The following analysis is the second in a four-part “Digital Commerce Roadmap” series that The Mars Agency publishes annually to provide a comprehensive overview of key digital marketing opportunities available across six leading retailers.

We are excited to shift our attention to the topic of directing quality traffic to retailer websites. In the previous article, we emphasized the significant value of organic search in capturing attention for your brand. This time, we’ll delve into strategies for driving more quality traffic to those sites — particularly to brand pages, product detail pages (PDPs) and custom landing pages.

Unlike search, which is focused almost entirely on keywords, your efforts to drive quality traffic can leverage both retailer DSPs (demand side platforms) and third-party sources to create the custom audiences you’ll need. For this purpose, it doesn’t matter if your target audience isn’t searching for your product at the moment because you’ll be creating your own demand, potentially re-target consumers, and testing any preconceived notions you might have about who your shopper is.

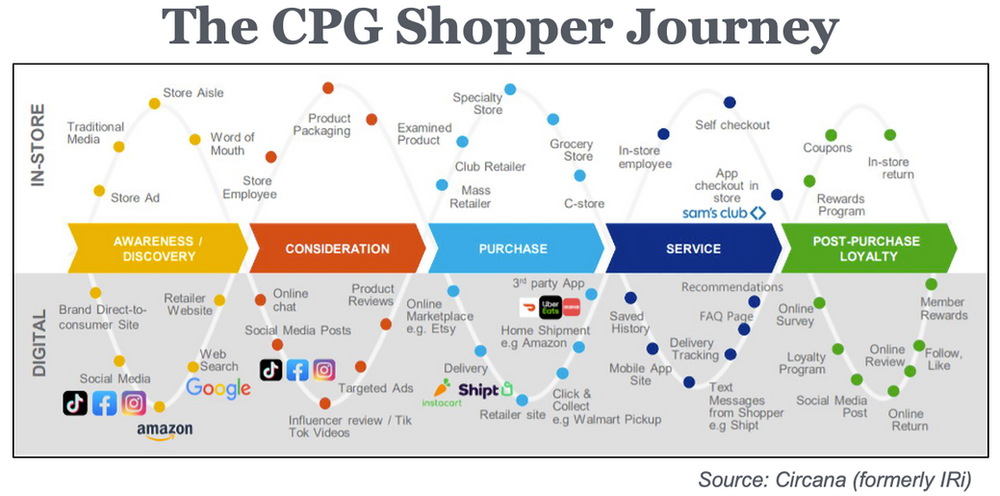

Consumers are increasingly interconnected, more knowledgeable, less inclined toward brand loyalty, and definitely open to various shopping channels. The path to purchase that they take isn’t a simple, direct route; there are numerous twists and turns as they progress from one touch point to another in their journey. And shoppers seek different types of content and information in different stages of this journey. Consequently, optimizing for one single characteristic of a search engine results page (SERP) will no longer get the job done.

As illustrated in this graphic from Circana (formerly IRi), a comprehensive shopper journey can now span multiple digital and physical channels and touch points. That requires brands to get very strategic about their connected commerce strategies overall and the role that driving traffic to retailer websites will play: How often is your target audience online? Which social platforms do they frequent? How receptive are they to other types of media? These are some of the questions you’ll need to answer.

It should already be obvious that there isn’t any one-size-fits-all solution for brands. The ability to search and shop for products across any channel — anytime and anywhere — has dramatically altered their relationship with shoppers. According to Forrester, more than 70% of retail sales will be digitally influenced by 2027, which makes it even more critical for brands to develop a holistic understanding of shopper behavior so they can deliver the relevant content needed to connect all those touch points in the purchase journey.

Here are some guidelines for doing that at six key retailers.

DRIVING TRAFFIC TO:

KEY CONSIDERATIONS

So far this year, we’re still seeing Amazon’s A10 algorithm (which determines organic search rankings) placing an emphasis on external traffic. While brands in the past could be “rewarded” even if the traffic didn’t drive purchase, this is no longer the case. The A10 algorithm now strongly favors searches and listings that will deliver a purchase.

UPS on-demand fulfillment subsidiary Ware2Go argues that A10 now places greater emphasis on click-through rates and conversions because many shoppers begin their product searches on Amazon but end up buying on rival platforms like Walmart.com or Target.com. And these competitors are owning more placements in Google search results than Amazon. So by emphasizing external traffic in A10, Amazon’s other end goal is to increase its own Google search rankings.

According to an Amazon report published in February, 41% of the retailer’s total sales traffic comes from offsite search channels. Of that traffic, 44% is coming from social media channels when shoppers are in product or brand discovery mode.

Another important traffic (not to mention sales) driver is email. Out of all offsite sources, email has the highest conversion rate when brands include tailor messages and call-to-action, according to the report.

By understanding Amazon’s A10 design and traffic composition, Amazon sellers can take the appropriate action. We recommend diversifying your marketing strategy with the right media mix model — in particular, using DSP ads, social media and email to drive traffic to Amazon. Leveraging influencers is another crucial tool that should be leveraged.

While Amazon PPC (pay per click) ads remain important, not all types are created equal. In fact, Amazon itself has noted that brands worldwide using the Sponsored Brands video ad format generate 43% more purchases from new-to-brand customers than those that don’t.

FAST FACT:

Amazon’s massive ecommerce success stems partly from its efficient supply chain: Although its U.S. digital sales are 10 times greater than Walmart’s and 20 times more than Target’s, its fulfillment center square footage is only 3 times greater than Walmart’s and 8 times more than Target’s, according to Supply Chain Dive/Max Garland.

QUICK TIPS:

Make sure that your products are ranking in national media search terms to take full advantage of your full-funnel media strategy — in our experience, this is even more important for sellers on Amazon Europe.

It’s also crucial to personalize the Amazon shopping experience, which includes adjusting product listings to match customer preferences. By blending data-driven marketing with a touch of personalization, brands can stand out and perform better on Amazon.

DRIVING TRAFFIC TO:

KEY CONSIDERATIONS

Instacart has steadily grown into a mature advertising platform. In fact, Cleveland Research Company (CRC) recently noted that the last-mile delivery service is now looking for more brands to commit to a joint business plan that includes an advertising budget. Therefore, it’s time to consider investments that will drive traffic to your Instacart product listings.

In light of the current inflationary pressures on consumer spending, coupons have been an effective tool for generating incremental spend on the platform, according to brands with which we work. But they tend to drive the most-impressive results when combining a coupon program with paid search.

Elsewhere, Instacart now has an affiliate network called Instacart Tastemakers that lets creators, publishers and developers monetize the purchases their audiences make on the platform. This program is also driving increased traffic to grocery item listings.

FAST FACT:

According to 1010data, Instacart’s top five retailers — Publix, Costco, Aldi, Kroger and Wegmans — account for more than 50% of total sales. But Food Lion, ShopRite, Meijer and Walmart have made substantial share gains over the last two years, along with Publix, Costco and Aldi; these 7 retailers have increased their share of the Instacart universe by more than 10%.

QUICK TIP:

To capture the most value, Instacart recommends starting with a minimum daily ad budget of $20 to ensure your campaign will generate the necessary traffic to let the algorithm optimize for sales and other key KPIs. Campaigns with a daily budget greater than $100 will optimize faster, thereby driving more sales.

DRIVING TRAFFIC TO:

KEY CONSIDERATIONS

With its longstanding brand loyalty program, Kroger can tie 96% of its sales to specific households. Kroger’s retail media arm, Kroger Precision Marketing (or KPM), is leveraging this robust first-party data, combined with customer profiles, to make localized advertising more effective. Meanwhile, Kroger’s private marketplace (PMP) is an open programmatic program that gives brands promising opportunities to drive traffic to the websites of the grocer’s many banners (although it doesn’t allow tags from the demand-side platforms of rivals like Amazon and Walmart).

Kroger hasn’t stopped there. This May, the retailer rolled out smart screens to 500 stores under a three-year pilot program with digital merchandising platform Cooler Screens. Kroger believes this in-store experience will give shoppers targeted, relevant ad messages to help them make better purchase decisions.

For brands, this development means they’ll be able to drive traffic to online PDPs from cooler screens in addition to mobile phones. For Kroger, digital commerce researcher Stratably predicts that digital profitability will improve when platform-agnostic media buys will be able to drive both digital and in-store sales.

These are opportunities that brands should definitely seek to leverage.

FAST FACT:

Like Amazon, Kroger also has a proprietary clean room solution called the 84.51° Collaborative Cloud. The tool provides access to clean, unaggregated, de-identified transaction-level data for Kroger’s 60 million loyalty program households in a privacy-compliant environment. The rich data includes in-store, pickup and delivery transactions. Brands should explore how this can provide clearer business visibility

to their activity with Kroger.

QUICK TIP:

Kroger takes an in-house approach to programmatic, so make sure your search, media, and data analytics teams have the right processes in place and the proper expectations in mind when collaborating with the retailer.

DRIVING TRAFFIC TO:

KEY CONSIDERATIONS

To some advertisers, Target’s Roundel retail media platform represents one of the more dynamic solutions currently available because of its accessibility for third-party programmatic, partnership with Index Exchange as a supply side platform (SSP) and use of Criteo and CitrusAd on the demand side.

Similar to Kroger, Target is looking to use Roundel as a bridge to make seamless connections between digital operations and physical stores. The goal isn’t to simply sell ad space to brands, but to craft ways of getting shoppers to buy more — and more often — at Target, on Target.com, and through the Target Circle app. (Although the retailer hasn’t made any official comment, it has hinted that the Target Circle loyalty program will be a focus going forward.)

The mission to drive quality traffic to Target.com, therefore, can’t single out the digital experience from physical stores. As covered in our report from Target’s annual Marketing Partner Summit, one-third of customers are making purchases in-store and via digital channels in the same week. Brands should partner with Roundel to find new ways of bringing the shopper experience to life by leaning into the “One Target” approach and taking advantage of more inventory, more search opportunities, and deeper connections into the entire organization.

FAST FACT:

In 2023, Target’s business “underperforms” in sales compared with Walmart, according to Stratably, which attributes the disparity in part to the difference in their category mixes: grocery accounts for 80% of sales on Walmart.com but just 60% on Target.com. This more-diverse portfolio mix means that Target’s “underperformance” may not provide a good framework for predicting the performance of non-grocery categories

(like health & beauty).

QUICK TIP:

Word across the industry suggests that, although it’s not a huge priority yet, Target is looking to expand the number of product categories and suppliers represented on Target+, its curated third-party marketplace. If you’re a digitally native DTC brand, work on your omnichannel presence to foster a stronger working relationship with Target’s merchandising team.

DRIVING TRAFFIC TO:

KEY CONSIDERATIONS

The Home Depot’s life as a media company started in 2019 with the launch of Home Depot Retail Media+, which lets brands place ads on a variety of company-owned properties including homedepot.com, the mobile app, offsite social, video media channels and even the in-store flyer.

In contrast to other retail channels, the path to purchase and conversion time in home improvement can be significantly longer because shoppers want to fully research their project before making a purchase. Since the consideration phase of the shopper journey is longer, brands should keep in mind that driving “quality” traffic to HomeDepot.com in this context involves shoppers look to be educated first, and then persuaded to buy.

According to CRC, using Google SEO as a source for external traffic to HomeDepot.com yields the strongest ROI, especially when used to support Retail Media+ campaigns. A small percentage of brands have also seen promising results from offsite display ads and email campaigns employing embedded sponsored tiles.

Since most Home Depot shoppers have a specific project in mind when researching products that will best suit their needs, video ads work extremely well in driving traffic. Because of this, some brands have also invested in YouTube and Connected TV ads.

As usual, presenting the right message, on the right channel, in the right medium, and at the right time will be essential to winning.

FAST FACT:

A specialty retailer operating in three countries (U.S., Canada and Mexico), The Home Depot has 2,322 stores and 198 million customers. TheHomeDepot.com enjoys 3.6 billion annual visits; about 55% of online orders, however, are still fulfilled in physical stores.

QUICK TIP:

As noted earlier, The Home Depot has a very high percentage of customers with a hands-on project in mind who start shopping online but end up in the store. TheHomeDepot.com, therefore, is all about connecting the shopper journey to enable a seamless experience between the two environments. The retailer itself runs a retargeting program that lets brands reach out to consumers who’ve visited their HomeDepot.com product pages with ads on social media and other off-site channels.

DRIVING TRAFFIC TO:

KEY CONSIDERATIONS

Walmart has been very busy the last few years. In addition to building up fulfillment services, it has expanded the Walmart Connect advertising platform significantly and doubled down on its marketplace.

Compared with Amazon.com, Walmart.com doesn’t carry as many ads; one recent Profitero study found the difference on the first page of search results to be roughly half. However, Walmart gives brands more control over ad placement. If you don’t want any ads to appear on the Buy Box, for instance, that can be excluded.

Meanwhile, Walmart appears to be competing against both Amazon and Target for Google search placement, since Walmart recognizes that Google represents the starting point for many shopper journeys.

This is where search ties into digital shelf optimization: Walmart pays for products to appear in national search engines, but will only do so for items that satisfy all their product listing requirements. Therefore, to drive more traffic to your Walmart listings, make sure the content on your PDPs and brand stores are meeting all the retailer’s requirements.

Another proven traffic-driver for Walmart.com is coupons and rebates: the site derives nearly 13% of its referral traffic from coupons and rebates, according to Similarweb. That makes third-party coupon solutions such as MikMak — which also identifies Walmart.com as among its more popular checkout points — an effective method for driving shoppers to the site.

Meanwhile, Walmart is attempting to monetize its shopper data by selling its Luminate analytics platform as a single source of truth across the retailer’s physical and digital sales channels.

FAST FACT:

Walmart’s U.S. ecommerce sales grew by 12% to $53 billion in fiscal 2023. Globally, the business has doubled in size over the last four years and now totals $82 billion, or 13% of total revenue.

QUICK TIP:

If you haven’t been using social media to drive traffic to Walmart.com, now is the time to act because the site is gaining an increasing amount of referral traffic from these platforms. According to Similarweb, 34% of these social referrals come from YouTube and 24% from Facebook. And while it might surprise you, the third-greatest share comes from Reddit.

Over the next two months, we’ll delve into other essential opportunities across these six retailer platforms, giving brands a comprehensive understanding of how to maximize success through each account. Next month, we’ll cover strategies for leveraging ratings & reviews.

The Mars Agency’s Ecommerce team knows that succeeding through online marketplaces requires quality content, winning the search algorithm, and a whole lot more. Our experts take clients to a new level of success by providing end-to-end business management, including operations, advertising, and digital shelf optimization. Using the agency’s proprietary data platform, our Digital Shelf Studio creates, enhances and optimizes client activity across the ecommerce landscape, helping them beat the competition and convert shoppers.

For more information, contact Kristin Wall, VP-Ecommerce.