As part of their ongoing mission to help clients stay ahead of the competition in a fast-paced, constantly evolving marketplace, the field teams in Publicis Commerce’s Retail Consultancy closely monitor the strategic activity taking place across all key retailers and channels.

Each month, the teams compile Marketplace Assessment reports on the retailers (including Walmart, Target, Amazon, and Kroger) and channels (such as Regional Grocery, C-Store, Club, Pet, Beauty, and On-Demand Delivery) that are most important to the business success of our clients. The following report outlines noteworthy events across 10 key retailers from the team’s most recent round of assessments. (To receive copies of the full reports, contact EVP-Retail Consultancy Kandi Arrington at [email protected].)

____________

Walmart Expands AI Commerce Push with Gemini

Walmart announced a landmark shopping integration with Google’s Gemini AI agent at the NRF ‘26 event in New York this month.

Through the integration, which was built by Walmart using Google’s concurrently launched open-standard Universal Commerce Protocol, Gemini will automatically include products from Walmart and Sam’s Club in responses to relevant queries from users, who will then be able to make purchases directly from the retailers without leaving the platform. While a timeline has not been revealed, the partners said the experience will launch first in the U.S. before expanding internationally.

In addition, Gemini users who link their Walmart or Sam’s Club accounts will receive recommendations for complementary products based on their purchase history and be able to have their Gemini purchases fulfilled along with items from their Walmart/Sam’s Club carts, among other benefits.

“The transition from traditional web or app search to agent-led commerce represents the next great evolution in retail. We aren’t just watching the shift, we are driving it,” said Walmart U.S. CEO John Furner, who next month will succeed Doug McMillon as CEO of Walmart Inc.

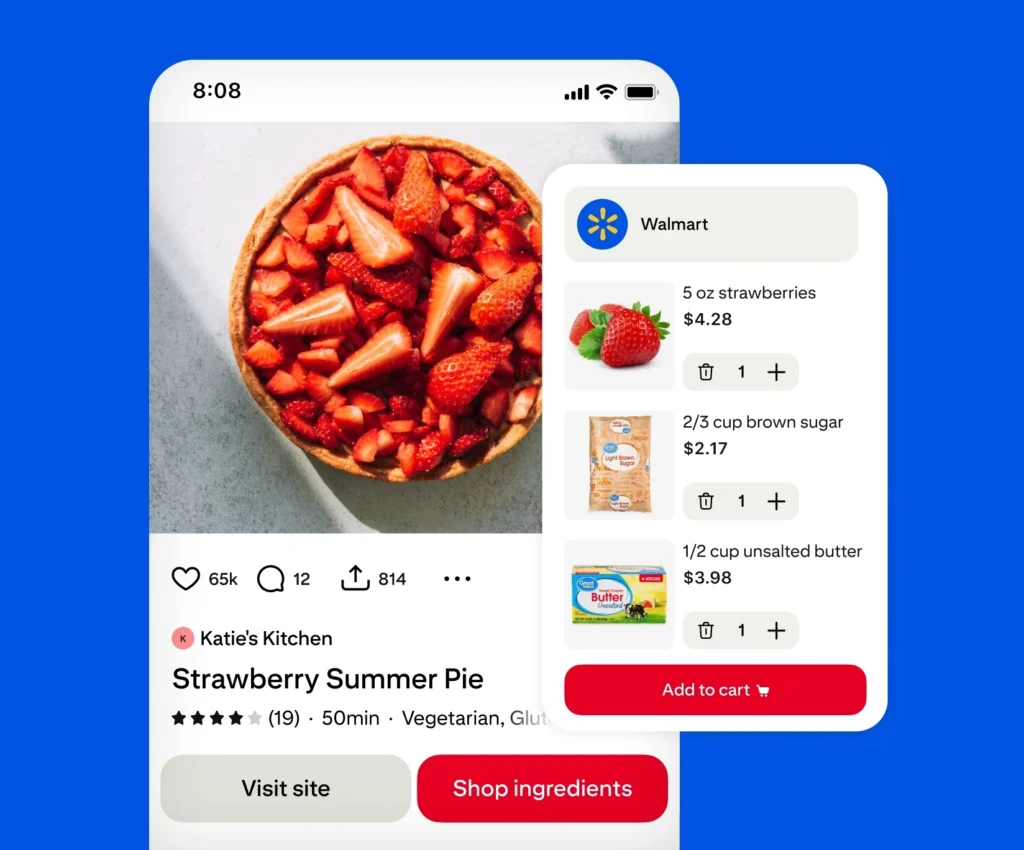

In other recent initiatives, an AI-powered pilot integration with Pinterest is bringing Walmart’s real-time pricing, product substitutions, and store-level fulfillment options into the social media platform’s content experience under a “Shop Ingredients” button that will be visible on select recipe Pins (visual bookmarks that save content to Pinterest boards). Rather than a brand program, Pinterest is positioning the integration as a step toward “bringing our vision to make every Pin shoppable closer to reality” as it pursues partnerships with additional retailers.

Relevance: Combined with a variety of internal initiatives and the ChatGPT integration launched last November, this new alliance with Google represents another way that agentic AI is reshaping Walmart’s go-to-market strategy — and where Walmart goes, the commerce marketplace usually follows.

The Walmart/Pinterest pilot, meanwhile, places the retailer’s grocery ecosystem inside one of the largest platforms for food inspiration: transforming passive product discovery into active commerce, seamlessly integrating functionality where intent is already high, and continuing to reduce friction between discovery and purchase. Both moves align with Walmart’s broader strategy of establishing a presence on as many shopper channels as possible.

Opportunity: As consumers increasingly adopt agentic search and social platforms that unite product discovery with purchase, it’s critical for brands to keep pace, tapping into new shopper insights and leveraging emerging engagement and conversion levers as they become available.Brands should embed themselves in these inspiration-to-action paths to expand reach beyond traditional shopper touchpoints and tap into high-intent behaviors (like recipe planning) to drive conversion. Optimized product content and reliable availability will make it easier for AI agents and commerce platforms to understand, recommend, and match items to shopper missions across the expanding digital shelf.

____________

Kroger Advances Its AI Shopping Assistant

Also at NRF ‘26, Kroger unveiled plans to roll out a personal shopping “companion” built on Google Cloud’s new agentic platform, Gemini Enterprise for Customer Experience. This meal/shopping assistant will help users by converting meal requests into recipes paired with shoppable ingredient lists, comparing product details, reordering past purchases, and building complex shopping carts for major lifestyle occasions — making purchase recommendations informed by real-time assortment, pricing, and availability, according to a release. The technology is intended to be a “comprehensive digital concierge across every customer touchpoint,” with reports indicating it will be accessible across Kroger stores and digital platforms.

“A customer planning a week of dinners, seeking recipe inspiration, or jumping into a new food regimen will be able to ask our integrated assistant to create a shopping list based on their immediate needs, their budget, and [their] family’s unique preferences,” explained Yael Cosset, Kroger’s Chief Digital Officer. “We are streamlining every aspect of the shopping experience, from building a basket and getting relevant offers and savings to scheduling a delivery faster than ever before.”

The retailer will also tap into Google Cloud’s Customer Experience Agent Studio to analyze interactions and intent on calls made by shoppers to stores to proactively identify and resolve customer-service issues, the company said.

Relevance: As AI agents proliferate, Kroger is offering its shoppers a unique option within its own environment, retaining control over how — and what — products will be showcased and sold. Kroger is also working with Instacart, integrating the on-demand delivery partner’s new Cart Assistant conversational AI agent into its iOS mobile app.

Opportunity: Brands should open dialogs with Kroger to understand the options available through these new shopper-facing platforms while helping the retailer drive loyalty and build baskets.

____________

The Home Depot Adds New Tricks to Magic Apron

In yet another Gemini integration announced at NRF, The Home Depot is upgrading its Magic Apron customer assistant to create an “AI-first” native experience that the retailer says is personalized and contextual. Accessible via the retailer’s desktop website and mobile app, Magic Apron’s expanded suite of AI tools will let shoppers describe their projects in plain language to receive conversational advice and personalized recommendations. The tool will also soon gain advanced multi-modal capabilities including image upload and visualization, according to a release. And a forthcoming store experience will integrate real-time inventory with aisle-level product locations.

In the coming months, the capabilities will expand beyond the retailer’s owned platforms across AI Mode in Google Search and the Gemini app.

Relevance: As retailers extend agentic AI beyond search into high-consideration, mission-based shopping journeys, The Home Depot is reinforcing its assistant with a decision-making layer, shaping not just product discovery but also how intent is interpreted, guided, and converted. Reducing project friction could also contribute to shopper satisfaction and long-term loyalty in addition to increased conversion.

Opportunity: The updates underscore the growing importance of understanding how products are positioned within AI-guided project planning. Brands that invest in rich product data, clear use-case positioning, and substitution readiness (signals indicating equivalent or compatible alternatives when the assistant needs to suggest replacements) will be better positioned to remain visible and influence outcomes at moments when shoppers are seeking advice — and assembling baskets with intent to purchase.

____________

Lowe’s Enhances Mylow Advisor

Yet more from NRF: Lowe’s, too, is among the retailers leveraging Google’s agentic capabilities to deliver personalized experiences across the path to purchase for shoppers.

Using Gemini Enterprise for Customer Experience, the retailer is enhancing Mylow, its AI-enabled home improvement advisor, “to provide guidance personalized to a customer’s home, their project, and where they live, bringing new levels of confidence to every decision,” said Seemantini Godbole, Lowe’s Chief Digital and Information Officer, in a release issued by Google.

Lowe’s launched Mylow in early 2025 for members of the MyLowe’s Rewards loyalty program through a partnership with ChatGPT parent OpenAI.

Relevance: Lowe’s was an early partner of OpenAI and continues to work with several vendors to power Mylow. When shoppers use Mylow online, the retailer says conversion rates more than double.

Opportunity: Brands working with Lowe’s may have a new frontier to win through hyper-local relevance and should seek ways to dynamically adapt assortment, regional availability, and installation or usage guidance to engage shoppers in specific markets.

____________

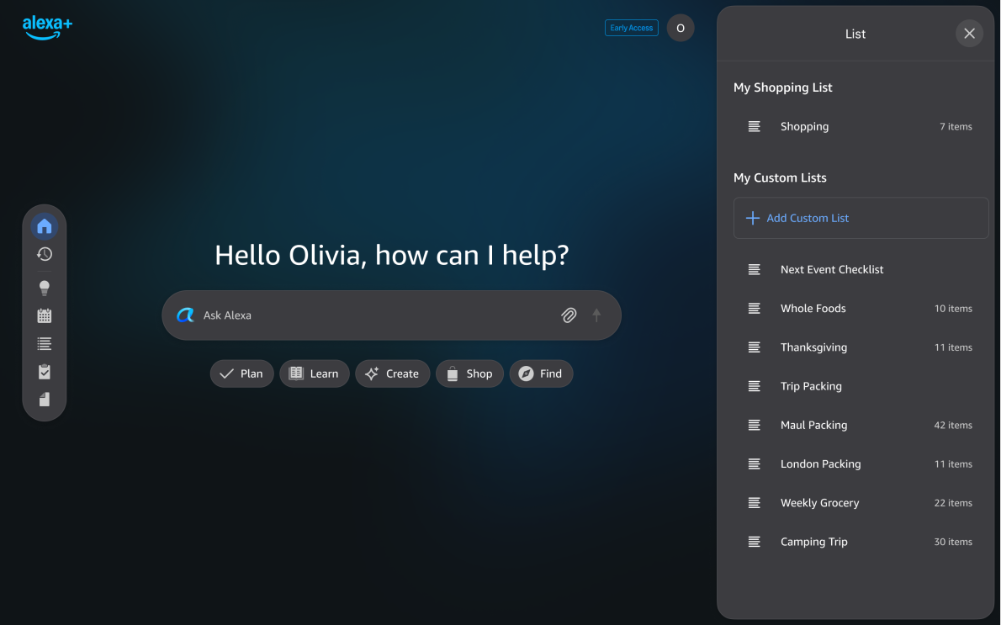

Amazon Brings Alexa+ to Desktop Browsers

Amazon launched a web-based version of Alexa+ at this month’s CES technology show in Las Vegas, expanding the AI-enabled personal assistant beyond voice and mobile platforms to desktop browsers. The Alexa+ website features a navigation sidebar that provides quicker access to the tool’s most-used features, which include smart home controls and shopping lists.

Additionally, the retailer is redesigning the Alexa mobile app to be more “agent-forward,” promising consistent context across devices and interfaces.

Relevance: Since unveiling Alexa+ in 2025 with a new capability to remember all previous chats and personal preferences, conversations have doubled, purchases have tripled, and recipe requests have quintupled, according to Amazon.

Opportunity: While the Alexa.com rollout is currently limited to consumers with a compatible Amazon smart home device, it paves the way for more users to access the AI assistant down the line — and for brands to engage them beyond mobile and smart devices.

____________

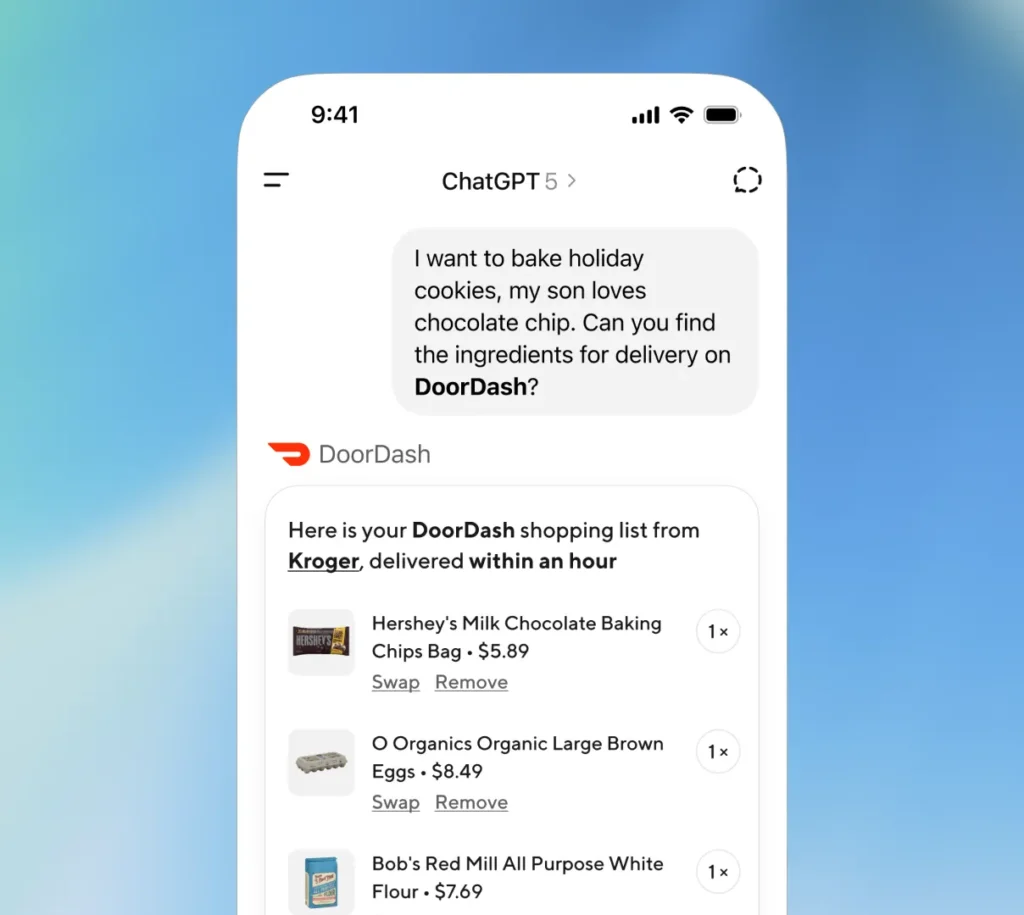

DoorDash Launches ChatGPT Grocery Shopping App

DoorDash has introduced its previously announced ChatGPT app, promising to turn recipes into shoppable grocery lists containing all required ingredients and enabling easy checkout in minutes — all within the third-party search agent’s native environment. The app was only available to select users at launch but is expected to reach all shoppers in the coming weeks. DoorDash also plans to expand the integration beyond groceries to additional product categories.

“AI is unlocking an entirely new search and discovery experience for consumers that’s dynamic and personalized,” said DoorDash co-founder Andy Fang. “As we expand this experience to more shopping categories, our focus is on building AI tools that give people time back and make local shopping easier.”

Relevance: The rollout builds on the delivery platform’s wider investment in AI-powered shopping solutions, which include personalized recommendations and search tools.The announcement came just days after a similar release by on-demand delivery rival Instacart; both apps let shoppers order multiple items at once, functionality that GPT’s own Instant Checkout app can’t yet do.

Opportunity: Brands should continue to diligently keep their product content updated to make sure items are discoverable and relevant to recipes on DoorDash’s platforms (and everywhere else).

____________

Instacart Debuts Data Hub Clean Room

Instacart also used the CES forum to unveil a “Data Hub” clean room solution that will let brands securely combine their own customer data with the on-demand delivery leader’s first-party purchase behavior data. Through Data Hub, the company is promising deeper visibility into key shopper behavior — including lifetime value, new-to-brand buyers, and repurchase frequency — that can be used to create more impactful media strategies, plan off-platform audiences, and measure omnichannel performance with flexible attribution approaches.

The tool has been piloted successfully with a select group of CPG partners and will expand to additional advertisers throughout 2026, according to a release. “Brands and agencies are eager for easier access to trusted, scaled sources of purchase data,” said Ali Miller, GM of Advertising at Instacart.

Relevance: Instacart continues to make strides in establishing itself as an essential retail media partner. Data Hub builds on last summer’s launch of a self-service consumer insights portal providing a view of consumer behavior and SKU-level performance. Other recent updates have included data integrations with TikTok’s Ads Manager platform plus Google search and video via YouTube, which also enables direct ordering on Instacart’s marketplace.

Opportunity: Brands can increasingly leverage Instacart’s SKU- and shopper-level insights to optimize activations and test creative strategies and cross-platform campaigns through its retail media network.

____________

Target Opens Experiential Store

Target this month completed the first phase of updates to its store in New York City’s SoHo district, which employs a design-forward, shoppable approach that shifts the retailer’s typical assortment focus from product essentials to curated apparel, beauty, home, and lifestyle merchandise. The space boasts a layout redesigned to encourage discovery through a rotating showcase of seasonal styles, influencer-driven curated trend collections, and interactive elements — like a “Selfie Checkout” spot — that go beyond Target’s traditional store format.

The retailer also is testing new fulfillment models for overnight delivery — including shifting order fulfillment to underutilized stores and piloting specialized delivery hubs — as part of a planned $5 billion in total capital expenditures slated for 2026.

Relevance: Among the core transformational priorities already cited by incoming CEO (and current COO) Michael Fiddelke are reinforcement of Target’s differentiated in-store experience and merchandising authority through new store concepts and assortments — as well as becoming more competitive through flexible fulfillment. Plans for the continued evolution of the SoHo store include experiential areas, a cafe, and programmed events.

Opportunity: As Target seeks to redefine how physical retail can build brand relevance and emotional connection with shoppers, partners may have a greater opportunity to differentiate with in-store elements that help the retailer drive traffic and engagement. Brands also need to make sure their product is available to accommodate expedited delivery options, and test paid search and onsite display ads focused on overnight delivery.

____________

Dollar General Charts Another Year of Growth

Dollar General plans to open 450 additional U.S. stores this year while remodeling or renovating 4,250 sites and relocating 20 others. The initiative will focus on rural markets and 8,500-square-foot stores — larger formats that accommodate expanded offerings in health & beauty and fresh produce.

“We are uniquely positioned to serve an underserved customer in rural America, where approximately 80% of our current store base serves towns of 20,000 or fewer people,” said CEO Todd Vasos.

Relevance: The retailer operated 20,594 total stores under the flagship DG Market, DGX, and pOpshelf banners at the end of fiscal 2024 (ended Jan. 31, 2025) and had planned to open 575 locations in 2025. Vasos recently stated that the retailer has identified some 11,000 potential locations.

Opportunity: As other retailers reduce store count (or close entirely), Dollar General continues to expand aggressively, remaining confident in its mission to support lower-income rural consumers who seek value on everyday items like food and household supplies and often have limited retail options. As shoppers pivot based on price and larger-format stores offer expanded assortments, brands should prioritize this still-growing channel.

____________

Aldi Plans Bold U.S. Expansion

Speaking of growth-mode value chains, Aldi will open approximately 180 stores in 31 states in 2026, which would increase total store count to nearly 2,800 by yearend. The discount grocer will enter Maine for the first time — its 40th state — while continuing expansion in the Southeast and West, including 10 new locations in Phoenix, AZ. Plans also include converting some 80 of the roughly 400 Winn-Dixie and Harveys Supermarket stores acquired from Southeastern Grocers to the Aldi format.

Relevance: Since acquiring Southeastern Grocers in 2024, Aldi has converted nearly 90 stores to its own banner and expects to rebrand more than 200 in total by the end of 2027. The changes are part of a five-year, $9 billion plan for store expansions, supply chain improvements, and digital upgrades, which is expected to bring the total store count — including new openings and conversions — to 3,200 by the end of 2028.

Opportunity: About 17 million new shoppers visited Aldi stores in 2025, the company said. Although Aldi places a heavy emphasis on private label, the retailer’s rapid expansion and growing shopper base could provide a lucrative opportunity for the national brands that do secure shelf space.

____________

Publicis Commerce’s Retail Consultancy is an unrivaled team of in-market commerce experts who simplify the complexity of retail for our clients. Located in Bentonville, Minneapolis, Cincinnati, Chicago, Seattle, and the “backyards” of other key retailers, they provide deep knowledge of the retailer, expertise in key business areas (like strategy, media and creative), and door-opening personal relationships with key executives to deliver an unmatched level of business success for clients across accounts, channels, and shopper engagement platforms. For more information, contact EVP-Retail Consultancy Kandi Arrington at [email protected].