As part of their ongoing mission to help clients stay ahead of the competition in a fast-paced, constantly evolving marketplace, the field teams in Publicis Commerce’s Retail Consultancy closely monitor the strategic activity taking place across all key retailers and channels.

Each month, the teams compile Marketplace Assessment reports on the retailers (including Walmart, Target, Amazon, and Kroger) and channels (such as Regional Grocery, C-Store, Club, Pet, Beauty, and On-Demand Delivery) that are most important to the business success of our clients. The following report outlines noteworthy events across eight key retailers from the team’s most recent round of assessments. (To receive copies of the full reports, contact EVP-Retail Consultancy Kandi Arrington at [email protected].)

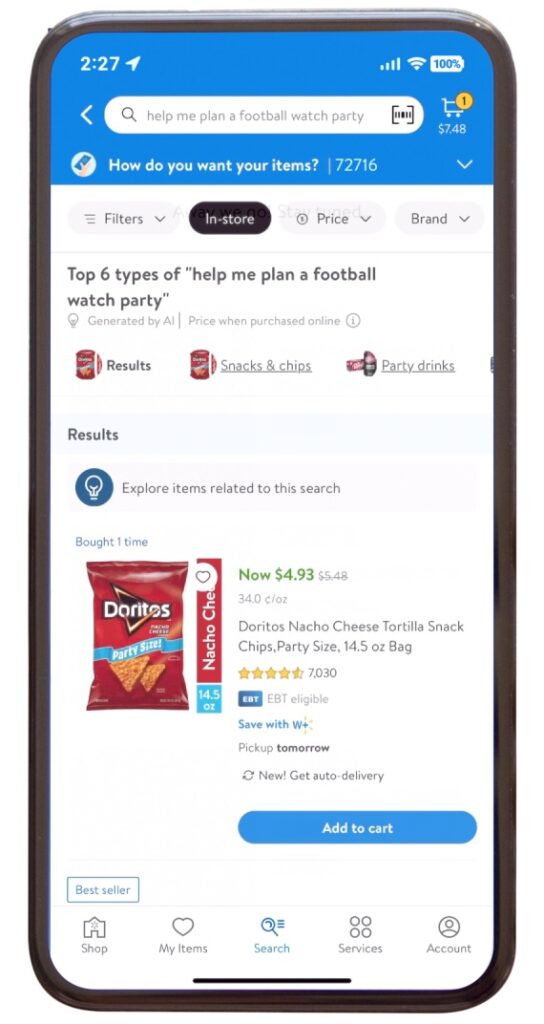

Walmart Puts More ‘AI’ into Retail

Walmart continues to scale its artificial intelligence capabilities and is publicly touting the effort.

Walmart continues to scale its artificial intelligence capabilities and is publicly touting the effort.

In recent initiatives around AI-powered “super agents,” Walmart is expanding the capabilities of its “Sparky” tool for shoppers and is developing “Marty” for sellers, suppliers, and advertisers, an “Associate” super agent for store-level and corporate employees, and a “Developer” platform where its in-house engineers will test, build, and launch all future AI capabilities.

Currently available on the Walmart mobile app, Sparky is a generative AI-powered tool that synthesizes product reviews, delivers occasion-based recommendations and “helps customers plan, compare and purchase with confidence,” according to the company. Recent updates are designed to turn Sparky into a “super agent” that can reorder previous purchases, build carts of relevant products for specific micro-occasions, and suggest relevant recipes after examining the shopper’s refrigerator.

“Marty” will improve engagement for sellers, suppliers, and advertisers by streamlining the onboarding process, managing orders, and creating ad campaigns, among other tasks. The “Associate” agent will help employees with a variety of tasks ranging from submitting parental-leave applications to pulling sales data on categories or products.

The quartet of super agents was previewed last week by Walmart U.S. Chief Technology Officer Hari Vasudev during a speaking event in New York. The world’s largest retailer also last week released a “Retail Rewired Report 2025” that highlights the company’s integration of agentic AI tools to both enhance customer experiences through personalized recommendations and streamline operations by assisting associates with tasks like inventory management.

Walmart is looking for these new tools to help the company achieve its stated goal of generating 50% of all sales through ecommerce within five years. Walmart reported that 17.2% of its $462.4 billion in U.S. net sales for fiscal year 2025 (ended Jan. 31), came through ecommerce.

Relevance: From Jason Goldberg, Chief Commerce Strategy Officer at Publicis Groupe:

If you’re wondering what the AI playbook should look like for a retailer, look no further than what Walmart revealed this week. The rollouts discussed above reflect a move from a collection of stand-alone AI projects to a unified agentic framework — built to empower all the key constituents across Walmart’s ecosystem. What’s more, Walmart added two executive leadership roles focused on AI to the management team — signaling its importance to the retailer’s vision for the future of retail.

Sparky likely has already serviced millions of Walmart shoppers with an improved shopping experience. More than 900,000 of Walmart’s 2.1 million associates are already using the AI features in the Associate app to make their day more efficient — Sam’s Club has eliminated more than 100 million manual tasks from clubs due to associate AI enablement.

The core principles of putting AI front and center on the retail leadership team and focusing on the experiences that matter to a retailer’s most important stakeholders is a solid foundation for any retailer looking to compete in agentic commerce.

Opportunity: The planned updates to Sparky could have a transformational impact on product discovery at Walmart that brands will need to comprehend and address. That begins with understanding how the shopper agent will use product data and other content to determine its product recommendations. Also critical will be an understanding of the new insights and campaign creation opportunities that might become available through Marty.

Albertsons Introduces Digital Display Network

Photo courtesy of Albertsons Companies.

Albertsons Media Collective will begin installing a digital screen network across select Albertsons Cos. stores this summer through a partnership with digital signage specialist Stratacache. The initiative will begin as a pilot in “two key regions” involving large-format digital screens in high-traffic locations such as entrances and the produce department, Albertsons said.

The network will give the grocer’s Albertsons Media Collective platform a formidable in-store opportunity to offer brand advertisers. Network capabilities will include advanced measurement tools for brand partners providing proof of play, direct sales attribution, and sales lift analysis. Albertsons Companies operates roughly 2,200 supermarkets across 35 states. The company has not publicly announced a timetable for any national rollout.

Relevance: In-store advertising opportunities are critical for retail media networks operating in CPG channels, where more than 80% of purchases are still made in physical locations. And the race is on, as most retailers have initiated plans to introduce digital media that can accurately measure ad performance.

Opportunity: The network will give brands the ability to engage and influence shoppers through meal inspiration, compelling offers, and other relevant messaging in the location where most products are sold. Brands should look for opportunities to conduct test & learns as Albertsons pilots the program, and then continue working closely with the retailer as the network scales.

Amazon Debuts Prime Delivery for Smaller Markets

Amazon has promised to bring same-day and next-day delivery services to millions more shoppers in 4,000-plus smaller U.S. communities by the end of 2025. The company has pledged to invest roughly $4 billion to triple the size of its delivery network by the end of 2026, with a focus on small towns and rural communities where fulfillment is significantly slower.

Amazon has promised to bring same-day and next-day delivery services to millions more shoppers in 4,000-plus smaller U.S. communities by the end of 2025. The company has pledged to invest roughly $4 billion to triple the size of its delivery network by the end of 2026, with a focus on small towns and rural communities where fulfillment is significantly slower.

The expansion aims to bring greater convenience to rural shoppers, who often live farther from brick-and-mortar stores, have a smaller selection of products and brands from which to choose, and have fewer delivery options when making online purchases. Amazon Prime members receive unlimited free same-day delivery on orders over $25 in areas where the service is available. The volume of items delivered the same or next day in the U.S. has grown by more than 30% so far this year, according to the company.

Relevance: Providing expedited delivery in rural areas where there are fewer brick-and-mortar competitors could significantly grow Amazon’s rural shopper base by bringing a new level of convenience. It also helps Amazon stay competitive with Walmart, which will be able to deliver to 95% of the U.S. population within three hours by the end of 2025, CEO Doug McMillon recently promised.

Opportunity: Expanding expedited delivery services could broaden the shopper base on Amazon, and therefore for brand partners as well — especially to communities that may be outside of their ACV (all commodity volume) reach.

Costco Executive Members Get Extra Credit

Costco’s Executive Members in the U.S. and Canada will receive a $10 monthly credit toward same-day delivery orders of $150 or more through a new partnership the warehouse club has struck with Instacart.

Costco’s Executive Members in the U.S. and Canada will receive a $10 monthly credit toward same-day delivery orders of $150 or more through a new partnership the warehouse club has struck with Instacart.

Although they account for less than half of Costco’s membership base, Executive Members drive 73% of sales while also paying double the standard $65 annual fee. Costco also recently began opening clubs one hour earlier each day (30 minutes on Saturdays) to provide the group with exclusive shopping time.

Relevance: Adding membership incentives around home delivery illustrates the strides being taken to improve digital shopping capabilities at Costco, which entered the ecommerce arena far later than most retailers. The initiative also emphasizes the importance of member satisfaction to the retailer, whose business model relies heavily on membership revenue. Costco first started partnering with Instacart for home delivery in 2017.

Opportunity: Brands need to follow Costco’s lead as the retailer continues building an omnichannel strategy for member engagement, which seeks to address general shopping trends toward convenience and accessibility.

Kroger Revisits In-Store Coupons

In response to complaints of “digital discrimination” from some shopper advocacy groups in recent years, Kroger has introduced “Weekly Digital Deals” handouts to stores that carry deals mirroring the offers made available to shoppers through digital channels.

In response to complaints of “digital discrimination” from some shopper advocacy groups in recent years, Kroger has introduced “Weekly Digital Deals” handouts to stores that carry deals mirroring the offers made available to shoppers through digital channels.

Distributed near store entrances, the flyers carry a single barcode that automatically applies to all promoted discounts when scanned at checkout. They were introduced to benefit the mostly older shoppers who don’t have access to digital deals via smartphones and other devices. The offers are available to all Kroger loyalty cardholders.

The city of San Diego passed an ordinance this spring requiring stores to offer an in-store alternative to all digital coupons.

Relevance: The initiative is a considerate (if perhaps quaint) way of ensuring that all shoppers have access to Kroger’s digital offers and additional evidence that not everyone has joined the digital world just yet.

Opportunity: For brands, the effort could increase redemption for their Kroger deals. And the loyalty card requirement ensures that first-party purchase data will still be collected. Brands should check with Kroger to understand what plans it may have to evolve the current flyer and if additional branding opportunities might become available.

Dollar General Rethinks Inventory Management

Dollar General has been adjusting its inventory management strategy in an effort to grow sales by improving in-stock levels for higher-selling products. After reducing shelf inventory by 1,000 SKUs last year, the retailer is enjoying higher in-stock levels but also lower overall inventory levels in stores. It also generated a 5.3% year-over-year sales increase in its latest fiscal quarter, which has it planning to eliminate additional SKUs.

Dollar General has been adjusting its inventory management strategy in an effort to grow sales by improving in-stock levels for higher-selling products. After reducing shelf inventory by 1,000 SKUs last year, the retailer is enjoying higher in-stock levels but also lower overall inventory levels in stores. It also generated a 5.3% year-over-year sales increase in its latest fiscal quarter, which has it planning to eliminate additional SKUs.

Dollar General is also scaling back on its use of temporary warehouses to grow distribution capability and drive efficiency. By December 2024, the retailer had closed 15 of its 18 temporary sites and plans to close the remaining three this year.

Relevance: As the supply chain continues to face growing complexities, retailers like Dollar General are hyper-focused on efficiency. By simplifying its inventory flow, Dollar General is able to reduce the risk of slower replenishment cycles, spoilage, and tracking errors while ensuring that stores are stocked with the items shoppers want most.

Opportunity: Brands should diligently review their SKU mix at Dollar General, working with the retailer to evaluate the products being offered to ensure they have the best array for its shoppers. They also should review case pack sizes to optimize planning and delivery to help the retailer achieve its inventory goals.

Tractor Supply Accelerates Growth Plans

Following a successful second quarter highlighted by a 4.5% increase in net sales to $4.44 billion, Tractor Supply unveiled plans to open 100 new stores in 2026. The announcement intensifies the home improvement/farm supply retailer’s accelerated growth plan of recent years that also included the recent acquisition of stores from rival Big Lots. Tractor Supply currently operates roughly 2,300 stores across 49 states.

Following a successful second quarter highlighted by a 4.5% increase in net sales to $4.44 billion, Tractor Supply unveiled plans to open 100 new stores in 2026. The announcement intensifies the home improvement/farm supply retailer’s accelerated growth plan of recent years that also included the recent acquisition of stores from rival Big Lots. Tractor Supply currently operates roughly 2,300 stores across 49 states.

Meanwhile, Tractor Supply’s loyalty program has grown to 41 million members who accounted for more than 80% of total sales in the second quarter, CEO Hal Lawton said during a recent earnings call.

Relevance: Tractor Supply continues to look for ways to extend its market share beyond the marketplaces and product categories that its name implies to become a mainstream mass merchant. Its status as a key retailer for the needs of rural America relies heavily on a strong physical store strategy.

Opportunity: Given the specialty nature of Tractor Supply stores, the new stores could offer brands more opportunities to expand their reach in rural locations and engage new shoppers through in-store demos and merchandising. With the loyalty program a priority, brands also should consider programs that will help Tractor Supply attract new members.

Target Leans on Price for Back-to-School Season

A decision to maintain 2024 prices on key back-to-school necessities is one of the many tactics Target has employed to attract seasonal shoppers. The retailer’s activations include:

- A comprehensive list of 20 must-have school supplies including writing essentials, notebooks, and folders whose price tags total less than $20. A similar list for college-bound students features 20 items under $40.

- The opportunity for teachers and college students to create personalized wish lists to share.

- A “School List Assist” service that lets shoppers submit their school name or ZIP code to find the specific items needed for their child’s class (as submitted by schools and teachers).

- Discounts for verified college students and teachers who are enrolled in the Target Circle loyalty program. Both groups receive a one-time storewide discount of 20%.

- A “Back-to-School-idays” savings event held July 27-Aug. 2 that dangled discounts up to 30% on key products. Stores conducted in-store experiential events, such as personalization stations allowing kids to add custom touches like pins and badges to their school gear, technology demos, and unique giveaways.

Relevance: More than two thirds of shoppers began their back-to-school shopping in early July this year, according to the National Retail Federation’s annual survey (conducted by Prosper Insights & Analytics). Target was well prepared for that early start to the season with its many online and in-store promotions.

Relevance: More than two thirds of shoppers began their back-to-school shopping in early July this year, according to the National Retail Federation’s annual survey (conducted by Prosper Insights & Analytics). Target was well prepared for that early start to the season with its many online and in-store promotions.

Opportunity: Brands should be tracking Target’s activity to identify opportunities to adjust their digital media strategies accordingly and help the retailer close back-to-school season with a bang. They also should be taking notes that can be applied to the programs they bring to Target for next year’s seasonal push.

Publicis Commerce’s Retail Consultancy is an unrivaled team of in-market commerce experts who simplify the complexity of retail for our clients. Located in Bentonville, Minneapolis, Cincinnati, Chicago, Seattle and the “backyards” of other key retailers, they provide deep knowledge of the retailer, expertise in key business areas (like strategy, media and creative), and door-opening personal relationships with key executives to deliver an unmatched level of business success for clients across accounts, channels, and shopper engagement platforms. For more information, contact EVP-Retail Consultancy Kandi Arrington at [email protected].