Ten key themes on the future of commerce marketing from Shoptalk Europe 2023.

Whatever the primary objective might be for your new shopper engagement strategy, retail media plan, generative AI adoption or revamped in-store activation, it also needs to deliver efficiency on the back end.

The need to improve operational efficiency — most importantly in the form of cost savings — was a common thread running throughout the stages and halls last month at Shoptalk Europe, where 3,000-plus brands, retailers, agencies and solution providers from across Europe and around the world gathered to discuss the state of commerce marketing.

If companies aren’t directly seeking ways to drive greater efficiency through their commerce marketing systems and processes, they’re vetting and choosing options for their other needs based on the efficiency they will also deliver. Due to the ongoing economic uncertainty worldwide, marketing organizations are working with the understanding — or at least the hope — that, “Efficiency and engagement can work together,” according to Krystina Gustafson, Shoptalk’s SVP-Content.

This need for efficiency is a major reason why generative AI was the hottest tech topic at this year’s Shoptalk, and why the conversation around last year’s hottest tech topic — the metaverse — cooled significantly. It’s also why retail media is poised to explode in Europe (and elsewhere) as it already has in the U.S., why the store remains a critical marketing channel, and why “unified commerce” is the ultimate goal of shopper engagement.

The following article examines 10 key themes that were on the minds and lips of Shoptalk Europe attendees, as observed by The Mars Agency executives who ventured to Barcelona last month to attend the event.

Commerce is “Everywhere”

Conversion can now happen literally anywhere, and it increasingly occurs through multiple vehicles — sometimes even simultaneously:

- The average shopper is using 5.3 channels, according to Forrester.

- At Carrefour, 62% of customers use the grocer’s app to prepare for an in-store trip, said Valérie Legat, Chief Digital Factory Officer. These omnichannel shoppers are delivering 27% more value to the retailer.

- 95% of shoppers in the Lego Store have their phone in hand, noted Katharina Sutch, the brand’s Director of Shopper & Omnichannel Activation.

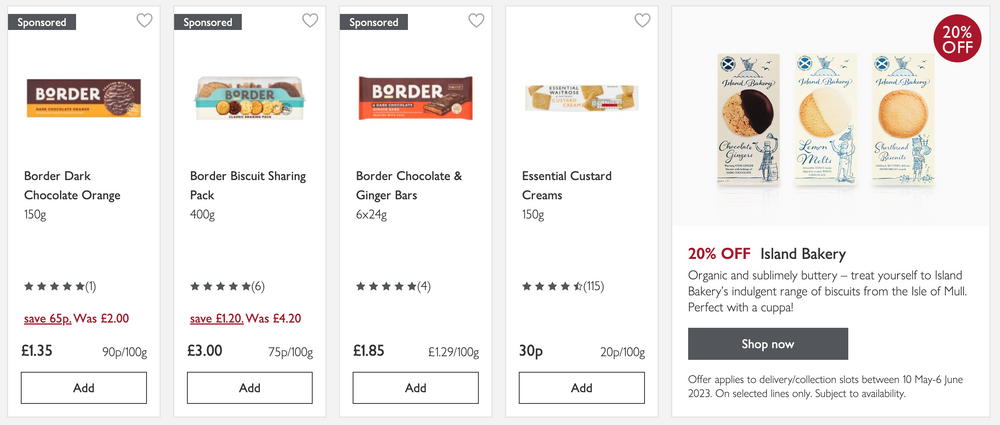

Google finds that more than 90% of in-store shopping journeys begin online in some fashion — although 95% of Target’s volume still touches the physical store in one way or another. Elsewhere, the number of people buying through social media will increase 43% from 2020-25, when the channel will account for $107 billion in sales; online marketplaces raked in more than $3.25 trillion in 2022.

“Customers are multi-channel, so we focus on creating connected customer experiences,” explained Tom Langley, Head of Personalisation & Retail Media at John Lewis Partnership (Waitrose supermarkets along with John Lewis department stores).

This, naturally, requires the implementation of digital technology within the physical store to provide the personalization that shoppers are used to getting online. As one example, Panera Bread has partnered with Amazon One to bring its loyalty program to life through biometric scanning that lets store associates immediately know a customer’s habits and preferences.

Just stop calling it “omnichannel,” which is a “backwards-thinking way” to view the market, said Joe Laszlo, Shoptalk’s VP-Content. A more accurate word now would be “unified,” to explain the need for seamless integration across channels, he suggested.

“We call it connected commerce. We want to be where the shoppers are … We try to map out the journey and show up in the best way,” said Simon Miles, VP of Global OmniChannel Commercial Strategy at Coca-Cola.

____________

Generative AI is a ‘World Changer’

That was the term used by Alan Boehme, Chief Technology Officer at H&M, who expects Generative AI’s impact to be as “world changing” as those created by the internet and the smartphone.

Gen AI hits the two sweet spots that marketers are looking for right now, according to Gustafson: it can improve and increase shopper engagement while also reducing costs. But its instant popularity after emerging last fall was also sparked by the potential for applicability across the entire organization, she suggested.

Among its more important applications will be making it far easier for brands to efficiently (there’s that word again) create the sheer volume of content and creative that’s needed to make “Commerce Everywhere” happen, as well as to deliver personalization in the physical store environment.

On the flip side, Gen AI can serve as the virtual store clerk online by providing relevant, accurate recommendations about products based on shopper need, suggested Robert Gentz, Co-Founder and Co-CEO of Germany-based fashion retailer Zalando.

Guardrails are necessary, however, to harness such a powerful tool. Companies need to start thinking about responsible use.

____________

The Metaverse JUST NEEDS

Some MORE THOUGHT

The metaverse is still in play, although it hasn’t quite lived up to the overly ambitious expectations heaped on it at Shoptalk Europe 2022. That massive hype cycle itself certainly hurt, turning the metaverse into a classic “technology in search of a solution” rather than a true business-driving opportunity.

Still, the Roblox game platform has nearly 60 million active daily users, although most of them do still lack disposable incomes of their own (only 14% are 25+).

Yet the metaverse has been proven through a number of use cases to be an effective (although maybe not yet so efficient) vehicle for immersing consumers in a brand-building experience, building communities of loyalists and even influencing shopper action.

So the strategy shouldn’t be to dismiss the technology outright, nor to adopt it simply for the sake of doing so, but to think critically about how it might help the brand achieve its objectives by effectively engaging with a target audience in a relevant way.

“The worst thing you can do is do nothing,” said Cristina Marinucci, Head of Global Shopper-Insights & Analytics at Mondelez International, which launched an “Oreoverse” gaming experience in early 2023.

____________

Retail Media Is Thriving

Spending on retail media in Europe could equal that of TV advertising, according to some forecasts, a strong indication that the discipline is ready to explode there as it has in the U.S.

Much of the investment is still currently skewed toward “bidding for search on Amazon,” surmised Ben Miller, Shoptalk’s Director of Original Content. “But that doesn’t take away from the fact that this is an attributable media spend.” And measurability leads to … (say it with us) … efficiency.

For brands, the key benefits of an effective network are “the same three things that have ruled advertising and marketing since the ‘Mad Men’ days,” said Laszlo. They are:

- Audience (reach, but also differentiation and experience).

- Data (with a particular need for quality and timeliness).

- Creative messaging (tailored to media types and engagement goals).

There are plenty of kinks to be worked out. Collaboration between brand and retailer must improve and standardization (especially for audience identification and performance measurement) is required, as well as a better understanding of which organizational budget should do the funding. “It’s time to do the hard work,” encouraged Miller.

But the payoff could be huge. Retail media gives the industry its greatest collaborative opportunity in a long time, said Miles at Coca-Cola, in calling for greater clarity on objectives and more consistency across networks. “We can’t do this without each other.”

“We want to stop talking about the profits of retail media and instead talk about what great content we can partner on,” said Langley at John Lewis.

____________

Gen Z Is Coming of Age

While most Roblox gamers don’t have their own spending money yet, their older Gen Z counterparts do — already, the 70 million-strong demographic commands more than $360 billion in disposable income, according to Bloomberg.

Gen Z certainly exhibits some unique shopping behaviors compared with prior generations, but the disparity might not be as great as imagined: Although their path to purchase is a multi-channeled journey covering various digital platforms (including a healthy dose of social), 80% say they prefer to shop in a store, according to Shai Eisenman, CEO of Bubble Skincare. (A favorite among Gen Z’ers, two-year-old Bubble recently expanded into Europe.)

Their lifestyle norms are also intensifying the need for brands to be authentic, transparent, sustainable and inclusive in all their business practices, but especially in marketing. But they’re suspicious of lip-service and quick to sniff out any falsehoods related to the paid use of influencers, noted Jason Crawford, VP of Digital Growth-Hype at Adidas.

Just be careful not to make them anxious: More than half (56%) of Gen Z’ers believe there is too much visual stimulation online, which can heighten anxiety, noted Alan Tyldesley, Retail Category Development Officer for EMEA at Spotify.

____________

The Store is Alive & Kicking

There’s been no real change in the fundamental purpose of the physical store: merchandising the right items, in the right place, at the right time. But the strategies driving success are evolving to address post-pandemic changes in shopper behavior and the overall role of brick-and-mortar, according to Alexandra Smith, Head of Space, Range & Merchandising at Morrisons.

The rise of online order delivery has, of course, affected both shopper behavior and the store’s role. And in another key shift, shoppers now are conducting fewer trips and buying more in bulk. In response to economic uncertainty, they’re also looking to spend less and, therefore, are more often looking for private label alternatives.

It’s therefore vital for marketers to fully understand their shoppers — how and where they’re buying, what’s going in their baskets (and what’s dropping out) — and then find ways to optimize the in-store strategy accordingly.

For example, more than 60% of sales at Morrisons come from a 20% segment of the customer base that is older and less affluent than the average UK shopper, Smith explained. The retailer is using these kinds of data-driven insights to inform pricing, assortment, product clustering, category prioritization, own brand strategy and advertising focus.

One incontrovertible key to in-store success is providing a “seamless” and “unified” store experience (in the words of the Shoptalk team) that lets shoppers move from one channel to the next without interruption or friction. Ethically sourced jeweler Brilliant Earth offers online consultations so that shoppers will find curated options waiting for them at the store.

Removing friction is important, but not if it causes you to lose touch with the needs of all shoppers: While self-checkout is an in-store necessity, Dutch grocer Jumbo now also offers “Kletskassa” (“Chat checkout”), a line for customers who would rather chat leisurely with cashiers.

____________

‘Purpose’ Is Now Required

“Sustainability without performance has no impact, and performance without sustainability has no future” is a mantra followed by Danone, explained Ayla Ziz, the company’s SVP of Global Sales & Chief Customer Officer.

Consumers are expecting more “purpose” from brands and retailers in the environmental, social and even political realms. And they’re savvier than ever about the standards that brands are promising to achieve, Ziz noted.

Gen Z, in particular, wants to know a brand’s point of view; they don’t expect perfection, but they do want demonstrable evidence that efforts are being made, according to Eisenman at Bubble Skincare, while suggesting that the beauty category is still guilty of presenting too much “greenwashing” and not enough legitimate sustainable activity.

With progressive retailers now also setting expectations (if not mandates) for their manufacturing partners, it’s critical for brands to identify and adopt efficient practices that can help the planet and/or society while also improving internal operations. (A few weeks after the event, Mars, Inc. unveiled an in-market test of new paper packaging for its eponymous candy bar in a partnership with Tesco.)

____________

Data Is the Driver

Engagement can’t be seamless or frictionless without a deep, up-to-the-minute understanding of shopper behavior. And it can’t be efficient without the proper tools to collect, synthesize, analyze and activate all the data that’s now available.

A top focus at Shoptalk was the ability to equip in-store personnel with the data needed to deliver a frictionless experience that emulates digital shopping: robust information about products and services; real-time inventory updates across the supply chain; the customer’s personal profile and history.

Best Buy’s Blue Shirts are now armed with a Solution Sidekick that does all that and can also send any necessary information to the shopper’s own device. The Fresh Start training program that Kroger developed with solution provider Axonify in 2021 has already translated into improved customer satisfaction.

In terms of performance measurement data, visibility is the crucial first step and can still be challenging, which makes partnerships with retailers so important, said Tony Navin, Ecommerce Director at Kraft Heinz. (That’s a key part of retail media’s allure, of course.) Improved visibility is also the goal behind Kraft Heinz’s efforts to align cross-functional data behind a “single front door” that allows each team to customize as needed, he said. A future goal will be leveraging performance data to be more predictive.

When it comes to retailer and brand data sharing, “Ultimately we want the same thing: to create a great customer experience,” said Neel Arora, Global Head of Ecommerce at Nestlé. Focusing on that end goal can greatly improve the collaborative process.

____________

Shoppers Like to Watch

When it comes to emerging tools, livestream shopping has also hit a bump in the road. Consumers globally haven’t embraced the concept at the same levels first seen in China, which has led some leading social platforms to pull back on their initiatives. Now, even the most bullish predictions expect livestream to grab no more than 5% of total ecommerce sales by 2026.

That doesn’t mean the concept won’t work universally (it’s been hugely successful in the beauty category, for one), or that shoppable video in general isn’t effective — just that requiring shoppers to dedicate a significant length of time at a specific moment to attend a live event might not be the best method of engagement.

Some brands have had success repurposing their livestreams into clips to place on their ecommerce product pages. Best Buy is employing video at the point of consideration and, in a nod to “seamless” engagement, is offering live video consultations as part of its virtual store experience.

____________

The Economy’s Impact is Mixed

Inflation has been at multi-decade highs and is expected to linger for some time longer, Credit Suisse warned. But its effect on commerce so far has been mixed: overall disposable spending is at a “period low,” but the purchase of luxury goods is outpacing inflationary pressures.

And marketers, for the most part, have continued to spend through the uncertainty. The Shoptalk content team even noted that there seemed to be “less stress” about the economy among event attendees than they had expected.

The potential for a recession still looms, however, which at some point could impact even the most efficient commerce marketing plans.

About The Mars Agency

The Mars Agency is an award-winning, independently owned, global commerce marketing practice. With talent around the world, they connect people, technology and intelligence to make clients’ business better today than it was yesterday. Mars’ industry-leading MarTech platform, Marilyn®, helps marketers understand the total business impact of their commerce marketing, enabling them to make better decisions, create connected experiences and drive stronger results. Learn more at www.themarsagency.com and meetmarilyn.ai.