As part of their ongoing mission to help clients stay ahead of the competition in a fast-paced, constantly evolving marketplace, the field teams in Publicis Commerce’s Retail Consultancy closely monitor the strategic activity taking place across all key retailers and channels.

Each month, the teams compile Marketplace Assessment reports on the retailers (including Walmart, Target, Amazon, and Kroger) and channels (such as Regional Grocery, C-Store, Club, Pet, Beauty, and On-Demand Delivery) that are most important to the business success of our clients. The following report outlines noteworthy events across 12 key retailers from the team’s most recent round of assessments. (To receive copies of the full reports, contact EVP-Retail Consultancy Kandi Arrington at [email protected].)

____________

Walmart Opts In to ChatGPT’s ‘Instant Checkout’

Walmart and Sam’s Club shoppers will soon be able to make purchases within OpenAI’s ChatGPT using the answer engine’s new “Instant Checkout” functionality, which this month began directly facilitating single-product purchases but will expand to multi-item carts at an unspecified date.

Read the full article here.

____________

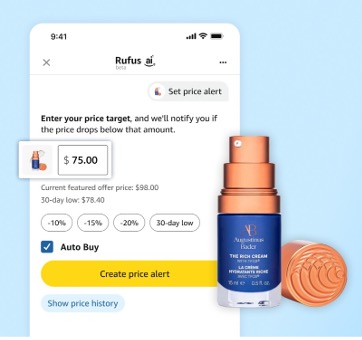

Amazon Solves for Shopper Indecision

A new AI-powered “Help Me Decide” tool expands Amazon’s ability to make product recommendations. The tool analyzes browsing, search, and shopping history to deliver personalized suggestions that clearly explain why a specific product is the best option, including relevant attributes, insights from customer reviews, and connections to the shopper’s past purchases.

Designed to help shoppers quickly choose between similar options, the Help Me Decide button will automatically appear at the top of product detail pages after shoppers have viewed several similar items but haven’t yet made a purchase. It’s also accessible by tapping “Keep shopping for” on Amazon.com’s home page. Browsers who don’t like the first suggested option can click to receive an upgraded pick or a budget-friendly alternative.

Relevance: Help Me Decide expands Amazon’s suite of AI-powered shopper-facing tools, which is led by agentic AI search engine Rufus. This latest functionality arrives on the heels of the company’s “Hear the Highlights” product summarizer and updated Amazon Lens visual search tool.

Opportunity: As Amazon continues to automate search and discovery with new AI-fueled capabilities, it’s imperative that brands learn what factors are driving the recommendations so they can stay top-of-mind — as in top of page — with shoppers. An optimized digital shelf content strategy is a critical place to start. (Mars United’s latest Digital Shelf Report outlines brand content and sales enablement considerations at leading ecommerce players such as Amazon; a forthcoming report will help companies decode the patterns behind Rufus’ product recommendations.)

____________

Target, Instacart, DoorDash Build ChatGPT Apps

Target, Instacart, and DoorDash are among several retail companies planning to integrate with OpenAI’s ChatGPT. The companies later this year will introduce their own apps within the answer engine, enabling interactive interfaces directly within conversations on the platform.

Distinct from the universal Instant Checkout feature discussed earlier, these third-party apps (unveiled even more recently) are functionally designed to power more immersive, brand-specific experiences. The apps enable a wider set of features that, among other capabilities, will let ChatGPT users browse a full product catalog and access their personal account details and loyalty-program information with each retailer.

The retailer-specific apps will be accessible by name and may also be suggested by the answer engine during chats “at the right time,” according to an official announcement.

Relevance: With ChatGPT potentially becoming a central interface for product discovery and transactions, retailers and on-demand delivery companies are positioning themselves to be at the forefront of the next wave of shopper engagement and commerce.

Opportunity: Generative AI is redefining how shoppers find and buy the grocery products they need. Brands likewise should explore ways they can position themselves in these new moments of purchase intent and investigate any options that arise to drive discovery, loyalty, and conversion.

____________

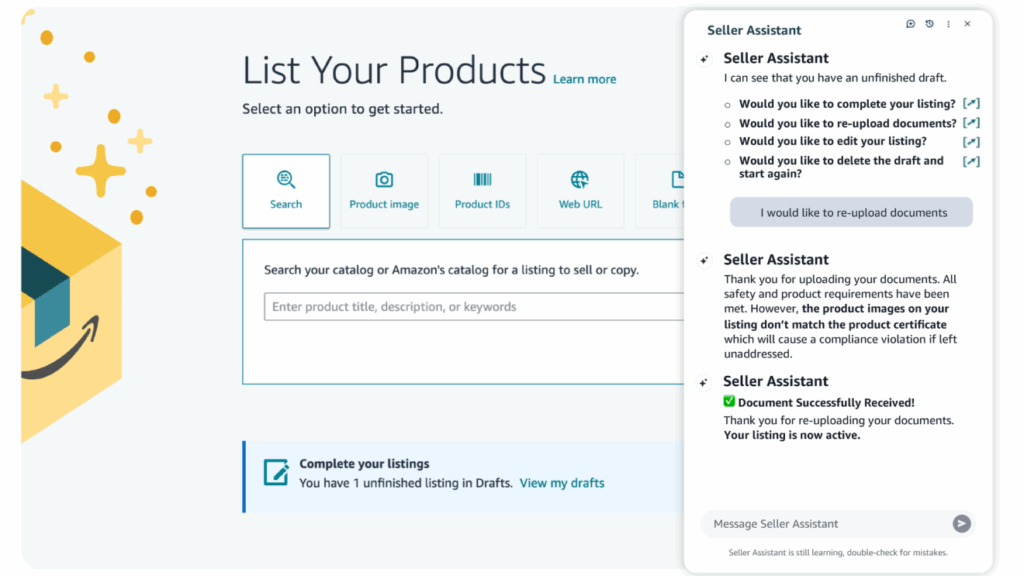

Amazon Taps Agentic AI for Sellers

Meanwhile, back at Amazon, the ecommerce leader has added agentic AI capabilities to the Seller Assistant tool it introduced last year.

The upgrade transforms the tool “from passive assistance to active partnership,” moving it beyond monitoring account health and optimizing inventory to anticipating seller needs and developing optimized advertising and marketing strategies, the retailer said in a corporate post. When authorized, it can also go one step further and coordinate everything from promotions and inventory adjustments to campaign launches.

Seller Assistant is currently available to all U.S. sellers at no additional cost and will roll out to other countries in the coming months.

Relevance: Shopper-facing search activations are getting all the attention, but retailers are using agentic AI to improve back-office functions for brand partners as well. Amazon is also infusing its Creative Studio with tools to help sellers develop video and display ads through simple conversation prompts.

Opportunity: Brands should make sure to tap into the expanding AI capabilities of Seller Assistant and Amazon’s other AI-powered tools to streamline campaign planning to potentially reduce costs while improving performance.

____________

Shipt Launches ‘Chat to Cart’ Function

ChatGPT is not the only answer engine in the marketplace, of course: Shipt is working with Perplexity AI to leverage its new Comet browser through a “chat to cart” feature. The functionality is designed to encourage discovery of new and trending products while also suggesting items that Shipt’s customers may have forgotten. The aim is to make product discovery and cart curation more seamless and personalized, Shipt said in a corporate post.

Shipt is encouraging users to download Comet and set it as their default web browser, after which they can ask for detailed support to build and curate their carts across Shipt’s marketplace of 100-plus retailers. To encourage trial, Shipt is promising $10 off orders of $35 or more through Dec. 1.

One of the key benefits of the partnership is that “Perplexity is learning with each search on its Comet browser, better understanding user preferences, helping [shoppers] discover new products, and infusing even more personalization to the Shipt experience,” said Katie Stratton, Shipt’s Chief Growth and Strategy Officer.

Relevance: As the adoption of answer engines like Perplexity increases, using a consumer-facing natural language interface to enhance cart building differentiates Shipt (for the moment at least), elevating the on-demand delivery platform to the level of shopping assistant and keeping it aligned with evolving shopper expectations for personalization and ease.

Opportunity: Brands should work with Shipt to find out how Perplexity’s recommendations are determined and explore what options may become available — not only to get in front of shoppers but also to leverage the behavior and audience data that will be derived through the partnership.

____________

Walmart Gets Closer to Marketplace Sellers

Walmart will pilot new opportunities for first- and third-party marketplace sellers to showcase their products in-store at no charge, the retailer announced at its annual marketplace seller summit (which this year took place in August).

The retailer’s new “Store of the Future” in Cypress, TX, is deploying QR codes at the shelf near specific products that link shoppers to an extended online assortment as well as digital tools and services such as professional installation options. Among the featured products at the moment are Kenmore washing machines, Weber grills, Vizio TVs, and Huffy bikes, Modern Retail reported.

Walmart is collaborating with first-party sellers to curate what to highlight, Manish Joneja, SVP of Walmart U.S.’s Marketplace and Walmart Fulfillment Services, told Modern Retail. The retailer is not yet sharing plans to scale the initiative, he said.

Relevance: Walmart unveiled a slew of additional capabilities, tools, and incentives at the summit designed to make its marketplace faster, easier, and more cost-effective for sellers. Connecting physical and digital shopping via omnichannel efforts like in-store QR codes keeps Walmart aligned with evolving consumer expectations while setting standards for the future of in-store shopping that other retailers will likely follow.

Opportunity: As Walmart gives marketplace sellers greater visibility in stores, it may become tougher for traditional brand partners to stand out. Despite the challenge of increased competition, brands may be able to partner closely with Walmart to co-create in-store digital discovery programs that increase shopper engagement — as well as to access QR code behavior data that can help refine marketing strategies.

____________

Kroger Expands DoorDash Relationship

Building on a prior arrangement that only covered sushi and items from the floral department, Kroger is now making its complete store inventory available via DoorDash while integrating promotions and loyalty program discounts into the on-demand delivery provider’s ecosystem. The grocer is hoping the partnership will help reach new households and attract incremental shopping trips from existing customers, according to an official announcement.

Kroger and DoorDash also plan to collaborate on joint innovation, beginning with retail media advertising opportunities, shopper insights for brand partners, and new delivery models that leverage Kroger’s store network and DoorDash’s technology to help brands grow and engage customers in more relevant ways.

“We are bringing our high-quality, fresh, full grocery assortment to new customers. We are making it easier to shop in the way that best fits their day. And we are offering lower prices and more relevant offers to drive more traffic, which increases the data we use to power our retail media business,” said Yael Cosset, Kroger’s EVP and Chief Digital Officer.

Relevance: Kroger also works with both Uber and Instacart, the latter of which still powers the retailer’s branded service. The grocer historically has also invested heavily in its own robotic fulfillment centers in partnership with UK-based warehouse automation specialist Ocado, but has recently indicated that individual stores will play a larger role in future ecommerce fulfillment strategies.

Opportunity: Brands working with Kroger now have another vehicle for shopper engagement that could potentially reach new shoppers — but also another choice to make when deciding which retail media network to leverage for reaching Kroger audiences. (For more thoughts on hyper-segmentation in the name of convenience, view this interview with Saatchi X SVP John Elliott.)

____________

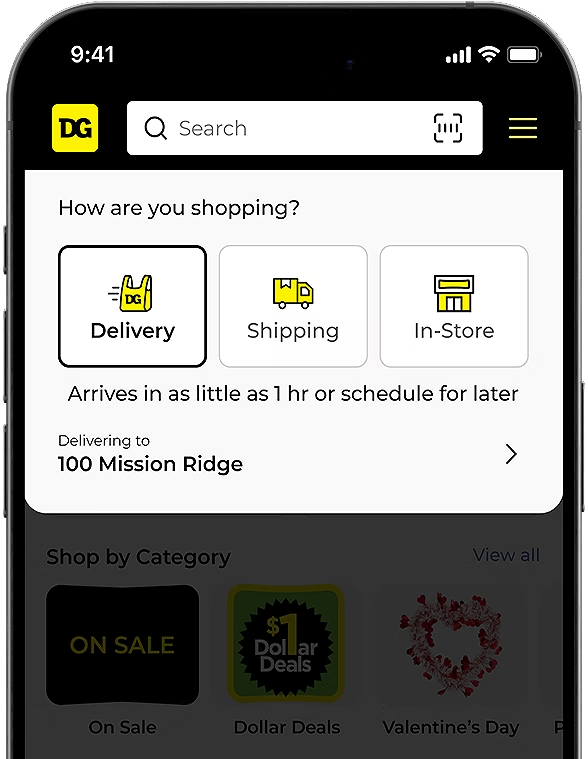

Dollar General Rapidly Scales Delivery Options

Dollar General is accelerating the rollout of its own white-label on-demand delivery service to complement existing relationships with Uber Eats and DoorDash — the latter of which is providing the infrastructure for the branded offering and the drivers to handle order fulfillment.

Dubbed DG Delivery, the service is already available via website and app within a five-mile radius of nearly 6,000 stores but is expected to reach 16,000 locations by the end of 2025, the company said during its latest earnings call. Users pay in-store prices and can redeem digital coupons and cash-back offers, with purchases recorded in a Dollar General account history.

Relevance: DoorDash’s standard service is currently available for 17,000 of Dollar General’s more than 20,700 stores; Uber Eats currently covers 4,000 stores but is expected to soon reach 14,000 locations. Although the DoorDash and Uber Eats partnerships reportedly drive new customers to Dollar General, DG Delivery has been adding incremental trips since its soft launch last year. DG Delivery data finds the average basket ring to be $22.80, vs. $17.10 in stores (and $19.20 on DoorDash).

Opportunity: Rapid expansion of the service, along with the pricing parity and promotional opportunities now available, should help brands reach Dollar General’s value-focused shoppers through a fast-growing, convenient channel. As it seeks to build trip frequency and basket size among existing shoppers, DG Delivery is primed for help with stock-up and convenience messaging.

____________

Costco Is Attracting Younger Shoppers

Nearly half of Costco’s new-member sign-ups in the fourth quarter of fiscal 2025 (ended Aug. 31) were under the age of 40, the company indicated during its recent earnings call, crediting more prominent marketing around online sign-ups for helping introduce the warehouse club to a younger audience.

Costco’s overall member renewal rate in the U.S. and Canada was 92.3% during the fourth quarter, a decline of 0.4% from the prior quarter and 0.6% year-over-year that the company largely attributed to the higher number of online sign-ups entering the renewal cycle (and not a September 2024 increase in membership fees). Members signing up online rather than in clubs renew at a slightly lower rate on average, but Costco is hoping to rectify that fact by placing a greater emphasis on automatic renewal and supporting with targeted digital communications.

Relevance: Costco’s total paid memberships grew 6.3% year over year to 81 million while Executive memberships — which are double the cost at $130 per year — increased 9.3% to 28.7 million. The warehouse club chain said it experienced a lift in upgraded membership in the U.S. after unveiling new benefits. The retailer has also improved its capabilities to deliver more relevant messaging on its home page based on membership type.

Opportunity: As it invests in opportunities to improve the renewal rate among newer digitally focused members, there’s room for brands to help Costco consider how to better engage these younger shoppers, demonstrate the value of membership, and move them up to the Executive tier. Brands may want to consider increasing the amount of digital communication in their plan alongside their in-club efforts.

____________

Hannaford Upgrades Ecommerce Platform

Hannaford launched an updated website and app on Oct. 28, making it the last of Ahold Delhaize USA’s five store banners to transition to Prism, the company’s proprietary digital and ecommerce platform.

The upgrade includes an improved search engine designed to help shoppers find items faster and easier, according to Grocery Dive. It will also let them pre-select substitutions as well as approve or reject suggested alternatives for their home-delivery and store pickup orders. The platform additionally accommodates more forms of payment, including EBT and Apple Pay. (In a concurrent move, payments and coupon redemptions will no longer be accepted curbside.)

Relevance: Hannaford’s transition signals a major modernization of its digital shopping experience that aligns with broader shifts across the grocery industry toward omnichannel convenience. It also completes the consolidation of data and marketing capabilities across Ahold Delhaize USA, creating a more unified retail media and analytics system.

Opportunity: Brands stand to benefit from improved product discoverability through Hannaford’s new user experience and will have a streamlined ability to work across all five banners to develop retail media campaigns.

____________

Publicis Commerce’s Retail Consultancy is an unrivaled team of in-market commerce experts who simplify the complexity of retail for our clients. Located in Bentonville, Minneapolis, Cincinnati, Chicago, Seattle, and the “backyards” of other key retailers, they provide deep knowledge of the retailer, expertise in key business areas (like strategy, media and creative), and door-opening personal relationships with key executives to deliver an unmatched level of business success for clients across accounts, channels, and shopper engagement platforms. For more information, contact EVP-Retail Consultancy Kandi Arrington at [email protected].