As part of their ongoing mission to help clients stay ahead of the competition in a fast-paced, constantly evolving marketplace, the field teams in Publicis Commerce’s Retail Consultancy closely monitor the strategic activity taking place across all key retailers and channels.

Each month, the teams compile Marketplace Assessment reports on the retailers (including Walmart, Target, Amazon, and Kroger) and channels (such as Regional Grocery, C-Store, Club, Pet, Beauty, and On-Demand Delivery) that are most important to the business success of our clients. The following report outlines noteworthy events across nine key retailers from the team’s most recent round of assessments. (To receive copies of the full reports, contact EVP-Retail Consultancy Kandi Arrington at [email protected].)

____________

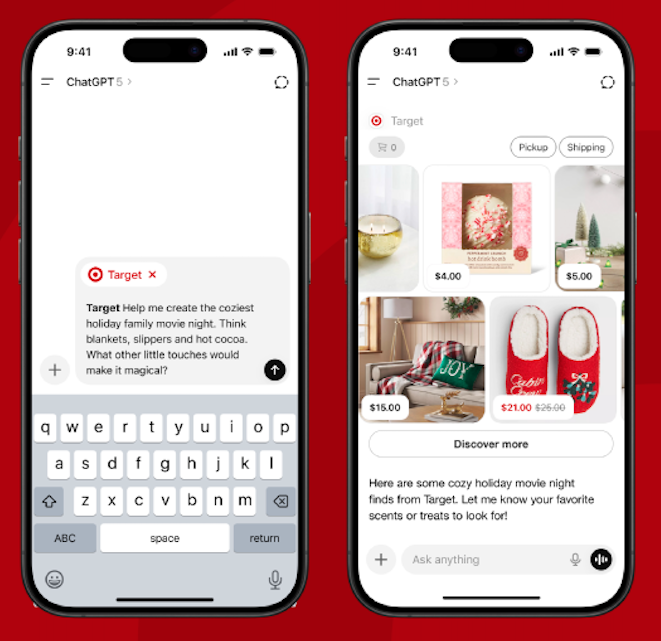

Target Goes All-In on AI

Just in time for Black Friday, Target launched the app within OpenAI’s ChatGPT generative AI/agentic search engine that was first unveiled in early November. The app’s beta experience enables multi-item purchases in a single transaction (something ChatGPT’s own Instant Checkout tool can’t yet do), fresh-food shopping, and flexible fulfillment options. Forthcoming updates will add personalized recommendations, full-assortment access, and seamless checkout through existing Target accounts.

“We’re proud to be one of the first retailers bringing shopping into this new channel,” said Prat Vemana, Target’s Chief Information and Product Officer. “Technology is helping define Target as a company that doesn’t just use AI — but runs on AI.”

Beyond ChatGPT, Target’s broader technology investments involve embedding AI across inventory, search, store operations, and merchandising, with the intent of connecting enterprise data to deliver more predictive, personalized, and seamless shopping experiences across channels. The retailer is praising AI for shortening checkout times, improving inventory accuracy, personalizing search and recommendations, and powering tools like the “Target Trend Brain,” which spots emerging trends.

Target also has enhanced its own store app with AI-driven, shopper-facing tools including a conversational gift finder, list-to-cart scanning of handwritten lists, and smart in-store navigation that recommends alternative fulfillment methods if items are unavailable.

Even as it pushes forward digitally, however, Target continues to invest in physical stores. By the end of 2025, it will have remodeled 90 locations and opened 18 stores this year, and it has plans to open 300 more stores over the next decade. A $5 billion capital investment in 2026 will fund store upgrades, expanded product assortments, and additional digital capabilities.

Relevance: Internet analytics company SimilarWeb estimates that 15% of Target’s referral traffic is already coming from ChatGPT, which made establishing a direct relationship with OpenAI a no-brainer. Generally speaking, adoption of new AI tools and opportunities supports Target’s strategy of returning to profitability by elevating the shopper experience and growing basket sizes while facilitating more precise retail media, demand forecasting, and on-shelf availability. (On a side note, the basket size of in-store app users is nearly 50% larger than other shoppers, Chief Guest Experience Officer Cara Sylvester noted recently.)

Opportunity: It will be essential for brands to find ways of collaborating with Target (and other key retailers) as the company works to build an effective strategy for partnering with third-party search agents — as well as to develop internal tools for its app and website. Understanding how Target’s evolving data and technology ecosystem will enhance visibility, efficiency, and sales performance will be critical.

Elsewhere, AI-powered operations like in-stock monitoring and navigation can strengthen in-store activation and campaign performance. And monitoring tools like the “Target Trend Brain” can help anticipate product trends and optimize launch timing, presenting opportunities to align promotions with inventory availability and drive stronger sales.

____________

Walmart Updates Its Shopper App

Walmart added several AI-powered features to its mobile app that are designed to simplify product discovery, event planning, and in-store navigation:

- Generative AI assistant Sparky can now curate shopping lists based on occasion-specific needs.

- AI-generated audio summaries (currently available for some 1,000 premium beauty products) are synthesizing product descriptions and reviews into short, conversational sound bites.

- Augmented reality showrooms let shoppers explore dynamic 3D interiors and add showcased products directly into their carts.

- An in-store savings tool presents location-specific deals, with category filters and price comparisons viewable on one screen.

- Enhanced store search and navigation tools provide real-time product availability and locations.

- Digital shopping lists automatically get sorted by aisle in stores.

Relevance: Walmart is undertaking a significant digital transformation, tapping AI for shopper-facing experiences and across its operations. Outgoing CEO Doug McMillon has stated that AI will fundamentally change how every job is done at the retailer, impacting internal functions, shopper engagement, and brand partnerships.

Opportunity: Walmart reports that in-store shoppers spend about 25% more during trips when they use the app. As the retailer continues to accelerate the automation and simplification of the shopping trip, brand partners must prepare to be more efficient, data-driven, and tech-enabled to keep pace with Walmart’s AI adoption — which will bring new advertising and engagement opportunities along with operational efficiencies.

____________

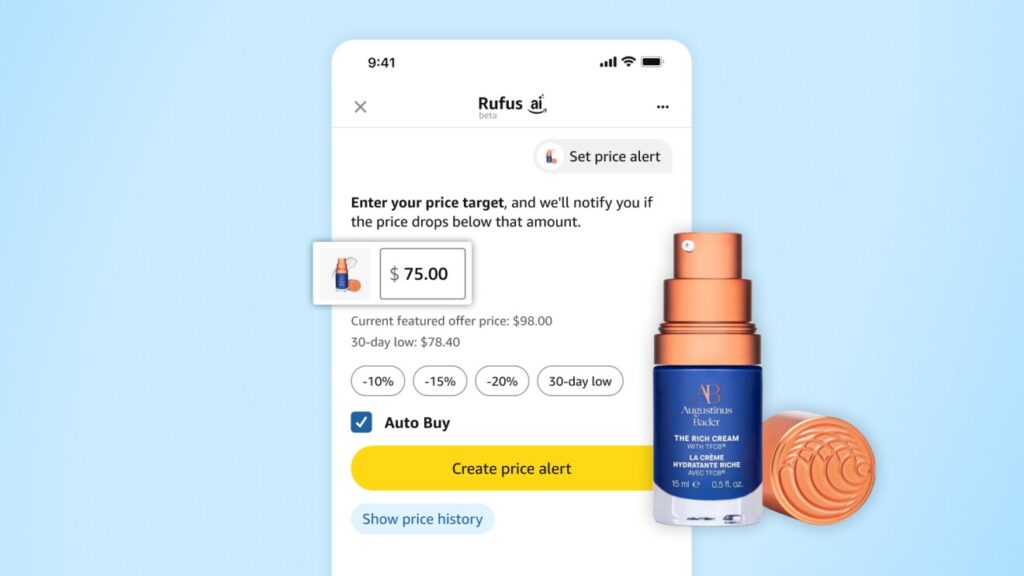

Amazon Gives Rufus New Agentic Features

Amazon has upgraded Rufus for Prime members with an agentic function that will automatically buy products when they go on sale. These auto-buy requests will remain active for six months (or until cancelled by the user), with Rufus checking every 30 minutes and making purchases when the item hits a specified price threshold. (Non-Prime members, meanwhile, can sign up to receive price alerts.) Rufus now also provides 30- and 90-day price histories for products on request.

In the coming months, Rufus will expand its memory beyond an individual account’s shopping activity to include interactions across Amazon devices and services such as Kindle, Prime Video, and Audible. Amazon says this will enable the agent to provide more relevant, personalized answers and product search results while also allowing shoppers to ask for previously browsed or shopped items to be reordered.

Relevance: Amazon indicates that more than 250 million shoppers globally have consulted with Rufus in 2025; monthly users are up 149% year over year, with interactions rising 210%. Shoppers that use Rufus during a purchase journey are 60% more likely to convert, according to Amazon.

Opportunity: Brands should prepare for the potential impact of auto-buy and personalized recommendations on their pricing, promotions, and inventory planning strategies as AI-driven shopping behavior accelerates.

____________

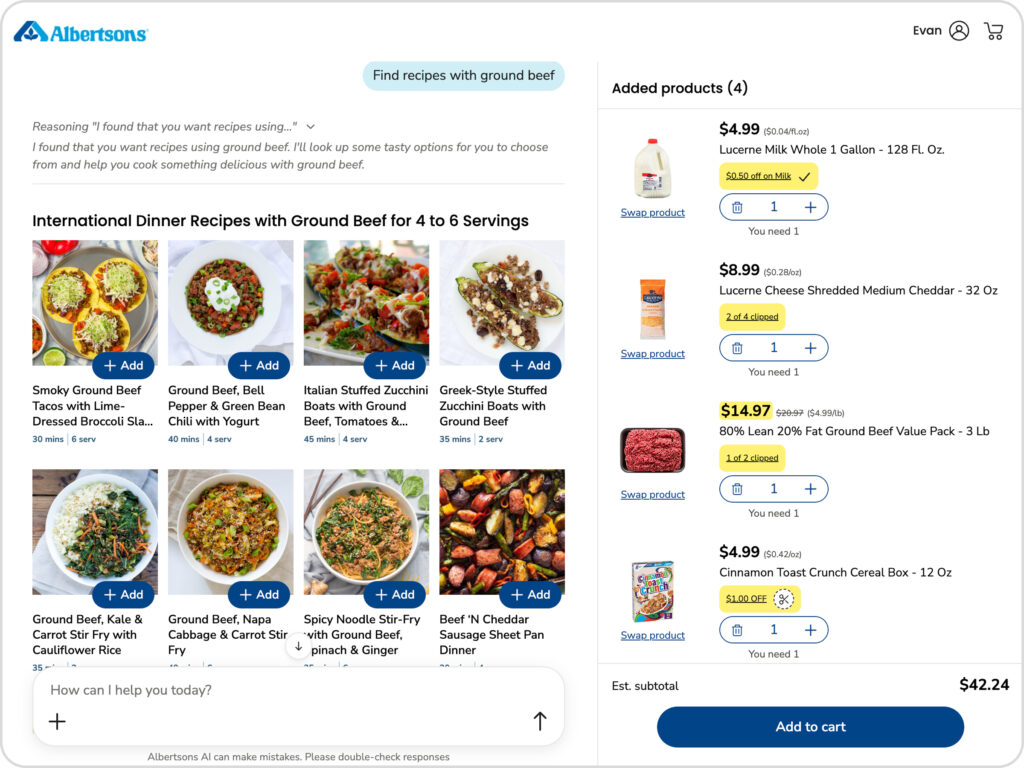

Albertsons Debuts Agentic Shopping Assistant

Albertsons Companies has introduced an AI shopping assistant across all banner websites that can digitize recipes and lists, build smarter baskets, and hold intelligent two-way conversations, the retailer said. Powered by OpenAI models and branded simply as Albertsons AI, the assistant aims to streamline grocery shopping time from an average of 46 minutes to as little as four, according to a release.

Going beyond the Ask AI search solution launched earlier this year, Albertsons AI can reorder frequently purchased items, generate a meal plan and corresponding shopping list, shop handwritten grocery lists, generate recipes based on available ingredients, build carts from an online recipe or image, and curate product ideas (with accompanying deals and coupons) based on a theme or holiday.

The grocer intends to expand the assistant to chain mobile apps in early 2026, adding additional agentic commerce capabilities such as budget optimization, in-store aisle location, and voice integration.

Relevance: Albertsons AI represents one of the grocery channel’s boldest moves toward agentic commerce. Betting on an assistant built on many collaborative agents, the retailer is paving the way for future off-platform integration as it continues its digital transformation.

Opportunity: In addition to priming digital shelf content strategies to improve automated discovery, brands should work with their Albertsons partners to understand what opportunities may emerge for personalized, context-aware engagement within the retailer’s agentic ecosystem and how new shopper behavior insights can help optimize campaigns.

____________

Kroger Leans on Partners for App Upgrades

Kroger has refreshed its mobile shopper app with streamlined navigation, cleaner visuals, and enhanced personalization, Jody Kalmbach, Group VP, Digital Experience and E-Commerce, told Progressive Grocer. Savings tools including coupons, weekly ads, and loyalty points tracking are now consolidated in one section; the overall design update is intended to emphasize food-first storytelling.

The refresh represents “day one of this next level of the simplified experience,” Kalmbach said, noting that the grocer will “continue to optimize” the app “where we know the customer wants us to go, but also based on feedback that we receive.”

Later this year, Kroger plans to integrate Instacart’s new Cart Assistant conversational AI agent into the iOS version of its app. The longtime partners will also widen access to their Kroger-branded 30-minute Express Delivery service through the retailer’s websites and explore integrated marketing capabilities.

Elsewhere, Kroger expects to make the full assortment at most stores available through Uber Eats in 2026. It also will integrate the on-demand delivery provider’s restaurant selection directly into its own website and app, as well as connect membership systems to provide built-in loyalty benefits and delivery tracking — a first among retailers, said Susan Anderson, Uber’s Global Head of Delivery, in a joint release.

Relevance: Major grocers are leaning more heavily on third-party technology platforms to streamline fulfillment and personalize digital experiences without adding internal costs. While Kroger is expanding its relationship with both Uber and DoorDash, the Cart Assistant integration reaffirms Instacart as the retailer’s primary delivery fulfillment partner.

Opportunity: Kroger’s app optimizations have the potential to attract incremental shopping occasions and perhaps even new households while enabling more targeted offers through retail media and in-app promotions. Brands should stay attuned as the retailer and its partners develop new engagement tools that use shopper data to personalize promotions and recommendations.

____________

Grocers Adopt Instacart’s New Agentic AI Solutions

Beating Kroger to the cart (so to speak), Sprouts Farmers Market will be the first retailer to deploy Instacart’s Cart Assistant, integrating the AI agent across its website, mobile apps, and in-store Caper Carts — the smart carts also supplied by the on-demand delivery company. Intended to support personalized meal planning, budgeting, and product recommendations, Cart Assistant is part of a new suite of AI solutions built on Instacart’s existing technology platform.

“We’re excited to leverage AI technology to make it easier than ever for customers — especially our health enthusiasts — to personalize their experience so they can easily shop our curated assortment to find those unique items for their lifestyle and discover exciting, new emerging brands,” said Nick Konat, President and Chief Operating Officer of Sprouts.

Elsewhere, Good Food Holdings, which operates several premium and natural grocery chains on the West Coast, has launched another Instacart tool for retailers: Store View. Also integrated with Caper Carts, Store View provides real-time shelf visibility for continuous inventory tracking and heat mapping. Additional solutions offered by Instacart include Catalog Engine, which enriches product listings with AI-powered nutrition, ingredient, and other data, and Agentic Analytics, which converts retail data into actionable insights.

Relevance: In an era of rapid technology change, AI tools are increasingly making grocery shopping smarter, faster, and more personalized. To avoid the capital expenses required to scale these tools internally, smaller retailers like these should continue to leverage external partners such as Instacart — which, for its part, expects adoption of its offerings to accelerate.

Opportunity: The engagement/insights tools that Instacart is rolling out across the grocery channel not only give brands greater opportunities to work with existing retailer partners but also a chance to reach shoppers at other chains that aren’t typically in the marketing plan. As these grocers continue to embed tools that learn shopper habits, save favorite items, and predict future needs, first-mover advantage is possible for brands aiming to capture a greater share of evolving, AI-driven baskets.

____________

Amazon Augments Whole Foods Selection

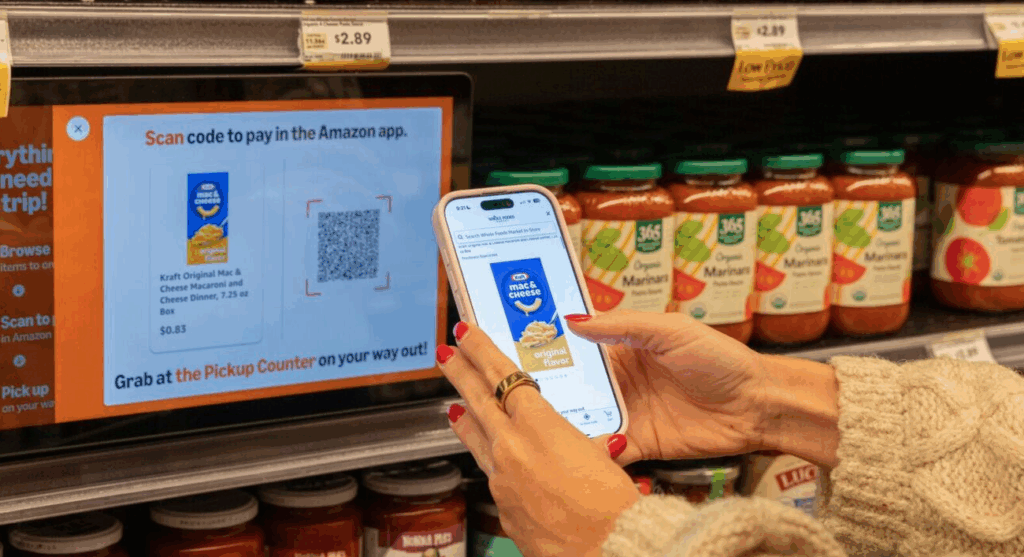

Meanwhile, at one Whole Foods Market near Philadelphia, Amazon is piloting a program that lets shoppers buy thousands of national-brand packaged goods not carried by the natural and organic grocer — including items with artificial sweeteners and color additives. Shoppers scan QR codes on video screens and signage throughout store aisles to access the products in a customized digital storefront.

The expanded assortment (along with Whole Foods’s standard inventory) is housed in an automated, on-site micro-fulfilment center and often available for pickup at the store’s Amazon counter within 10 minutes of being added to a digital shopping cart. Online Whole Foods shoppers have similar access and can choose curbside or in-store pickup.

“This new concept store experience allows customers to get everything on their shopping list in one convenient stop or one online order,” said Jason Buechel, CEO of Whole Foods and Vice President of Amazon Worldwide Grocery Stores, indicating that the goal is to combine “quality with convenience while still delivering the exceptional shopping experience customers expect.”

Relevance: First announced last year, this “store within a store” pilot lets Amazon offer a broader product assortment via Whole Foods without directly diluting the grocer’s strict ingredient standards. It’s the latest step in Amazon’s ongoing efforts to unify the grocery business, which was consolidated into a single entity in 2022. Buechel assumed added responsibilities for leading Amazon’s worldwide grocery stores division earlier in 2025 and has since pulled in additional Whole Foods executives.

Opportunity: The unique hybrid shopping environment unifies physical and digital shopping across Whole Foods and Amazon. As Amazon refines and scales the model, the combined grocery ecosystem will expand access to the specialty grocer’s previously inaccessible customer base and potentially create new cross-selling opportunities for brands.

____________

Sam’s Club Launches Creator Program

Sam’s Club has introduced Sam’s Club Creator, an influencer program inviting creators of all niches and audience sizes to partner with the retailer. Participants apply online, build a personalized storefront of favorite finds from Sam’s Club’s inventory, generate affiliate links when shopping on SamsClub.com, then track their performance and commission-based earnings.

Relevance: This program provides a new amplification channel, giving products at Sam’s Club added exposure via creator content — recommendations, storefront features, and affiliate links — that can drive traffic and conversion. For new, seasonal, or simply growth-focused items, the program offers a new lever to build awareness and consideration among members beyond media advertising alone.

Opportunity: While there’s currently no direct way for brands to partner with creators through Sam’s Club, they can collaborate independently, especially with influencers who have strong storytelling potential (unique features, lifestyle tie-ins, and visually engaging content). When issuing RFPs (requests for proposal) for campaigns tied to Sam’s Club programs, brands can ask for Creator Program-approved influencers to ensure alignment and enable the greater exposure.

____________

7-Eleven Unlocks Alcohol Rebates

7-Eleven is rolling out digital alcohol rebates at some 10,500 participating flagship and Speedway convenience stores using the platform of technology provider Swiftly. The program delivers state-specific, real-time offers on beer, wine, and spirits through the retailer’s apps, with near-instant cashback payouts via PayPal, Venmo, or digital prepaid Visa — bypassing the slow, manual process of traditional mail-in rebates.

At launch, offers will be supported by coordinated in-store signage and product displays to drive awareness and redemption. The Swiftly platform integrates directly with retailer apps, offering “a proven solution that drives loyalty, boosts sales, and delivers unmatched value for shoppers and brand partners alike,” according to CEO Henry Kim.

Other convenience retailers that have recently implemented Swiftly’s alc-bev program include EG America, Circle K, ExtraMile, Sheetz, and MAPCO.

Relevance: Traditional mail-in alcohol rebates have had low redemption rates. This digital program aims to fix that by helping brands reach shoppers at the point of purchase with a faster, simpler redemption process. For retailers, it can strengthen loyalty and drive incremental sales. Swiftly positions the program as a measurable, compliant way for brands to engage consumers.

Opportunity: C-stores are a critical channel for alcohol brands, particularly beer. Brands working with 7-Eleven can use this opportunity to gain real-time campaign performance insights, including redemption rates and regional product performance, to inform future collaborative promotions. They also can benefit from a scalable, transparent opportunity designed to activate shoppers in a highly regulated category.

____________

Sheetz Levels Up Loyalty

Elsewhere in the c-store channel, Sheetz is modernizing the Sheetz Rewards loyalty program with the intention of executing faster, delivering more relevant offers, and strengthening engagement across its shopper base.

Supporting the retailer’s commitment to digital innovation and personal customer engagement, the third-party platform of Ignite Retail Technology will give Sheetz a unified loyalty engine, advanced data insights, and seamless integration across in-store, mobile, and digital channels, according to a press release from the solution provider.

Relevance: Loyalty programs are evolving to meet consumer expectations for personalization and convenience. By upgrading its technology, Sheetz aims to strengthen shopper relationships and drive incremental visits and sales.

Opportunity: The new platform theoretically gives Sheetz more robust data and integration capabilities across all digital touchpoints, enabling brands to align promotions with shopper behavior. This creates opportunities for targeted offers and improved campaign performance. Sheetz operates some 800 stores across Pennsylvania, Maryland, West Virginia, Virginia, Ohio, North Carolina, and Michigan.

____________

Publicis Commerce’s Retail Consultancy is an unrivaled team of in-market commerce experts who simplify the complexity of retail for our clients. Located in Bentonville, Minneapolis, Cincinnati, Chicago, Seattle, and the “backyards” of other key retailers, they provide deep knowledge of the retailer, expertise in key business areas (like strategy, media and creative), and door-opening personal relationships with key executives to deliver an unmatched level of business success for clients across accounts, channels, and shopper engagement platforms. For more information, contact EVP-Retail Consultancy Kandi Arrington at [email protected].