers.

Download this report here: The Mars Agency Groceryshop 2022 Recap

If you had a dollar for every time the word “convenience” was used during Groceryshop 2022, you’d be able to buy Slurpees for a small suburb.

Granted, extensive use of the word shouldn’t be all that surprising at a conference whose agenda featured numerous executives from both traditional c-stores like 7-Eleven and Casey’s and more “new age” providers of shopping convenience such as Instacart and DoorDash.

But it wasn’t just the obvious, biased players talking about convenience. And it most definitely wasn’t the traditional definition of convenience being discussed.

That’s because the shopping fundamentals that have made c-stores a vital retail channel for so long are now dominating shopper expectations in every retail format — and because the other shopper expectations that have long dominated CPG retail have taken on a convenience spin.

The traditional characteristics of retail convenience — namely, speed, assortment and value — have intensified and taken on far more nuance than ever before. Consumers once satisfied with finding an adequate solution to their immediate needs at the 24-hour c-store down the road now expect the exact product they want delivered to their home in 30 minutes or less — at no additional cost.

Convenience is now best viewed as a consumer behavior rather than a retail channel, suggested Daniel Folkman, SVP-Business at “instant commerce” operator Gopuff, whose business model is designed to bring the traditional c-store experience directly into consumer homes.

In that light, the goal is to create “smoother, easier, more enjoyable” experiences that will help consumers “get on about their day,” said Marissa Jarratt, Chief Marketing Officer at 7-Eleven. Along with the rest of the CPG industry, 95-year-old 7-Eleven (which one speaker credited with “inventing convenience”) is now working to reinvent convenience for a new era of shoppers.

The traditional consumer tendency to simply shop the stores closest to home might not be as common anymore, but “proximity” is still critical in terms of the ability to get purchase-minded consumers as close to a transaction as possible, as well as to get relevant marketing messages in front of them at the right time and right place.

“There’s no end to what the customer wants,” said Matt Von Gilder, Head of Ecommerce & Digital Experience at regional grocer SpartanNash, which, in terms of shopping and order fulfillment, has become a “choose your own adventure store.”

And choose they will: We are now living in a world of “wet cement” where consumers consistently change their habits and “want the ability to change their own habits,” said Bryan Gildenberg, SVP-Commerce at Omnicom Commerce Group. Retailers and brands, therefore, must provide the consumers with all the options necessary to choose their own purchase experiences.

The following overview covers five intertwined aspects of this new definition of convenience, along with five emerging opportunities retailers and brands are leveraging to bring them to life for shoppers.

1. SPEED

The “hotly debated quick commerce space,” as one speaker called it, was the most popular topic at the event, as “instant commerce” providers and traditional retailers alike outlined and compared their various last-mile fulfillment models.

The debate part of the discussion centered on how “instant” commerce really needs to be, especially given the added costs required for both operators and, often, consumers. While most leading retailers are taking steps to offer quick delivery (one hour or even 15 minutes), not all are convinced it will ever be a core shopper demand. “It’s a good thing for a very specific set of needs, but I don’t think that’s the entire market,” said Fidji Simo, CEO of Instacart.

In fact, “speed is sometimes the opposite of convenience” if it hinders the retailer’s ability to provide order reliability, breadth of product assortment and relevant experiences, according to Groceryshop SVP-Content Krystina Gustafson, who also predicted that c-stores will be the “next wave of digital adopters.”

Cost is an important consideration, with many consumers more than willing to accept next-day delivery if that alternative is free. “You need a portfolio of options. Speed is a component, but there will be value-based options, too,” said Tom Pickett, Chief Revenue Officer at DoorDash. Nonetheless, DoorDash is helping Albertsons and Loblaw’s offer delivery for a limited set of products in less than 30 minutes and itself is testing 15-minute windows.

2. VALUE

More consumers (30%) cite rising food prices as a greater personal concern than the general economic downturn or a COVID resurgence, according to NielsenIQ. To keep spending in check, they’re stocking up during sales (50%), using coupons (42%), seeking out less-expensive stores (38%) and switching to private label (37%).

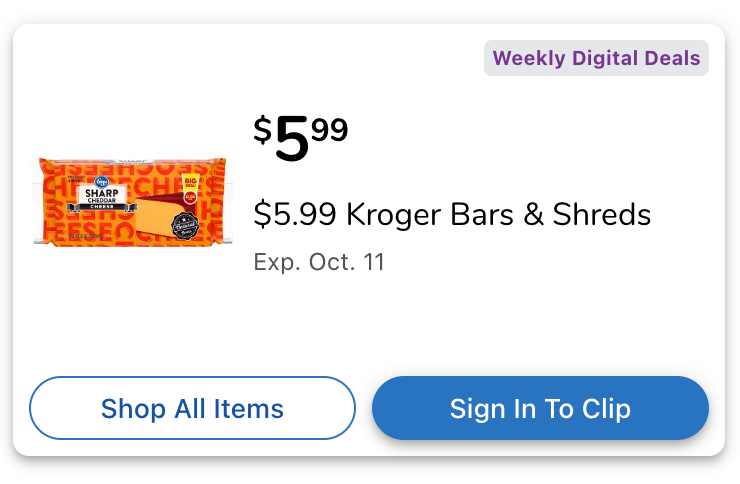

Those trends are playing out across all retailers: Kroger shoppers clipped 750 million digital coupons in the last fiscal quarter, according to CIO Yael Cosset; Walmart shoppers are buying smaller pack sizes, moving from wet to dry dog food, and opting for cheaper protein options, said Walmart U.S. CEO John Furner; Casey’s shoppers are taking more trips but putting less in their baskets (and buying more private label), noted CEO Darren Rebelez.

Instacart shoppers are spending the same amount of money but buying fewer items, which means “they are putting less food on the table,” said Instacart’s Simo. In response, the last-mile service is working with CPGs to offer more deals and promote less-expensive — and slower — delivery options.

Walmart is trying to be prudent about keeping prices low on key items. “You win on the basket over time,” said Furner. CPGs, too, are staying sensitive to consumer concerns: More than 50% of the meal ideas that Campbell Soup Company presents online can be prepared for $3 or less, said Leslie Waller, VP-Marketing, Beverage & Growth Channels.

3. PERSONALIZATION

One persistent obstacle to the long-discussed need for one-to-one marketing has been the inability to undertake “personalization at scale,” said Emily Frankel, SVP-Head of Ecommerce Marketing at PepsiCo. “We now have the robust data needed to do that.”

And it’s about time, since personalization has become mandatory: “Gen Z expects it” in terms of the products they’re offered and the time, location, and messages that are used to reach them, said Jarratt at 7-Eleven, while noting that 75% of the retailer‘s 7Rewards loyalty program claim to shop more because of the personalized offers they receive.

According to Kearney, the impact is strong throughout the purchase funnel: 77% of consumers say they highly value personalization in marketing offers (awareness), 65% in new product opportunities (consideration) and 80% to provide a seamless shopping experience (conversion). The payoff? 67% say a personalized experience will make them buy again (retention).

Kroger is beginning to personalize the home page hero ads shoppers see when they visit the retailer’s websites. But it also enables shoppers to do their own personalizing through services like Start My Cart, which lets them create a list of regularly purchased favorites. “Everybody starts with search [when targeting shoppers], but we see tremendous add to cart [activity] through Start My Cart,” said Bill Bennett, the retailer’s Head of Ecommerce.

Kroger’s mobile app is even making the in-store trip more personalized by delivering offers based on the shopper’s exact location within the aisles, Bennett said.

4. CHOICE

Consumers are no longer willing to compromise when it comes to their product and fulfillment choices, says Kroger CIO Yael Cosset. Retailers, therefore, must develop all the capabilities needed to make sure they won’t have to do so.

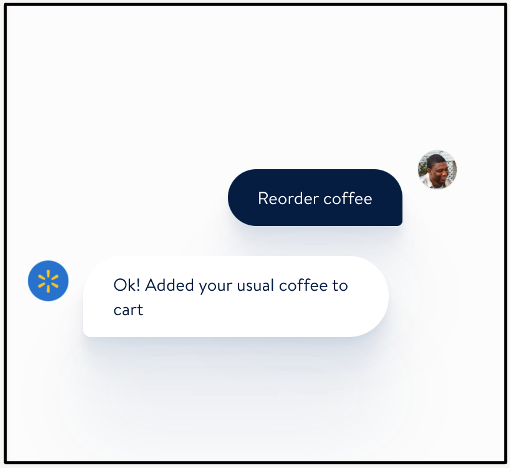

Walmart is “serving customers the way they want to be served,” said Furner. In the most extreme example, the retailer continues to expand the Walmart InHome program, which delivers groceries “all the way … inside the refrigerator,” he explained. At the conference, Walmart also unveiled a new shopping opportunity: a Text to Shop service that enables easy mobile ordering from literally anywhere.

Ecommerce growth levels have reverted back to pre-pandemic levels, but that doesn’t mean consumers have abandoned the channel — which is, in fact, an expression of their need for convenience, said Claire Davies of consultancy LEK.

Lest we forget, however, most consumers are still choosing to shop in person, which makes a continued focus on the brick-and-mortar store critical to success. Even Foxtrot, which launched as a pure-play “dream convenience store” offering a curated selection of local favorites, now operates stores in hometown Chicago, Austin and Dallas, according to CEO Michael LaVitola.

“We’re really excited about bringing back the theater of retail” to post-pandemic shoppers, said Whole Foods CEO Jason Buechel. Efforts to achieve that goal will encompass store design, product assortment, and collaboration with parent Amazon on convenience-enabling technology such as the Just Walk Out cashier-less payment system and the even more advanced Dash Cart smart shopping cart, Buechel said.

“We want our products to be available to consumers in any channel they want,” said Vince Jones, Ecommerce Chief at PepsiCo, while explaining that the CPG’s direct-to-consumer efforts like Snacks.com are “not so much about revenue” but about building one-to-one shopper relationships, gathering insights and testing concepts.

Choice in products, however, is far less about providing an endless array of options than it is about delivering relevant, curated selections, according to a number of speakers.

In fact, offering an “endless shelf … creates absolutely no value for the shopper” because it hinders their ability to find the items that best fit their needs, said Omnicom’s Gildenberg.

To simplify choice, healthy living-focused Thrive Market first works to “hyper-curate” the assortment, and then assigns 100-plus filters to each SKU so shoppers will always find what they want, explained CEO Nick Green.

That, of course, requires an understanding of what consumers want, which can only be gained through data-driven insights. In addition to the behavioral understanding it gets through the 7Rewards program, 7-Eleven taps into its “BrainFreeze” panel of 150,000-plus customers to understand their “wants, needs, desires and dreams,” said Jarratt.

5. BALANCE

While building out its pickup and delivery services, Kroger needs to ensure that it won’t “pass the complexity to the consumer in terms of price … and we’re not forcing customers to compromise on what they want,” said Cosset.

That comment exemplifies the need for retailers and brands to strike the right balance across all of these new facets of convenience: between ecommerce and the physical store, price and speed of delivery, product choice and curation, personalization and scale. Striking the right balance across all of these shopper-facing factors is critical to achieving a reasonable balance internally between sales growth and profitability.

As always, the question of price is central to many decisions, as retailers seek to balance the need to maintain profitability at the risk of alienating recession-conscious customers. “There is still a demand for convenience, but in economical ways,” noted Tim Simmons, Chief Product Officer at Sam’s Club, which recently instituted a home delivery charge with basic club memberships.

One critical new challenge for retailers is “resetting the planogram to accommodate click & collect without disrupting the store shoppers,” said Natalie Knight, CFO at Ahold Delhaize.

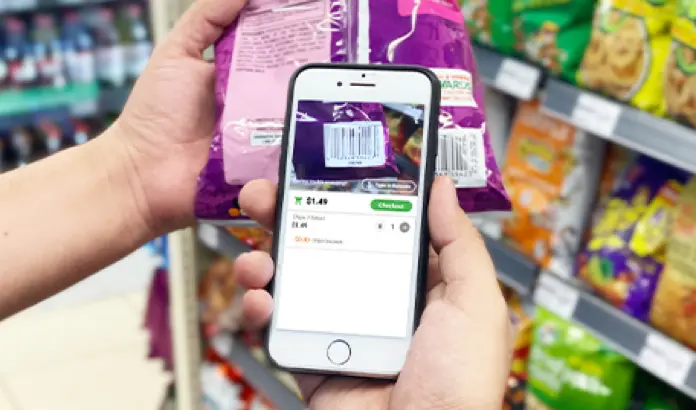

“We don’t want to create any friction for the customer,” added Raghu Mahadevan, SVP-Chief Digital Officer at 7-Eleven, which also is working to remove existing friction by taking Scan & Go cashier-less shopping chain-wide and experimenting with autonomous delivery tools; Sam’s Club, too, is expanding its Scan & Go program while also testing a Scan & Ship tool that lets in-store shoppers opt for home delivery of purchased items.

NEW CONVENIENCE CHANNELS

Mobile

Mobile is the true enabler of “anytime, anywhere” commerce, said Christina Marinucci, Head of Global Shopper Insights & Analytics at Mondelez International. “Mobile is a great [product] discovery platform, but you have to strike a balance to not be intrusive and irrelevant,” said Alicia LeBeouf, Head of Industry-Retail, Marketplaces & Grocery at Meta.

Walmart’s new Text to Shop service lets the shopper place an order “whenever, wherever she needs to,” including bed, kitchen and car, “explained Dominique Essig, Walmart’s VP- Conversational Commerce.

For Walmart, Text to Shop is the latest piece of an expanding, multi-modal “ecosystem” of shopper engagement aimed at building one-to-one relationships with shoppers, Essig said. But while a text-based platform allows for “hyper-personalized” messaging to shoppers, “it is very intimate, and you should treat is as such,” she advised.

Social Commerce

Brands must now be prepared to conduct commerce “at the speed of TikTok,” said Sam Tomlinson, EVP of Strategy & Analytics at Warschawski.

“You have to meet your customers where they are. Social is where your customers are,” said LeBeouf at Meta. “We think this is the future of shopping,” added Gopuff’s Folkman.

However, communicating effectively through social channels “requires a commitment to authenticity that might make some creative directors cringe a bit,” warned Tomlinson. “Social media is not perfect or polished, so that’s what users expect.”

“You have to take risks, you have to experiment, and it’s a never-ending process” said Ivonne Kinser, VP-Marketing & Innovation at Avocados from Mexico, which has been spending 70% of its annual media budget on a Super Bowl ad largely “as an excuse for us to launch a massive digital campaign that generated billions of impressions.”

Metaverse

“You will be shopping in the metaverse very soon,” said LeBeouf at Meta, which basically announced its high expectations for the technology when changing its name from Facebook earlier this year.

Meta isn’t the only bullish company, though. “I think the metaverse is where we are going” as the company continues to establish cultural relevance for its brand among Gen X’ers and younger Millennials, said Jarratt at 7-Eleven.

“The metaverse of the future is going to be your brand website,” predicted AJ Dalal, GVP, Data Strategy & Consulting for Publicis Sapient. “You are not going to want to send your consumers to [a third-party platform such as] Decentraland” and thereby lose control of their activity, he suggested.

Dalal says brands can currently participate at three levels: Watch and Learn to monitor the space and apply the understanding to future activity; Engage lightly to benefit from the current buzz; go All In by investing heavily to potentially gain a “big strategic opportunity.”

Livestreaming

The return rate on items purchased through livestream shopping events is half the general average “because the consumer knows what they’re buying,” said Deborah Weinswig, CEO of Coresight Research, which expects sales through the medium to almost triple to $57 billion by 2025 and ultimately generate as much revenue as ecommerce.

The medium is remarkably inexpensive to adopt (platform costs are as low as $39 per month) and extremely profitable to activate: “This will be your highest ROI across the entire company,” Weinswig predicted, while encouraging retailers to enlist employees to host events right from the store. “The potential is limitless.”

One note on results: Only one-third of ultimate sales actually take place during the live event, with the rest occurring as much as 60 days later as consumers continue to watch — many for a second or third time.

Retail Media

Retail media will account for 20% of all digital advertising dollars by the end of 2023, according to eMarketer estimates. With that amount of money coming down the pike, it’s no surprise that retail media conversations often focus on the potential impact on CPG budgets and business relationships rather than on the potential benefits for shoppers.

But retail media networks do have the ability “to influence the entire customer journey,” as long as they are operated “in service of the shopping experience” rather than focused simply on driving ad revenue, said Kristi Argyilan, SVP-Retail Media at Albertsons.

“We don’t think we’re going to win in the ad business because we have a great search [media] product, but because we put products in people’s hands faster than anyone else in the whole world,” said Gopuff’s Folkman. That gives Gopuff an attractive audience and a wealth of consumption data to share with brands, he said.

That kind of understanding about the need for real partnerships continues to grow among retail media operators. “PepsiCo is my client, and retailers need to make that shift [in mindset],” says Argyilan. “We’re not entitled to anything. We have to earn the funding that’s coming our way.”

The first step toward true partnership is “to get everyone in the room,” said Andrea Steele, Head of Amazon, B2B and On Demand Retailers for The Hershey Company, in regard to the common practice of retailer networks and merchants/marketers working separately with suppliers. As an industry, retailers “definitely make that hard,” acknowledged Kroger’s Bennett. “And we end up disconnected many times internally.”

On the flip side, Bennett asked CPG partners to provide “greater visibility” into their media strategies. “In-store plans are super-cohesive, but we sort of let the supplier do whatever they want online,” he said.

Measurement of performance remains critical. “We need to know that we’re seeing an impact on our sales,” said Frankel at PepsiCo. “It’s easy to get romanced by some of the shiny objects out there,” said Ethan Goodman, The Mars Agency’s SVP-Commerce Media. “But true full-funnel measurement is more important to unlocking the power here.”

To that end, Albertsons is “leaning heavily into incrementality,” said Argyilan. “We want to integrate into how brands are measuring.”

In best of breed partnerships, retail media is treated as one piece of the broader holistic plan, with partnering brands getting access to data “as if it were our own first-party data,” said Frankel. “Retail media is not media. It’s retail plus media,” added Goodman. “What are the natural goals we’re trying to drive together, and how might retail media play a role in achieving that?”

“Our best work happens when we’re brought in at the strategic business level, not just to help amplify a promotion,” concurred Argyilan. “You can’t really get the benefit of a retail media network at the tactic level.”

________________

SHAREABLE SOUND BITES

“Just because consumers are willing to pay more doesn’t mean they should have to.”

Daniel Folkman,

SVP-Business, Gopuff

________________

“Everything that we do with data is focused on improving the customer experience.”

Fidji Simo,

CEO, Instacart

________________

“Every brand out there is trying to become a retailer, and every retailer is trying to become a brand.”

Jason Goldberg, Chief Commerce Strategy Officer, Publicis

_________________________

Matt Paolucci,

VP-Commercial Strategy, Chobani

“It’s reckless to ignore data, but it’s lame to solely rely on it.”

“Embrace the strengths of your organization. Don’t be frustrated with the limitations.”

“Build a team that people in the organization want to work with.” (on the first step to gaining organizational buy-in on data initiatives)

_________________________

“If you’re not including cooking instructions for an air fryer [in your communication], you’re missing an opportunity.”

Darren Seifer,

Food & Beverage Industry Analyst, NPD Group, while noting that 52% of U.S. households now own the appliance.

_________________________

“The data is certainly there. But there is work to be done”

Emily Frankel,

SVP-Head of Ecommerce Marketing, PepsiCo,

on the state of retail media measurement

_________________________

“Best-in-class brands are taking a more holistic view of retail media as a way to build the business, and they’re integrating their retail and national media activity.”

Ethan Goodman,

SVP-Commerce Media, The Mars Agency

_________________________

Leslie Waller,

VP-Marketing, Beverage & Growth Channels, Campbell Soup Company

“If you’re talking about Gen Z or Millennials, you’re talking about a more health-conscious consumer.”

“We need to make sure we show up on the digital shelf as much as the physical shelf.”

_________________________

“Every single ad platform on the planet has to figure out that balance.”

Bryan Gildenberg,

SVP-Commerce, Omnicom Commerce Group, on the need for retail media networks to balance monetization with the consumer experience

_________________________

“The consumer is ready, willing and eager to give us their data when there is a value exchange.”

Charisse Hughes,

Chief Brand & Advanced Analytics Officer, Kellogg Co.

_________________________

Nathalie Gerschtein, President, L’Oreal’s North American Consumer Products Division

“It’s about learning it all, not knowing it all.”

“We want to understand their beauty dreams, not just their beauty needs.”

_________________________

Nick Green, CEO, Thrive Market

“We have incredible data not only on what [our shoppers] buy but on what they want to buy and can’t find.”

“The consumer is going to be the driving force.” (on the need for companies to become more sustainable)

_________________________

“If you play aggressively, you can have an outsized influence.”

Brian Rudolph, CEO, Banza, on the benefits of ecommerce

_________________________

“The best ideas come from CPGs that are looking at the relationship differently. It has become more important to partner on new customer acquisition.”

Bill Bennett, VP-Head of Ecommerce, Kroger

_________________________

“For every dollar invested in data tools, you should spend $1 on organizational culture and change management.”

Deepak Jose,

Global Head of ODDA & Analytic Solutions, Mars Wrigley.

“A big, big driver of our profitability going forward.”

Natalie Knight,

CFO, Ahold Delhaize,

on her expectations for the unified online-offline retail media network the grocer will launch across banners in 2023

“We forgot how guests like to do things.”

Darren Rebelez, CEO, Casey’s, explaining why the chain added an AI-fueled call-in service to accommodate more old-fashioned shoppers after launching an online pizza-ordering system

_________________________

John Furner, CEO, Walmart Stores U.S.

“Data is the new currency.”

The shift to ecommerce “has made it easier to see patterns and be more predictive.”

“Using data to get ahead of demand is the biggest challenge going forward.”

_________________________

“We have to jointly build a product that works for everybody.”

Tony Xu,

CEO, DoorDash,

on the instant commerce provider’s retail media strategy

Download this report here: The Mars Agency Groceryshop 2022 Recap

_________________________

About The Mars Agency

The Mars Agency is an award-winning, independently owned, global commerce marketing practice. With talent around the world, we connect people, technology, and intelligence to create demand and drive profitable, sustainable growth.