Insights and analysis about the holiday shopping season’s unofficial kickoff, which now encompasses special events at Walmart and other key retailers.

Colloquially known as October Prime Day, Amazon’s annual Prime Big Deal Days event is only in its fourth year but has quickly become an early rallying point for the holiday retail rush, spurring concurrent events from competing retailers.

Held Oct. 7-8 this year, Amazon’s sales bonanza attracted value-seeking shoppers with price discounts and product availability on their minds in the context of rising inflation and other economic uncertainties. Although seasonal purchases remained a major impetus, shopper sentiment leaned more toward stocking up on discounted essentials. Consumer insights firm Numerator found that just 23% of Big Deal shoppers bought holiday gifts during the event, while 28% took advantage of deals on everyday items.

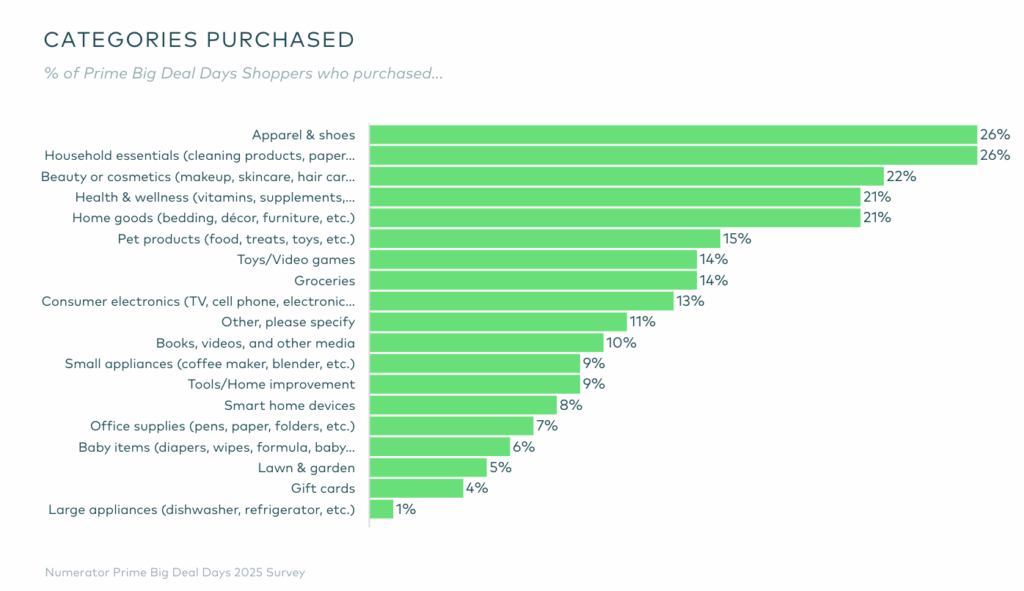

In fact, Numerator’s poll of 5,000 shoppers indicated that four of the five most purchased categories represented core consumer packaged goods: household essentials, beauty and cosmetics, health and wellness, and groceries. Apparel and footwear was the top category overall, while home goods, toys and video games, pet products, and consumer electronics rounded out the top nine. (A catchall category for “other” items came in 10th.) The focus on everyday items suggests consumers are approaching discretionary spending with restraint heading into the all-important fourth quarter — although research from Mars United and partner Profitero+ has found that shopping for essentials to be a common aspect of both this event and Amazon’s flagship Prime Day sale in July.

Amazon was unusually quiet about announcing results post-event; it customarily has touted each new Prime Day as “record-breaking.” Numerator reported an average basket size of roughly $45 and average household spending at around $104. Nearly half (44%) of all orders were under $20, which suggests shoppers are prioritizing value and hesitating to plan too far ahead. Numerator also found that 90% of shoppers knew that the Prime Big Deal Days event was happening before visiting Amazon.com, and about one-third said it was their primary reason for going.

Leading up to the event, Amazon highlighted discounts on national brands such as Lego, Mattel’s Fisher-Price, Tonies, Beats, Apple, Dyson, Samsung, LG, Levi’s, L’Oreal’s Lancome and holiday decor wholesaler National Tree Company (the last two of which offered exclusive products). The majority (58%) of shoppers told Numerator they were very or extremely satisfied with the deals they encountered, and most intended to return to Amazon in the next three months to buy (more) holiday items — 59% “definitely,” 25% “probably.”

But Amazon is clearly no longer alone: More than half of Prime Day shoppers (56%) said they compared Amazon’s prices and products at other retailers — Walmart (68%), Target (43%), and club stores (25%) — before making their Amazon purchase. Some also planned to, or already had, participated in competing sales events: 27% mentioned Target Circle Week (which was held Oct. 5-11), and 36% referenced Walmart Deals (Oct. 7-12). The latter retailer differentiated its positioning by boasting that membership was not a requirement for participation.

Amazon, meanwhile, leaned into the exclusivity of its event to drive Prime memberships. The retailer even sweetened the pot ahead of this year’s sale by unveiling a new benefit in the U.S. that lets members add items to an order that’s already in progress with a single tap. Eligible items carry a blue “Add to Delivery” button that skips checkout and automatically includes the product in a previously scheduled shipment. (There is also a new “Undo” option that appears briefly to allow immediate removal of erroneously added items.)

TRACKING BRAND PERFORMANCE

Mars United partner Profitero+ has compiled three exclusive reports examining sales performance and promotional activity across seven key product categories during Prime Big Deal Days on the U.S. and UK Amazon.com websites, as well as on Walmart.com during that retailer’s concurrent event.

As is often the case during similar tentpole sales events (such as Cyber 5 in2024), brands that gained the greatest visibility through either paid or purchased opportunities generally differed across the nation’s two leading retailers, continuing to underscore how unique brand activity and shopping behavior are at each.

When looking at estimated share of sales, there were only a few standout instances where category leaders were consistent on both Walmart and Amazon in the U.S.:

- Apple in Electronics,

- Lego in Toys,

- L’Oreal’s La Roche Posay in Beauty & Personal Care, and

- Nestle’s Purina in Pet — though with different product lines (Dog Chow and Cat Chow at Walmart; Pro Plan at Amazon).

Otherwise, most top brands across the two retailers were quite diverse. In Food & Grocery, for example, beverage brands (including Celsius, Red Bull, Talking Rain Beverage Co.’s Sparkling Ice, and Monster Energy) dominated at Amazon while Walmart skewed toward snack and meal brands (such as McKee Foods’ Little Debbie, Mondelez’s Oreo, Gruma’s Mission, and Kraft Heinz’s Kraft). This suggests differences in shoppers and trip missions at each: possibly a convenience-first base at Amazon given the prevalence of what are often single-serve beverages versus one prioritizing affordability and stock-ups at Walmart given the predominance of multi-serve pantry staples.

With even category-level consumer priorities and behavior differing by retailer, effective marketing practices at Amazon may not translate to Walmart, and vice versa. Successful brand strategies — including promoted SKUs, messaging, and investment levels — must be tailored to the nuances of each.

Private Label Presence

Notably, the only brands that topped share of sales across multiple product categories at either retailer were private labels — Walmart’s Great Value (in Food & Grocery, Household Essentials, and Home Improvement) and Amazon’s flagship brand (Electronics, Household Essentials, and Pet) and sub-brands (Ring and Blink in Electronics and Home Improvement, and Blink also in Pet).

It’s also worth noting that Amazon unveiled a new Amazon Grocery private label uniting top-rated products from the Amazon Fresh and Happy Belly brands one week prior to the event — “a time when consumers are particularly price-conscious,” affirmed Jason Beuchel, VP of Amazon Worldwide Grocery Stores and Chief Executive Officer at Whole Foods Market.

With broad appeal across categories, growing brand equity and consumer trust, and a strong value perception, private brands were the most consistently dominant across categories — at least within the respective retailer’s own ecosystem.

Sales Growth vs. Paid Activity

Excluding own brands, just a handful of share-of-sales leaders also made the top promoters list in the same categories at each retailer. In fact, only one at Amazon: smart home device brand Govee in Home Improvement.

Promotional and sales activity at Walmart aligned more broadly, with national brands that made both lists spanning:

- Apple in Electronics,

- Markwins Beauty Brands’ Wet N Wild in Beauty & Personal Care,

- Kraft in Food & Grocery,

- Reckitt’s Lysol and Church & Dwight Co.’s Arm & Hammer in Household Essentials,

- Mars Petcare’s Pedigree and J.M. Smucker Co.’s Meow Mix in Pet,

- Hart (an exclusive brand) in Home Improvement, and

- Lego in Toys.

It would be short-sighted to conclude that Walmart shoppers are more responsive to promotions or that the retailer’s media network is more effective in driving results based on this comparison alone. The likelier implication is that brand ad strategies differed across the two retailers based on market position and strategic objectives.

Promoter Trends

Giving credence to the preceding assessment, the top paid promoters (based on item counts with deal badges including “Prime Day” and “Rollback”) at Amazon versus Walmart couldn’t be more disparate.

As usual, lesser-known brands with Amazon-focused distribution strategies rose to the top among promoters at Amazon, with the leading brand in each category often outspending competitors by a wide margin. Examples include China-based brands Workpro in Home Improvement, Hygger in Pet, and Bedsure in Household Essentials.

Similar trends appeared in some Walmart categories. Two clear examples came in Electronics and Pet, where China-based Uxcell and Pet Artist, respectively, outspent all other advertisers by a landslide. However, Walmart’s promotional mix was generally much more heavily populated by established brands.

The results get even more interesting when drilling down to individual top sponsored products. For that, we invite you to download the reports HERE.