By Ethan Goodman, Mars United Commerce

For brands navigating the rapidly evolving retail media space, measurement might be the most confusing aspect — and understandably so, since it’s also probably the most complicated.

While there’s no way to eliminate all of the complexity involved in accurately assessing retail media investments, there are some best practices that brands can adopt to simplify the task and make it easier for their organizations to more clearly understand the value that retail media delivers. Here are three that are worth a “look.”

1. Look at Objectives

As an important first step, we always advise clients to take a holistic approach to setting key performance indicators and measuring success. Success in retail media requires organizations to align across functions — Sales, Marketing, Brand — and shared objectives to ensure that everyone will be rowing in the same direction. Once you’ve done that, every media touchpoint deployed during the campaign can be measured and optimized against those objectives.

There are a variety of evaluation options available for retail media but, ultimately, the criteria you apply should be determined by the objectives you’ve set. For instance, the toolbox of KPIs for a new item launch will likely be very different than the one used for a tentpole event amplifying your base brand, as we’ll discuss in more detail.

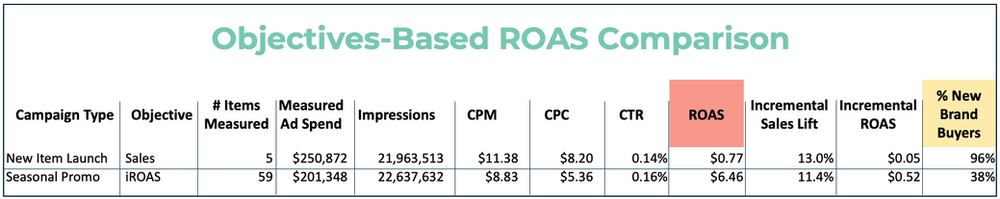

As marketers, we’ve been trained to jump right to return on ad spend (ROAS) as the go-to measure of success for retail media. But the aforementioned scenario offers a great example of why that shouldn’t always be the case. If you compare the ROAS of the two campaigns above, you might quickly conclude that the first one couldn’t possibly have been successful and should never be repeated, since the ad spend for both campaigns was relatively the same and the second one achieved a much higher ROAS.

But if you take a step back and look at the overall context, you’ll see that the first campaign supported a new item launch, where the primary objective was to drive household penetration and trial. You’ll also notice that the number of promoted items measured to get that ROAS was five, compared to the 59 measured in the second campaign, which supported a seasonal anniversary program.

Finally, if you remember the objective of the new item launch, and then consider that the percentage of new-buyer conversions was 96%, that unimpressive 77-cent ROAS no longer seems like a failure — especially given that per-customer acquisition costs are always higher on a new item launch, and that always drives down ROI.

This point here should be obvious: When you evaluate results based on your objectives rather than pre-determined benchmarks for a single metric, you’ll have a much better contextual lens through which to measure success.

2. Look Beyond ‘Media’

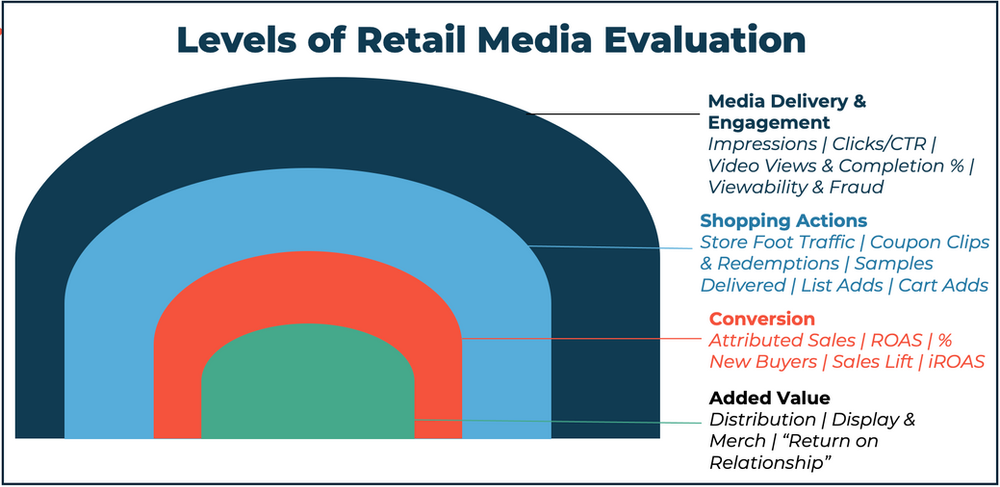

The range of possible KPIs for retail media starts with standard media metrics such as cost per thousand (CPM), click through rates, and impressions. But this is where some organizations get into trouble, because their media stakeholders want to use these metrics to make “apples to apples” comparisons between retail media and the traditionally national media levers like Facebook and Google.

In some cases, this is a valid practice, particularly when you’re measuring things like brand safety, ad viewability, or fraud, where organizations need to apply the same standards across all media. But in other cases, while it’s always important to look at the data, it’s not really appropriate to use these metrics for one-to-one comparisons.

Why? Because as you move down the funnel above, you’ll see that the impact of retail media is like a Russian nesting doll with multiple layers to consider. And the next layer is shopping actions and engagement. Is the activity driving traffic into stores? Are people clipping and redeeming offers? Are they claiming samples? Are they adding items to carts and lists? These are just some of the shopper behaviors that can be influenced by retail media.

The next level is conversion, which has long been the common default metric for shopper marketers, ecommerce marketers, digital commerce marketers — and appropriately so, because we’re working at retail and are closer to the sale. Conversion metrics include attributed sales, sales lift, ROAS (as mentioned earlier) and iROAS.

The final piece of the retail media equation is often left out because it’s very hard to quantify, and that’s the “added value” it can earn. This additional layer of evaluation looks at how the retail media investment impacts in-store activity: Did it help expand product distribution or help gain incremental merchandising — or did it simply strengthen your relationship with the merchant or other key stakeholders at the retailer?

Granted, this level of impact is very hard to quantify. But if your retail media investment (the annual commitment or a program-specific spend) gets you an extra endcap or other secondary display in the store, that’s something you also need to consider. Mars United Commerce is working with our clients and retailer partners to develop ways that will bring this level of evaluation to life.

3. Look for Incrementality

Although campaign objectives will vary, which will lead you to employ various metrics from one campaign to another, conversion will always be critical. So the distinction between attributed sales and ROAS vs. incremental sales and iROAS is important.

When using attributed sales to determine ROAS, the basic premise is that a shopper who is verified as having seen or clicked the media impression buys your product within a specified attribution window (usually 7, 14 or maybe 21 days).

This is a very good metric. But, as noted earlier, we’ve been trained to believe that it’s the “end all, be all” in every case. It isn’t, however, because it doesn’t provide a view into incrementality; it strips out all context and only provides a general understanding of the overall number of shoppers who bought the product.

For that reason, incremental lift and iROAS has become the Holy Grail. As shopper marketers, we want to know more details about who bought the product: Were they new to the category or the brand? Did they increase their basket size? Are they buying the product more frequently? That’s the level of incrementality we want to understand.

Right now, however, retail media networks aren’t able to measure incrementality and are only reporting the sales increase among people exposed to a campaign compared to a control group of people who weren’t. But they can get there, and they will.

These additional levels of impact are what make retail media so difficult to measure. They’re also what makes those “apples to apples” comparisons with national media so often misleading. There is still a lot of work to be done with retailers before we can measure the true, accretive value of a retail media investment. But based on recent conversations we’ve had, I think we’ll get there soon enough.

About the Author

Mars United’s EVP-Digital Commerce, Ethan Goodman is a renowned marketing strategist with deep expertise in digital commerce and shopper marketing. He’s been named a “Young Influential” by Adweek and a “Who’s Who in Shopper Marketing” by the Path to Purchase Institute, where he also serves as a Distinguished Faculty Member.

Prior to his current role, Ethan built, grew and managed Mars United’s Ecommerce and Innovation practice groups, and also guided the team that created SmartAisle — the world’s first voice-powered shopping assistant for brick & mortar retailers.