As part of their ongoing mission to help clients stay ahead of the competition in a fast-paced, constantly evolving marketplace, the field teams in Publicis Commerce’s Retail Consultancy closely monitor the strategic activity taking place across all key retailers and channels.

Each month, the teams compile Marketplace Assessment reports on the retailers (including Walmart, Target, Amazon, and Kroger) and channels (such as Regional Grocery, C-Store, Club, Pet, Beauty, and On-Demand Delivery) that are most important to the business success of our clients. The following report outlines noteworthy events across 10 key retailers from the team’s most recent round of assessments. (To receive copies of the full reports, contact EVP-Retail Consultancy Kandi Arrington at [email protected].)

____________

Albertsons Upgrades Apps with Conversational Search

Albertsons Companies has deployed Google Cloud’s Conversational Commerce agent to enhance the Ask AI tool the retailer launched this summer. Accessible via the search bar across all of the retailer’s banner apps, the agent determines shopper intent and preferences to engage in real-time conversations and deliver relevant results and recommendations.

“We are providing our customers [with] a solution that moves beyond traditional search to help them digitally shop across aisles, plan quick meal ideas, discover new products, and even recommend unexpected items that pair well together,” said Jill Pavlovich, Albertsons’ SVP, Digital Customer Experience.

In other activity, the grocer is testing electronic shelf labels (ESLs) in a 40-store pilot and has restructured its merchandising operations to create what it calls a “unified, agile, and customer-centric approach that brings our national and division merchandising teams closer together.”

Relevance: Building on its long-standing relationship with Google Cloud, Albertsons is the first retailer to bring the Conversational Commerce solution to market. ESLs, meanwhile, have been gaining wider adoption across the industry, transforming the shelf edge from a static (and labor-intensive) print zone into a dynamic, data-driven marketing channel.

Opportunity: Brands and retailers need to adjust their content and media strategies to address agentic AI-driven search, which is poised to reshape ecommerce. (This whitepaper from Publicis Groupe’s Jason Goldberg examines a few ways they can do so.) Brands also should begin to explore ways of syncing their retailer-specific or even national marketing campaigns with in-store ESLs, or to initiate real-time promotions and shorter, more targeted activations — capitalizing on the ESL’s ability to track sales impact.

____________

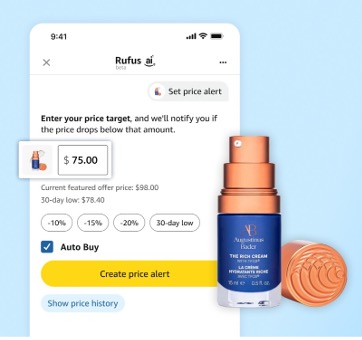

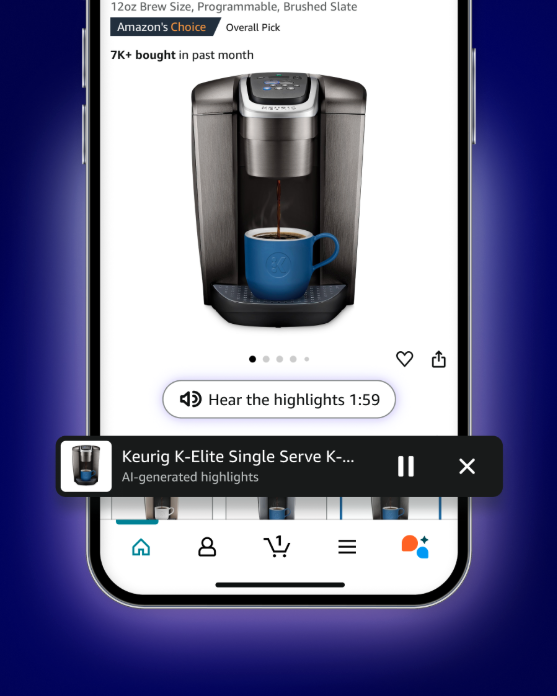

Amazon’s New AI Features Include Audio Summaries

Expanding its array of consumer-facing AI tools, Amazon recently began introducing a “Hear the Highlights” product summarizer. The new feature aggregates information from Amazon’s product catalog, customer reviews, and information from across the internet to generate a short-form audio summary. The functionality has already scaled to cover some one million products and is available to all U.S. consumers as a button in Amazon’s mobile shopping app.

Among additional AI-powered product search and discovery innovations, Amazon is currently updating the Amazon Lens visual search tool with a “Lens Live” overlay that:

- lets shoppers easily focus on a specific product within camera view.

- presents real-time product matches in a swipe-able carousel.

- allows shoppers to directly add items to their shopping cart or wish list.

- integrates agentic AI chatbot Rufus, infusing the experience with suggested questions and quick summaries of what makes a product unique.

Relevance: AI-enabled audio product descriptions may ultimately replace the cumbersome act of scrolling through unwieldy lists of customer reviews to inform shopper decision making. In the meantime, they’re immediately beneficial in improving accessibility for visually impaired shoppers.

Opportunity: Brands need to remain AI “compliant” with a well-maintained strategy for digital shelf content as Amazon continues to modify search and discovery with new capabilities like these. (Mars United’s latest Digital Shelf Report outlines content and sales enablement options for brands at Amazon and other leading ecommerce players.)

____________

Gopuff Debuts Redesigned Website

Gopuff is touting its updated website as “redefining the future of shopping” through a personalized experience adapted to each customer’s unique lifestyle, location, and shopping habits. Alongside a redesigned layout, revamped navigation menu, and fresh visuals, the site’s new capabilities include:

- personalized recommendations based on purchase history, and customized birthday offers.

- hyper-local insights on best-selling items, as well as a live heatmap that shows other local shoppers who are placing orders.

- real-time local inventory and order tracking, with item-by-item packing updates.

- a “Nutrition” tab that displays an item’s calories, fat, sodium, carbohydrate, and protein content, along with dietary attributes such as “vegan” or “gluten free.”

- multilingual search options.

While the updates are intended primarily for the website shopping experience, Gopuff plans to integrate some of the new features into its mobile app in the coming months.

Relevance: With its vertically integrated business model, Gopuff owns all product inventory and operates its own micro-fulfillment centers, giving it a leg up on other on-demand delivery platforms in terms of transparency and helping it stand out and build trust among shoppers.

Opportunity: Brands should work with their Gopuff partners to understand how the new website can best be utilized to enhance product discovery, consideration, and purchase.

____________

Chewy Launches Fresh Dog Food Service

Pet channel ecommerce leader Chewy is leaning into the broad trend toward pet humanization with a new food-delivery subscription service providing freshly prepared, minimally processed, and personalized meals tailored to the nutritional needs of dogs. Called “Get Real,” the service spans three exclusive human-grade recipes (available as both full meals and meal toppers) made with 10 or fewer ingredients plus vitamins and minerals.

Chewy is offering customizable subscription plans that let shoppers adjust delivery frequency for the ready-to-serve meals, which are pre-portioned to provide the recommended ideal serving for each dog based on weight, breed, age, and activity level. A 50% discount on first orders entices trial.

Relevance: The service offers quality and convenience for dog owners who are increasingly seeking premium food options for their pets. For Chewy, entering the fresh food market provides a unique value proposition that differentiates it from ecommerce competitors. And the convenience-first subscription service delivers consistent revenue and stronger customer retention.

Opportunity: With both Chewy and pet owners expanding their purviews toward fresh and specialized food options, brands should consider diversifying their own messaging and offerings to appeal to health-conscious shoppers by emphasizing the quality of ingredients and providing sourcing transparency. For more recommendations on winning with this critical retailer, check out this recent report from Mars United’s Chewy team.

____________

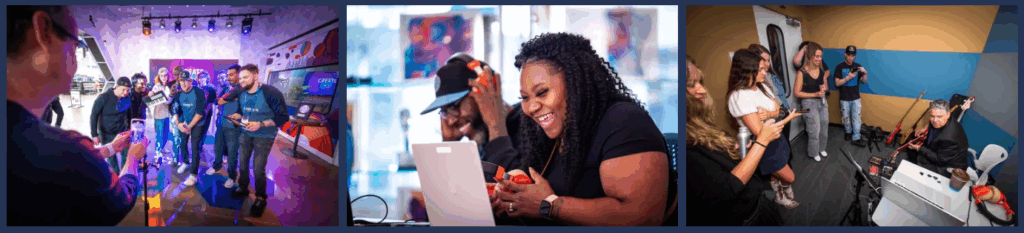

Walmart Opens a Content Studio

A Walmart Supercenter in Franklin, TN, has become host to a first-of-its-kind “Create-It Studios” space serving as both a full-scale production facility and an event venue. The pilot is a partnership between the retailer and Full Sail University, a private school specializing in entertainment media and emerging technology.

Billed as “the ultimate place for creators,” the 2,200-square-foot layout encompasses six professional studios fully equipped to record podcasts, produce music, shoot video, create digital art, and mix sound. Access to the tools is available by the hour or day. The space is also hosting expert-led workshops, live performances, and other community events.

Relevance: With retailers testing various ways to connect with cultural trends like content creation, the move positions Walmart as an innovator by transforming this supercenter from a simple shopping destination into a community hub for creativity, skill-building, and entertainment.

Opportunity: The space creates a venue for brands to partner on experiences that go beyond the shelf — including Walmart Live events, sponsorships, or content collaborations — while also potentially serving as a test-and-learn center for future experiential activations.

____________

Ulta Rethinks the Store Experience

Ulta Beauty is doubling down on stores as experience hubs and wellness as a long-term growth driver as its “Beauty Unleashed” strategy gains traction. The specialty retailer has introduced expanded wellness sections with elevated fixtures across some 370 stores, with another 50 locations on deck. It also expanded its beauty and wellness assortment with 8 new Korean inspired brands that hit shelves late summer, and will further grow its offering through the impending debut of a curated, invitation-only online marketplace.

Meanwhile, even as it pushes forward with international expansion plans in Mexico and the Middle East, Ulta is scaling back overall growth plans from its earlier target of 200 to about 150 locations over the next two to three years.

Relevance: The retailer is trimming some of the fat from its ambitious plans as it moves from a phase of heavy investment toward more scalable growth and refocuses on its own stores while pulling back from its store-within-a-store relationship with Target.

Opportunity: As Ulta goes back to the basics with a strategy centered on physical stores, there is a corresponding need for brands to position the brick-and-mortar experience as a key part of their omnichannel plans.

____________

Wakefern Expands via Acquisition

Wakefern Food Corp. has expanded both its store base and marketplace positioning by acquiring 16-store premium grocery chain Morton Williams in a deal that will close later this year. The New York City-based chain will continue operating under the Morton Williams name and remain independently owned and operated — aligning with Wakefern’s co-op model.

The strategic move expands Wakefern’s reach into New York City, a dense and competitive urban market that has always had high barriers to entry. It also adds a premium banner to the fold as Wakefern seeks to diversify what primarily is a value-driven portfolio. The co-op comprises 45 member companies operating 365 retail supermarkets under the ShopRite, Price Rite Marketplace, The Fresh Grocer, Dearborn Market, Gourmet Garage, and Fairway Market banners.

Relevance: The Morton Williams acquisition is part of Wakefern’s transformative plan to drive long-term growth, expand market share, and increase its wholesale distribution reach. Last fall, the retailer co-op purchased the specialty food brand portfolio of Di Bruno Bros.

Opportunity: Local expertise fuels local success. Established players come with built-in shopper trust and market knowledge, while co-op models offer strategic flexibility, balancing scale and shared resources with local brand equity. Brands have an opportunity here to emphasize premium and specialty offerings that align with Morton Williams’ upscale inventory.

____________

Publix Reinvests in Stores

As it continues posting favorable sales results, independent grocer Publix is reinvesting profits back into stores. During the first half of 2025, the retailer opened 25 supermarkets and remodeled 47 existing locations as part of $1 billion in capital expenditures, according to a regulatory filing.

Through the rest of 2025, Publix expects to spend another $1.5 billion on new stores, remodels, construction or expansion of warehouses, new or enhanced information technology, and the acquisition or development of shopping centers in which the company operates, according to reports.

Relevance: Now operating roughly 1,400 stores across eight Southeastern states, Publix has generally increased its capital expenditures over the last few years. While this year’s projected total amounts to a slight decrease, the grocer continues to expand operations in the Southeast and grow along the East Coast. It also is doling out some $50 million to developing a technology hub in Lakeland, FL, to support growing omnichannel capabilities

Opportunity: Reinvesting at these levels makes it clear Publix is ensuring its infrastructure is set up for long-term success, giving brands a significant opportunity to grow their business through strategic partnerships that expand along with the store base.

____________

Ace Elevates Its Remodeling Initiative

One year after unveiling its “Elevate3” experiential format, Ace Hardware has completed some 130 remodels and plans to continue the rollout to new and existing stores over the next several years. The cooperative also is on pace to add some 175 locations by the end of 2025, though the format is not a blanked requirement for every new opening. The Ace footprint now encompasses roughly 5,100 locally owned stores across all 50 U.S. states.

By carving out distinct spaces that spotlight national partners, the Elevate3 design emphasizes branded experiences and category storytelling in key areas such as paint, power, home maintenance, and backyard/barbeque. The format’s latest enhancements include a pilot “Sun & Shade” department stocking premium sunglasses, lifestyle apparel, hydration products, and outdoor audio equipment, as well as a refreshed lighting aisle.

Relevance: The Elevate3 concept has moved beyond pilot to full rollout. The retailer is reporting 12% sales growth and 10% gross profit gains at Elevate3 stores compared to non-remodeled locations.

Opportunity: Brands should consider collaborative ideas for developing curated environments that will help Ace position itself as a unique destination in the home improvement landscape.

____________

7-Eleven Gets Hungry for Expansion

7-Eleven has unveiled plans to open 1,100 “restaurants” in North American stores by 2030 as it continues emphasizing foodservice as a key part of its transformation roadmap. The convenience-store chain currently operates what it considers restaurant spaces in some 1,080 of its approximately 13,000 North American locations.

7-Eleven previously announced plans to open 1,300 new stores in North America during the same timeframe. Investments include equipment for distinctive food offerings that are intended to attract more shoppers through an upgraded “fresh” food menu that can compete with the popular on-the-go offerings of channel competitors such as Wawa. The retailer also is updating and improving its 7Now delivery service, which is expected to add 200 more stores annually through 2030.

Relevance: After fending off a recent acquisition attempt, 7-Eleven is expanding and transforming at all levels of the organization to address shifts in consumer spending and franchisee profitability. Japan-based parent company Seven & i Holdings plans to spin off the North American operations into a separate public entity in late 2026.

Opportunity: Brands should consider working with 7-Eleven to develop promotions and product bundles that help support the retailer’s foodservice initiative while earning a greater presence in stores.

____________

Publicis Commerce’s Retail Consultancy is an unrivaled team of in-market commerce experts who simplify the complexity of retail for our clients. Located in Bentonville, Minneapolis, Cincinnati, Chicago, Seattle and the “backyards” of other key retailers, they provide deep knowledge of the retailer, expertise in key business areas (like strategy, media and creative), and door-opening personal relationships with key executives to deliver an unmatched level of business success for clients across accounts, channels, and shopper engagement platforms. For more information, contact EVP-Retail Consultancy Kandi Arrington at [email protected].