Retail Intelligence from:

As part of their ongoing mission to help clients stay ahead of the competition in a fast-paced, constantly evolving marketplace, The Mars Agency’s Customer Development teams closely monitor the strategic activity taking place across all key retailers and channels.

Each month, the teams compile Marketplace Assessment reports on the retailers (Walmart, Target, Kroger, Amazon) and channels (Regional Grocery, Small Format, Club) that are most important to our clients’ business success. The following report outlines 7 noteworthy events across the retail landscape from the team’s most recent round of assessments.

____________

Walmart Dives Deep into the Metaverse

The Story: Walmart announced the launch of two immersive metaverse experiences on the Roblox mega-platform, which has 52 million daily users. Called Walmart Land and Walmart’s Universe of Play, respectively, the environments offer unique, interactive content, games, musical events and other entertainment to help Walmart build stronger relationships with customers — especially younger ones.

In fact, the Walmart Land experience is designed “specifically with the next generation of customers in mind,” according to the retailer. Visitors can play games, attend motion-capture concerts by national acts, obtain virtual merchandise for their avatars, and interact with products from youth-focused cosmetics brands like Lottie London and Bubble.

Designed to be the ultimate virtual toy destination, and launched just in time to influence holiday shopping, Walmart’s Universe of Play lets visitors play games and take challenges while being exposed to products from brands like Paw Patrol and Razor Scooters.

“Roblox is one of the fastest growing and largest platforms in the metaverse, and we know our customers are spending loads of time there,” said Walmart U.S. CMO William White. “We’re focusing on creating new and innovative experiences that excite them, something we’re already doing in the communities where they live.”

Relevance: Walmart is building an ecosystem of engagement platforms that will allow the retailer to interact with potential shoppers wherever they may be. The metaverse in general, and Roblox in particular, provides a great opportunity to experiment with new ways to reach the younger shoppers who are flocking to these virtual platforms for entertainment and, increasingly, shopping opportunities.

Opportunity: Brands should closely monitor how Walmart uses this platform. While brands are currently being brought into the environments based on their popularity or relevance to younger audiences, Walmart could ultimately turn these efforts into a revenue stream by charging for participation. Ultimately, they also might try driving online purchases or real-world store visits through these virtual experiences.

____________

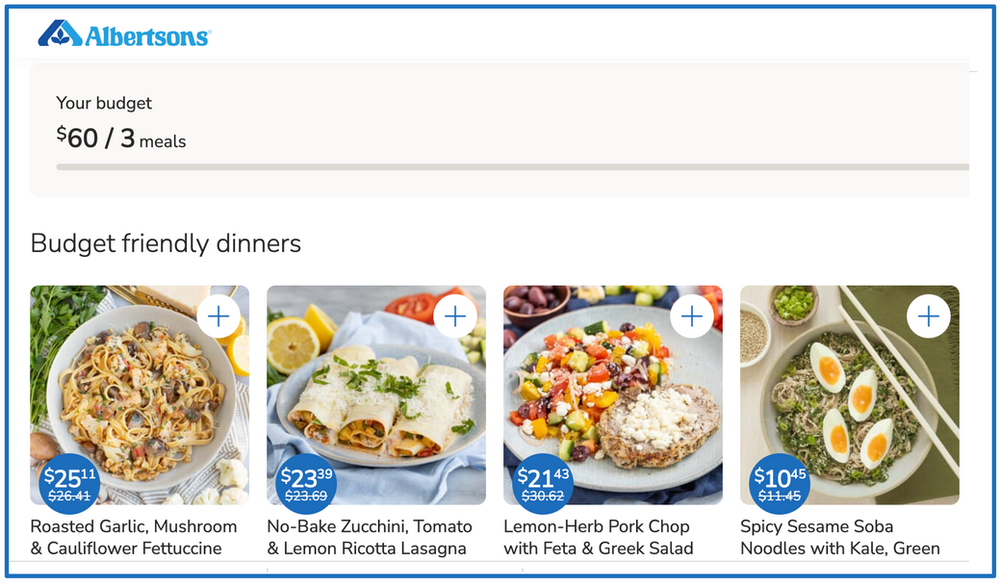

Albertsons Adds More Shopper Connections

The Story: Albertsons continues to introduce digital innovations aimed at providing “inspiration and ease” to shoppers. While speaking last month at Groceryshop, Chief Merchandising Officer Jennifer Saenz (on left in photo at right) mentioned two more-recent initiatives:

- An online tool that helps shoppers manage their weekly budgets.

- “Ava,” an Alexa-like voice assistant that will help the retailer personalize the shopping experience and deepen ties with customers.

In addition, Albertsons continues to leverage consumer data to develop a better understanding of its shoppers (an effort that should be strengthened by its new partnership with The Trade Desk). And Albertsons Media Collective is working to build a platform that operates “in service of the shopping experience” rather than solely as a revenue stream, SVP-Retail Media Kristi Argyilan said —also while speaking at Groceryshop.

Relevance: Albertsons has been very vocal about its intentions to revolutionize the customer experience. From online meal planning to one-hour order delivery, the grocer is investing heavily in new capabilities that will address the two core shopper motivations stressed by Saenz: inspiration and ease.

Opportunity: The retailer is also being very vocal about its desire to develop strategic partnerships with suppliers to build these experiences and bring them to life. Opportunistic brands should take them up on the offer.

____________

Meijer Plans a New Format

The Story: Meijer unveiled plans for a new store concept that will debut with two locations in Southeast Michigan in early 2023. These Meijer Grocery stores will be 75,000 to 90,000 square feet in size — more than half the size of traditional Meijer supercenters — and focus on exactly what their name implies. They will include non-grocery departments, however, but with condensed planograms.

Relevance: At the industry level, this news is just another indication that brick-and-mortar retail is not dying despite the recent emphasis on digital commerce. For Meijer, this smaller format will let the chain open stores in areas that can’t accommodate a supercenter and thereby help the retailer expand its shopper base.

Opportunity: The announcement illustrates the Midwest retailer’s willingness to test new ideas and seek opportunities to fill gaps in its business model with alternative store formats. CPG brands should explore ways to help Meijer effectively position the new, focused format to drive traffic and create in-store experiences that will foster shopper loyalty.

____________

ShopRite Tests Caper Carts

The Story: Wakefern Food Corp. is tapping into one tool from Instacart’s newly announced Connected Stores bundle of next-generation retail technology: Caper smart carts will roll out to ShopRite locations in the coming months. Reports suggest the co-operative will also deploy other modular tools from Instacart’s package, which includes a scan-and-pay checkout system, “Carrot Tag” electronic shelf labels, and other tools.

Relevance: Instacart is expanding its business model by offering these ready-to-go shopping tools to retailers of all sizes as a white label service that can help them compete with Amazon & Walmart — and also as a way to build deeper connections with its retailer partners. Regional grocer Wakefern (280-odd stores) has often showed a willingness to test new technology concepts.

Opportunity: New technologies often bring with them additional test & learn opportunities for CPG partners. Brands should explore with both Instacart and ShopRite what engagement options they might be able to explore with these new Caper Carts.

____________

Sam’s Club Increases Membership Fee

The Story: For the first time in nine years, Sam’s Clubwill increase its membership fees. Starting Oct. 17, the cost of a basic club membership will rise from $45 to $50 while fees for the higher-tier “Plus” membership will increase from $100 to $110.

Relevance: The move comes as inflation is driving store trips and Sam’s Club membership levels are enjoying an all-time high. Sam’s will take the sting out of the upcharge in the first year by reimbursing members with “Sam’s Cash” that can be used to make club purchases. Speaking at Groceryshop last month, Chief Product Officer Tim Simmons acknowledged that a recent decision to start charging a home delivery fee with basic memberships has led some shoppers to stop using the service — but others to upgrade to the Plus level.

Opportunity: Sam’s Club will need to continue showcasing the improvements it has been making to its products and services so that budget-focused shoppers fully understand all the benefits of membership. The retailer is likely to have an even stronger appetite to work with brands on exclusive and innovative products.

____________

Dollar General Gains Higher-Income Shoppers

The Story: Apparently pinched by inflation, higher-income households are shopping at Dollar General for essentials and discretionary items. CEO Todd Vasos recently noted that the retail giant has been attracting more customers with annual incomes of $75,000 to $100,000 as inflation has pushed up prices on groceries and gasoline. Some of these customers shopped at Dollar General for the first time earlier in the pandemic and have now returned, he noted.

Relevance: The trend at Dollar General is clear evidence of the impact that inflation is having on shopper behavior across multiple income levels, which is affecting choices at both the retailer and product level: Walmart, too, has been attracting more $100,000 households lately, Walmart U.S. CEO John Furner noted at Groceryshop, where other retail executives described declining basket sizes, switches to private label, and other price-conscious shifts.

Opportunity: If more shoppers are heading to value channels, CPGs might want to follow suit in terms of their marketing investments. More broadly, however, brands must consider how best to present their quality message to cost-conscious shoppers who might be thinking of trading down — or risk being forced to cut their prices to maintain share.

____________

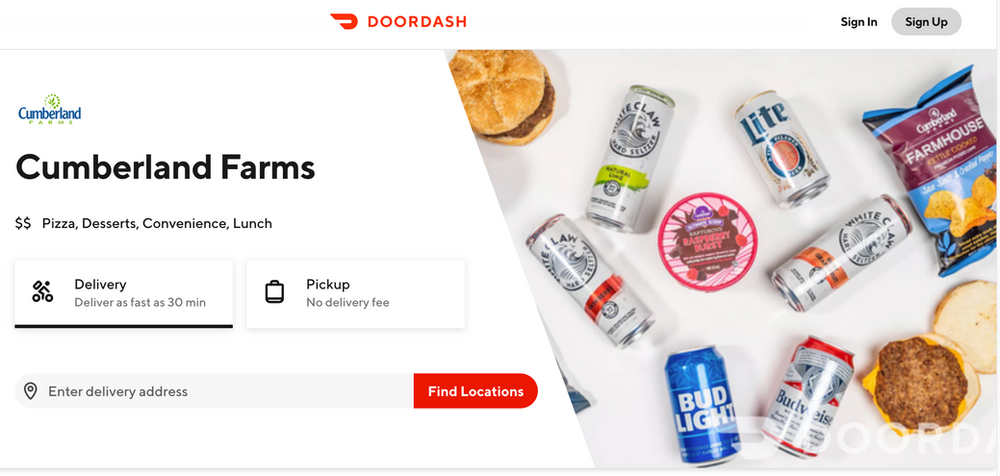

EG America Taps into DoorDash

The Story: The convenience retailer is partnering with the third-party “instant commerce” provider to begin offering on-demand delivery of sandwiches, pizza, snacks, and signature Farmhouse Blend coffee through more than 1,300 locations by the end of October. EG America is one of the largest and fastest-growing c-store retailers in the U.S, operating 1,700-plus stores under such banners as Cumberland Farms, Fastrac, Loaf N’ Jug, Minit Mart, Tom Thumb and Turkey Hill.

Relevance: The partnership with DoorDash illustrates how important delivery has become to the convenience channel, and adoption of third-party on-demand services has grown accordingly. EG America now joins other key channel players 7-Eleven, Circle K, Wawa, Casey’s and GPM in offering quick commerce to shoppers through DoorDash.

Opportunity: DoorDash’s growing partnerships with c-store chains could give CPGs a greater opportunity to get their message in front of shoppers in the channel, which for many brands has been too fragmented and regionalized to market through effectively.

____________

The Mars Agency’s Customer Development practice is an unrivaled team of in-market commerce experts who simplify the complexity of retail. Located in Bentonville, Minneapolis, Cincinnati, Chicago, Tampa and the “backyards” of other key retailers, they provide deep knowledge of the retailer, expertise in key business areas (like strategy, media and creative), and door-opening personal relationships with key executives to deliver an unmatched level of business success for clients across accounts, channels and shopper engagement platforms. For more information, contact Group SVP Kandi Arrington at [email protected].