As part of their ongoing mission to help clients stay ahead of the competition in a fast-paced, constantly evolving marketplace, The Mars Agency’s Customer Development teams closely monitor the strategic activity taking place across all key retailers and channels.

Each month, the teams compile Marketplace Assessment reports on the retailers (Walmart, Target, Kroger, Best Buy) and channels (Regional Grocery, Small Format, Club, Pet, Beauty) that are most important to the business success of our clients. The following report outlines 6 noteworthy events across the retail landscape from the team’s most recent round of assessments.

Costco Trials Sampling Stations

The Story: Costco appears to be testing “free sample” kiosks in a club near their Issaquah, WA, headquarters. A possible response to staff shortages (but also perhaps a way to simplify the chain’s strategy), these human-free kiosks are placed next to the product that’s being sampled to let shoppers “take one” on their own (and, without any mechanism for limiting the amount taken, will apparently rely on the honor system).

Relevance: Costco has long been known for its staff-managed sampling program, which has distributed free (often newly cooked) samples of food and beverages around the store. The sampling has been viewed as a big part of the chain’s “treasure hunt” appeal for shoppers. Expanding from the traditional sampling program, the introduction of these kiosks could represent new opportunities to drive product trial in warehouses.

Opportunity: Brands should keep tabs on this opportunity to drive trial at Costco and reach out to their category buyer for more information about participating. As the program develops, these kiosks might also provide a new option for gaining secondary in-store display placement.

____________

Ulta Beauty Taps into Seasonal Mini-Categories

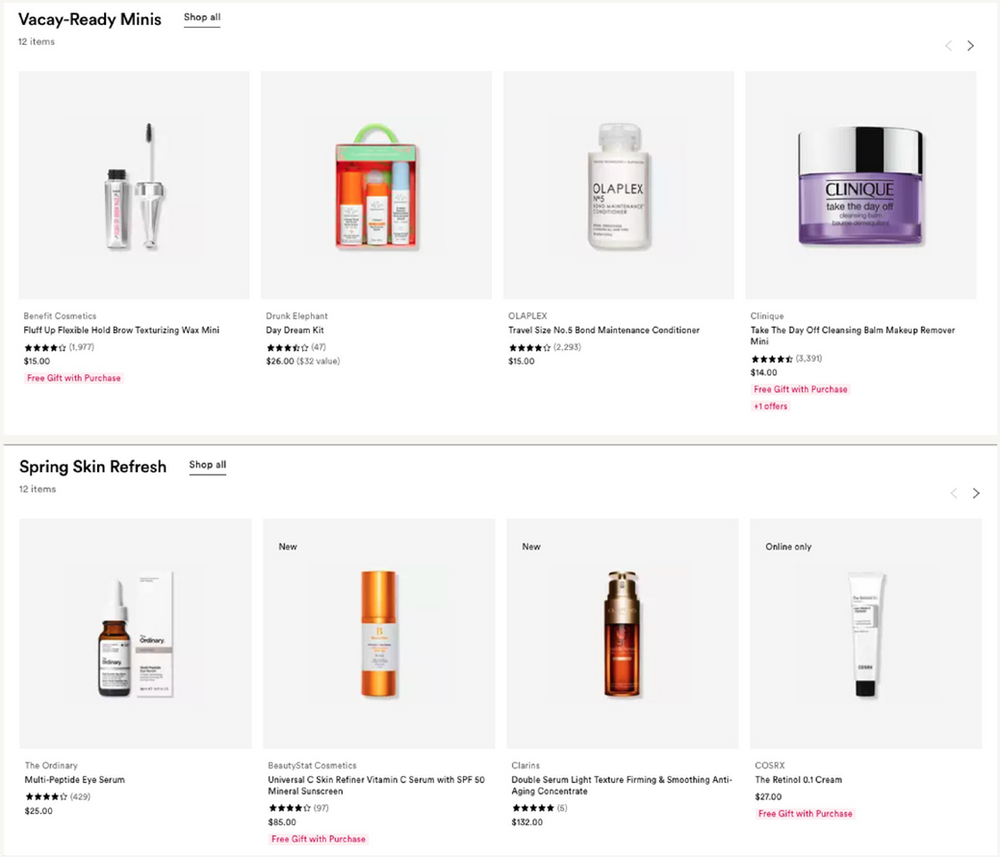

The Story: Beauty retailer Ulta built curated mini-categories on its website this spring to offer relevant selections for shoppers to browse as they prepared for spring break trips. The collections were designed to help trip-takers meet air travel requirements or help refresh and rejuvenate skin after the long winter months, among other themes.

Relevance: Ulta also sought to be seasonally relevant with corresponding content on the website such as “Vacay-Ready Minis” and “Spring Skin Refresh,” aiming to drive both sales and more efficient trips for shoppers. These categories potentially inspire shoppers to check out products they might not have been considering before visiting the website.

Opportunity: Brands should continue to work with Ulta to identify these kinds of white space opportunities, exploring category-leading ideas and solutions that can also help the retailer improve its overall performance.

____________

Walmart to Double Health Footprint by 2024

The Story: Walmart recently announced plans to open 48 additional health centers in the next two years, which would bring the total number of locations across the U.S. to 75. The Walmart Health medical centers, which are tailored to patients with no or poor insurance coverage in underserved areas, are located next to or inside Walmart Supercenters. Services include primary and urgent care, lab work, X-rays and diagnostics, dental, optical, hearing and behavioral health and counseling.

Relevance: Walmart has been taking early feedback from health center patients into consideration as it makes plans to better serve local communities. Thus, the new centers will feature changes to the physical footprint and updated equipment and technology. In addition, all Walmart Health locations will be outfitted with better health records software (supplied by Epic Systems). The planned location growth and operating improvements illustrate Walmart’s desire to be a leader in the retail clinic marketplace.

Opportunity: With Walmart Health located next to or inside Walmart Supercenters, the retail giant is positioning itself to become a one-stop shop for all healthcare needs. Relevant brands have an opportunity to benefit from the traffic these health centers deliver.

____________

Ahold Delhaize Reaffirms Strategic Focus

The Story: In Ahold Delhaize’s recently released 2022 Annual Report, CEO Frans Muller reiterated the laser focus the retailer’s banners have on:

● Keeping grocery prices as low as possible.

● Making healthy food options accessible to all shoppers by investing in high-quality own-brand products.

● Expanding the range of price-entry products the retailer offers.

● Offering more personalized discounts through loyalty programs.

Relevance: The theme of this year’s report is “Local matters,” which emphasizes the importance of serving communities and customers at the personal level. But while Ahold Delhaize strives to understand the unique needs of all the communities it serves, the retailer can also leverage the scale and efficiency it gains from being a global company to provide access to sustainable and healthy food across all markets.

Opportunity: In addition to the strategies described above, brands should read the report’s market trends section to learn about some of AD’s other key initiatives. Most relevant to brands, the retailer is focused on driving omnichannel growth and elevating healthy and sustainable practices.

To address the first strategy, brands should conduct digital promotions while working to optimize their digital shelf strategy to ensure a seamless customer experience; to align with AD’s sustainability goals, brands should continue to evaluate their sourcing and packaging policies, especially as more shoppers seek out sustainable products.

____________

Kroger Wants More Plant-Based Sales

The Story: At the recent Natural Products Expo West trade show, Kroger data division 84.51° used new behavior research to explain how grocers can shape their marketing and merchandising strategies to generate more sales from omnichannel shoppers seeking plant-based options.

Relevance: According to the Plant Based Foods Association, 66% of the total adult U.S. population is already engaged with the concept at some level, which demonstrates the current size and future potential of the category.

Opportunity: Shoppers are asking for more out of their consumables. Keeping them informed about the new, plant-based food options that your brands introduce may very well drive customer retention as well as gain new shoppers. Consider offering in-store and digital recipe cards to keep shoppers aware of potential uses for these new products and learning about items they might not have considered at the start of their trip.

____________

Alc/Bev Sales Grow at Convenience Stores

The Story: C-stores have benefitted from increased liquor consumption since the start of the pandemic, with total category sales in the channel now nearly equaling those at food stores: $28.5 billion vs. $28.7 billion, according to ,C-Store Dive.

Relevance: Total c-store alcohol sales rose 3.2% for the year ending Jan. 29, 2023, outpacing the grocery, mass market and drug channels along with select dollar and club stores. Beer delivered nearly 75% of total growth.

Opportunity: C-Store Dive expects spirits and ready-to-drink categories, along with Mexican beers and select wines, to continue outperforming in 2023. Brands should meet with their c-store partners to optimize the product mix and take advantage of these trends. In the meantime, check out The Mars Agency’s analysis of c-store shopper demographics and strategies for meeting their needs.

____________

The Mars Agency’s Customer Development practice is an unrivaled team of in-market commerce experts who simplify the complexity of retail for our clients. Located in Bentonville, Minneapolis, Cincinnati, Chicago, Tampa and the “backyards” of other key retailers, they provide deep knowledge of the retailer, expertise in key business areas (like strategy, media, retail media and creative), and door-opening personal relationships with key executives to deliver an unmatched level of business success for clients across accounts, channels and shopper engagement platforms. For more information, contact Group SVP Kandi Arrington at [email protected].